The most important thing to appreciate is that the market has moved to price not one but two cuts next year. The first is priced into the September Fed funds futures and the second is in the Dec Fed funds futures. This I in response to weaker than expected data that have elevated recession fears. The Atlanta Fed GDPNow puts Q2 growth at -2.1%. Banks have revised down their forecasts, but none of the 59 economists in the Bloomberg survey have forecast a negative...

Read More »Eurodollar Futures Interpretation Is Everywhere

Consumer confidence in Germany never really picked up all that much last year. Conflating CPIs with economic condition, this divergence proved too big of a mystery. When the German GfK, for example, perked up only a tiny bit around September and October 2021, the color of consumer prices clouded judgement and interpretation of what had always been a damning situation. From GfK back then: The growing consumer optimism signals that consumers here consider the German...

Read More »Spanish Inflation Shocks

Overview: The sharp sell-off in US equities yesterday, led by tech, is weighing on today’s activity. Most of the large Asia Pacific markets excluding Japan and India lost more than 1% today. The three-day rally in Europe’s Stoxx 600 is being snapped today. US futures are posting small losses. The US 10-year yield is little changed around 3.17%, while European benchmarks are narrowly mixed, with the periphery doing better than the core. The dollar is enjoying a firmer...

Read More »Nasty Number Five, Not Hawk Hiking CBs

It’s not recession fears, those are in the past. For much if not most (vast majority) of mainstream pundits and newsmedia alike, unlike regular folks this is all news to them (the irony, huh?) Economists and central bankers everywhere had said last year was a boom, a true inflationary inferno raging worldwide. For once, CPIs (or European HICPs) seemed to have confirmed the narrative. Unlike 2018 when inflation indices kept policymakers and their forecasts out in the...

Read More »Dollar Jumps, Stocks and Bonds Slide

Overview: The prospect of a more aggressive Federal Reserve policy has spurred a sharp sell-off in global equities and bonds and sent the dollar sharply higher. The large Asia Pacific bourses were off mostly 2%-4%. Europe’s Stoxx 600 is off 2.2%, its fifth consecutive losing session. US futures are off also. The NASDAQ was down 3.5% before the weekend and the S&P 500 fell 2.9%. The dollar rocks. The Scandis and Antipodean currencies are bearing the brunt and are...

Read More »No Pandemic. Not Rate Hikes. Doesn’t Matter Interest Rates. Just Globally Synchronized.

The fact that German retail sales crashed so much in April 2022 is significant for a couple reasons. First, it more than suggests something is wrong with Germany, and not just some run-of-the-mill hiccup. Second, because it was this April rather than last April or last summer, you can’t blame COVID this time. Something else is going on. . In America, the Fed Cult is out to take credit for this brewing downturn (Jay Powell seeking his place alongside Volcker, which...

Read More »Can’t Blame COVID For This One

Late in March 2021, then-German Chancellor Angela Merkel announced a reverse. Several weeks before that time, Merkel’s federal government had reached an agreement with the various states to begin opening the country back up, easing more modest restrictions to move daily life closer to normal. But with case counts sharply rising once more, the whole thing was going to get shutdown instead. The government declared a holiday starting April 1 (no fooling) last year,...

Read More »Industrial Synchronized Demand

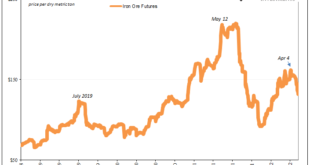

Are the industrial commodities starting to get a whiff of demand side rejection? Short run trends suggest that this could be the case. From copper to iron and the highest (formerly) of the high flyers, aluminum, this particular group has been exhibiting a rather synchronized setback going back to the end of March, start of April. This despite supply bottlenecks and production shortfalls which continue to plague each. Copper has now fallen to its lowest since last...

Read More »China Then Europe Then…

This is the difference, though in the end it only amounts to a matter of timing. When pressed (very modestly) on the slow pace of the ECB’s “inflation” “fighting” (theater) campaign, its President, Christine Lagarde, once again demonstrated her willingness to be patient if not cautious. Why? For one thing, she noted how Europe produces a lot of stuff that, at the margins of its economy, make the whole system go. Or don’t go, as each periodic case may be: Europe in...

Read More »China’s Covid Sends Commodities Lower and helps the Dollar Extend Gains

Overview: Fears that the Chinese lockdowns to fight Covid, which have extended for four weeks in Shanghai, are not working, and may be extended to Beijing has whacked equity markets, arrested the increase in bond yields, and lifted the dollar. Commodity prices are broadly lower amid concerns over demand. China’s CSI 300 fell 5% today and Hong Kong’s Hang Seng was off more than 3.5%. Most of the major markets in Asia Pacific were off more than 1%. Europe’s Stoxx 600...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org