On his (Le Monde) blog, Thomas Piketty emphasizes that labor productivity in France and Germany is as high as in the US, and much higher than in Italy or the UK (his figures here and here).

Read More »Gold Rises In All Currencies In 2016 – 9 percent In USD, 13 percent In EUR and 31.5 percent In GBP

– Gold gains in USD, GBP, EUR, CAD, AUD, NZD, JPY – Gold gains in CNY, INR & most emerging market currencies– Gold surges 31.5% in British pounds after Brexit shock– Gold acted as hedge and safe haven in 2016 … for those who need safe haven– Furthers signs of market having bottomed and bodes well for 2017 – What drivers will gold respond to in 2017? – EU elections and contagion risk, Geo-politics, terrorism, war...

Read More »Gold Rises In All Currencies In 2016 – 9 percent In USD, 13 percent In EUR and 31.5 percent In GBP

– Gold gains in USD, GBP, EUR, CAD, AUD, NZD, JPY – Gold gains in CNY, INR & most emerging market currencies– Gold surges 31.5% in British pounds after Brexit shock– Gold acted as hedge and safe haven in 2016 … for those who need safe haven– Furthers signs of market having bottomed and bodes well for 2017 – What drivers will gold respond to in 2017? – EU elections and contagion risk, Geo-politics, terrorism, war...

Read More »Nomi Prins’ Political-Financial Road Map For 2017

As tumultuous as last year was from a global political perspective on the back of a rocky start market-wise, 2017 will be much more so. The central bank subsidization of the financial system (especially in the US and Europe) that began with the Fed invoking zero interest rate policy in 2008, gave way to international distrust of the enabling status quo that unfolded in different ways across the planet. My prognosis is...

Read More »European Stocks Greet The New Year By Rising To One Year Highs; Euro Slides

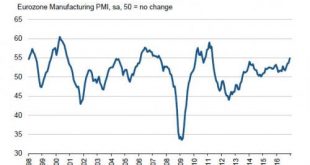

While most of the world is enjoying it last day off from the 2017 holiday transition, with Asia’s major markets closed for the New Year holiday, along with Britain and Switzerland in Europe and the US and Canada across the Atlantic, European stocks climbed to their highest levels in over a year on Monday after the Markit PMI survey showed manufacturing production in the Eurozone rose to the highest level since April...

Read More »Frontrunning: December 20

Trump wins Electoral College vote; a few electors break ranks (Reuters) European Stocks Head for a One-Year High (BBG) Japan's Central Bank Keeps Policy Unchanged, Upgrades Economic Outlook (BBG) Russia and Turkey vow to keep detente on track after murder (FT) The Political Implications of Events in Ankara and Berlin (BBG) Trump condemns Berlin attack, says things 'only getting worse' (Reuters) Merkel: "No Doubt Berlin Crash Was a Terror Attack" (BBG) Gunman in Zurich mosque shooting is dead...

Read More »S&P Futures Rise Propelled By Stronger Dollar; Europe At 1 Year High As Yen, Bonds Drop

It appears nothing can stop the upward moment of equities heading into the year end, and as has been the case for the past few weeks, US traders walk in with futures higher, propelled by European stocks which climbed to their highest in almost a year, while the dollar rose and bonds and gold fell, failing again to respond to a series of geopolitical shocks following terrorist attacks in Ankara, Berlin and Zurich. The yen tumbled after the Bank of Japan maintained its stimulus plan even as the...

Read More »Trump Urges “Civilized World Must Change” After Today’s Terror Attacks

After a violent trifecta of a day, in which terrorist attacks left at least 9 dead and 50 injured in Germany after a truck plowed through a crowded Christmas market (see "Truck Ploughs Into Berlin Market Killing Nine, Over 50 Injured; US Condemns 'What Appears To Be A Terrorist Attack'"); three more people hurt in a shooting at an Islamic Center in Zurich, Switzerland; and the Russian Ambassador to Turkey murdered on live television (see "Russian Ambassador In Turkey Murdered In Terrorist...

Read More »FX Daily, December 19: EUR/CHF Dives under 1.07

Swiss Franc Once again a line in sand for the Swiss National Bank is broken. The EUR/CHF falls under 1.07. But trading algorithms are like this: When the EUR/USD is falling, then the EUR/CHF must follow. The SNB decided not to intervene any more at 1.07. Two potential reasons: We doubted that Swiss inflation might overtake European inflation in 2019 or 2020. Interventions at higher levels are risky, given that stock...

Read More »Adoption Of The Euro Has Been ‘Unequivocally Bad’ For Southern European Economies

Via GEFIRA, Some say that the common currency prevents less productive economies from cheating by weakening their national currencies and forces them to become more efficient and competitive. Industrial production data shows that it is not the case. Italy, France, Greece and Portugal have not only stopped producing more; they are producing now less than in 1990! The decay started immediately after the introduction of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org