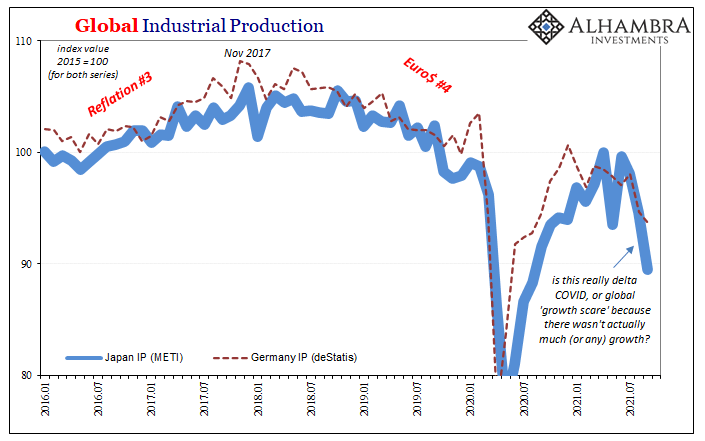

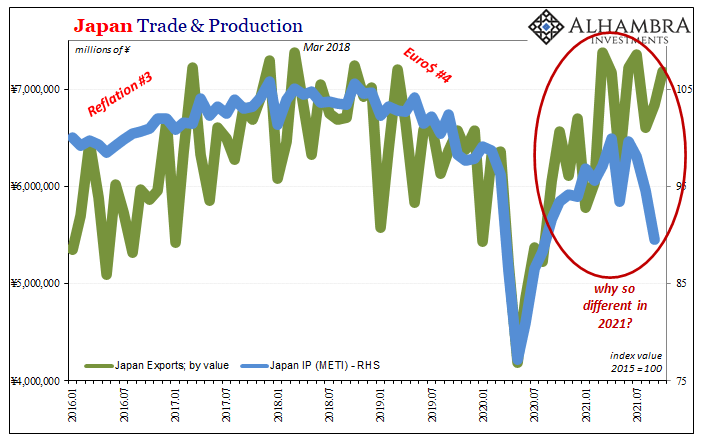

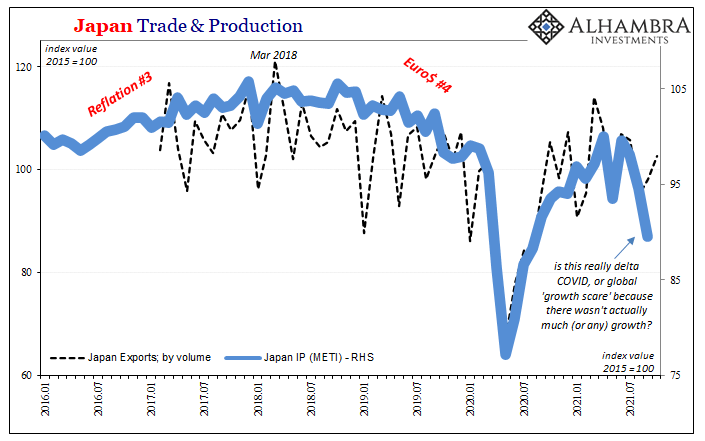

When Japan’s Ministry of Trade, Economy, and Industry (METI) reported earlier in November that Japanese Industrial Production (IP) had plunged again during the month of September 2021, it was so easy to just dismiss the decline as a product of delta COVID. According to these figures, industrial output fell an unsightly 5.4%…from August 2021, meaning month-over-month not year-over-year. Altogether, IP in Japan is down just over 10% since June, nearly 11% since peaking all the way back in April (there’s that month again). The pandemic-stymied Summer Olympics were late July and early August at delta’s apex, so another even bigger hit to Japan’s industry/export-heavy economy seems out of line with the direction. Where it does match only too well is with another

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, China, currencies, economy, exports, Featured, Federal Reserve/Monetary Policy, Germany, global trade, growth expectations, industrial production, inflation, Japan, Markets, newsletter, U.S. Treasuries, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| When Japan’s Ministry of Trade, Economy, and Industry (METI) reported earlier in November that Japanese Industrial Production (IP) had plunged again during the month of September 2021, it was so easy to just dismiss the decline as a product of delta COVID. According to these figures, industrial output fell an unsightly 5.4%…from August 2021, meaning month-over-month not year-over-year. Altogether, IP in Japan is down just over 10% since June, nearly 11% since peaking all the way back in April (there’s that month again).

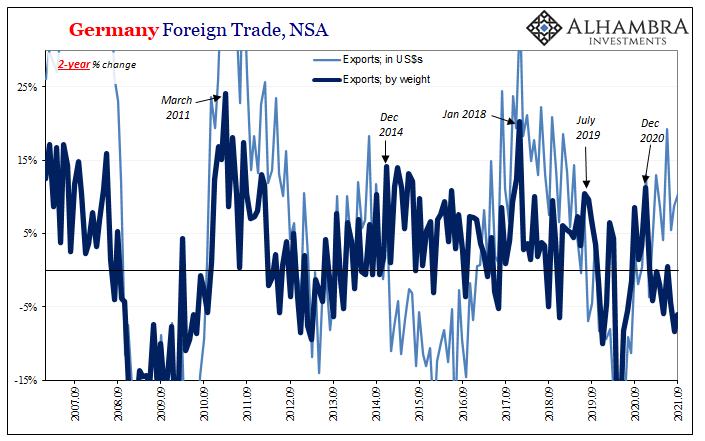

The pandemic-stymied Summer Olympics were late July and early August at delta’s apex, so another even bigger hit to Japan’s industry/export-heavy economy seems out of line with the direction. Where it does match only too well is with another industry/export-heavy bellwether like Germany. Coronavirus; or “growth scare?” |

|

| If it could be the latter, growth scare, what exactly do we mean? What is the data telling us?

At first thought, this seems an add pair of questions given how the term itself is quite literal and straightforward. The global economy grows, it pauses perhaps halts and we all wonder if the other side of the “scare” will remain growth or turn to something worse – usually a downturn if not full-blown recession at least somewhere(s) around the world where conditions (especially monetary) are most negative with the highest potential for ugly. In 2021’s case, meaning 2022, there’s an added dimension before we even begin to assess the critical stages of perhaps rolling over. |

|

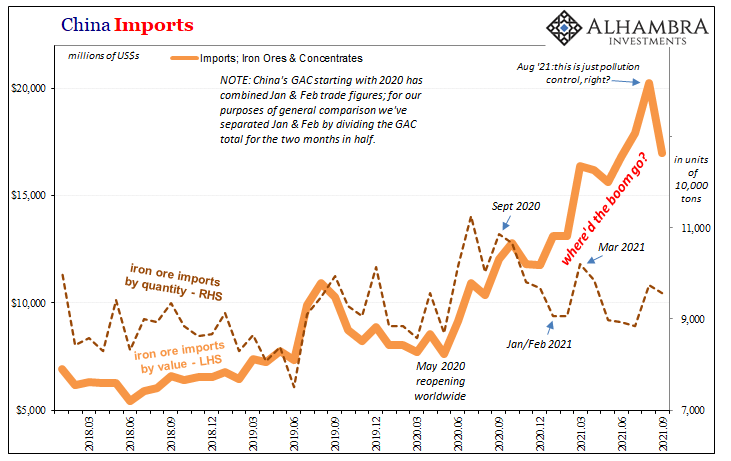

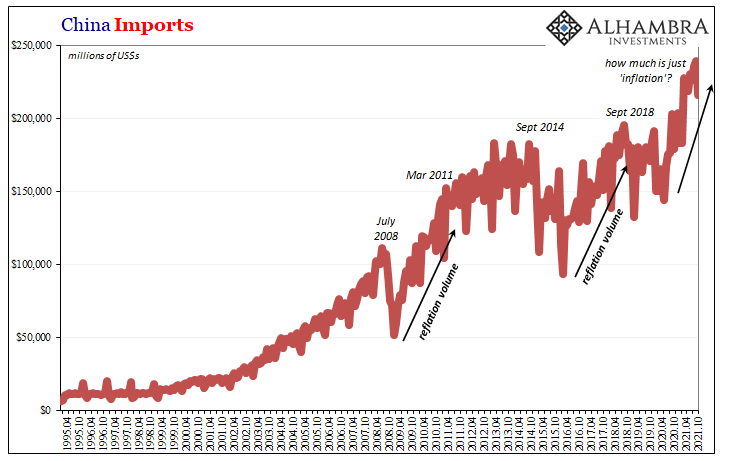

This can be summed up when referring to Irving Fisher’s money illusion, as discussed here. When looking at it first from the perspective of China and that country’s imports (specifically iron ore), a very different picture of “growth” emerges:

|

|

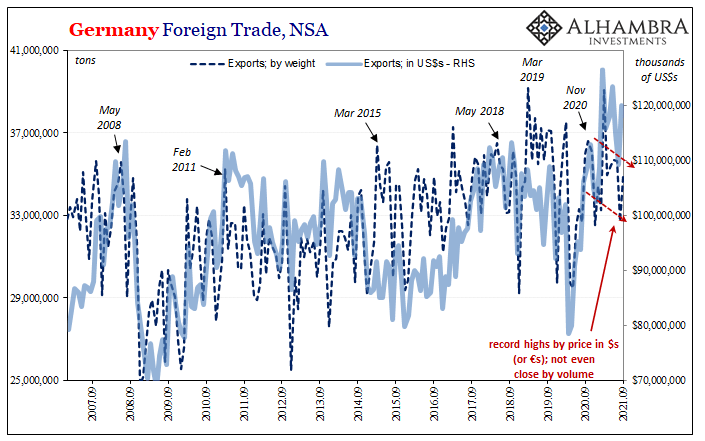

| This view was already questioned by the same illusion masking the same deficiency in that other bellwether Germany. German trade values are way up, yet production levels are not (as shown above at the beginning). COVID. Labor shortage. Supply issues. Etc. Something else?

While some of those things are likely causing some level of constraint, overall in Germany, trade like production is easily pieced together when accounting for non-inflation “inflation” which has infiltrated global supply chains due to separate issues rather than full-blown massive demand explosion. |

|

| On the contrary, as China, taking account for artificial prices we instead find Germany with a truly lackluster rebound (which did not improve in the updated stats for September 2021). | |

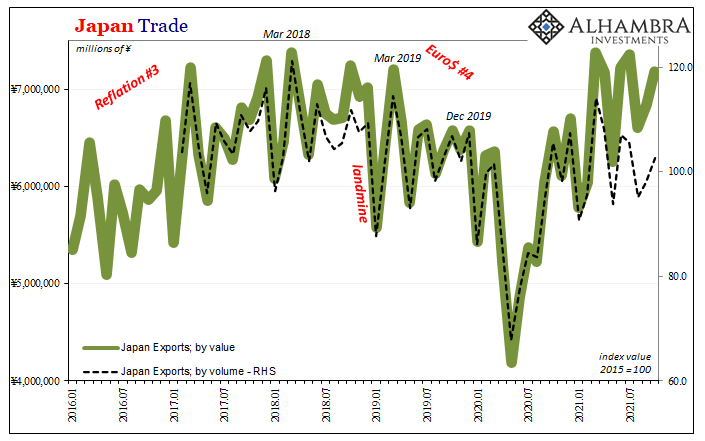

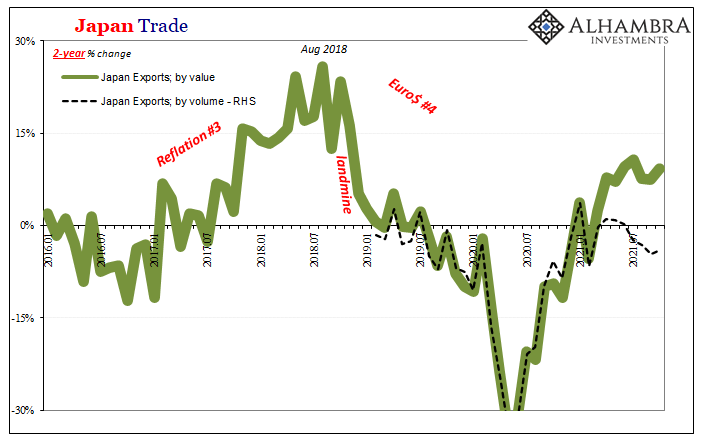

| Given where this essay began, you know what’s coming next. As Germany (and China), the same illusion has likewise infected the suffering Japanese.

Beginning with trade by value, in yen terms here, exports from Japan appear at least satisfactory though already nowhere near the same as 2018’s limited reach. And even nominally, export activity is tailing off; in October 2021, exports were valued at only 9.4% more than they had been in October 2020. The year-over-year nominal change (by value) had been 13% in September, and 26% in August. Even 2-year changes, taking account of base effects, have been stable at around high single-digits. |

|

| However, taking account of prices (by volume), suddenly Japanese trade looks both like Germany’s adjusted for prices as well as the frustratingly lower levels of production in each country. The “money illusion” in this global macro context makes a huge (the whole) difference – for interpretation, not production which is set by the other.

The only way values would become the deciding factor would be if “inflation” was actually inflation. It isn’t. By volume, exports from Japan in October were down 2.6% year-over-year, and down nearly 4% when compared to October 2019! Furthermore, no matter the terms of comparison, outbound trade from Japan peaked earlier in the year (March or April, again) and has been weakening ever since. |

|

| Thus, “growth scare” for Japan like Germany and also China doesn’t just apply to what month after month in the second half of 2021 is marginal production going the wrong way. It adds this extra “scare” in the form of the prior lack of growth in volumes hidden by artificial pricing which puts the potential for rolling over from a much lower peak – lower not just in relation to 2020’s recession, more importantly lower in relation to 2018’s!

In other words, the economy never really came back all that much; compared to 2020’s low, only somewhat. Instead, because of the unusual nature of the pandemic creating bottlenecks, a truly uninspiring global comeback was made to appear like a rip-roaring one inflation-y in its appearance. But now, with a little over a month until 2022, we can see how even as little as the 2020/early 2021 rebound had been, still its best days are almost certainly behind us anyway. |

|

| That’s a properly scary proposition. And it is that, not the pandemics subsequent proclivities, nor non-specific broad “supply issues”, which easily reconciles low production volumes with trade – and the indicated direction of trade – at the margins of these incredibly important economies. | |

| With prospects of an inventory overhang growing by the ocean-going traffic jam ongoing out West (of the US), material slowdowns in the global goods economy are even more relevant for what had been, for however little, formerly leading the post-recession renewal.

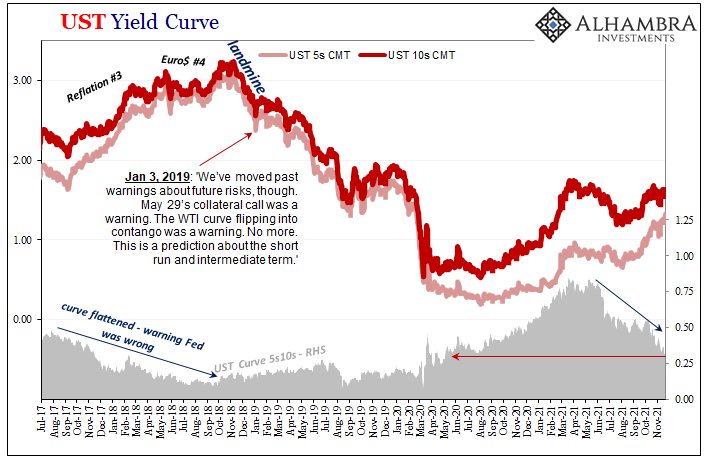

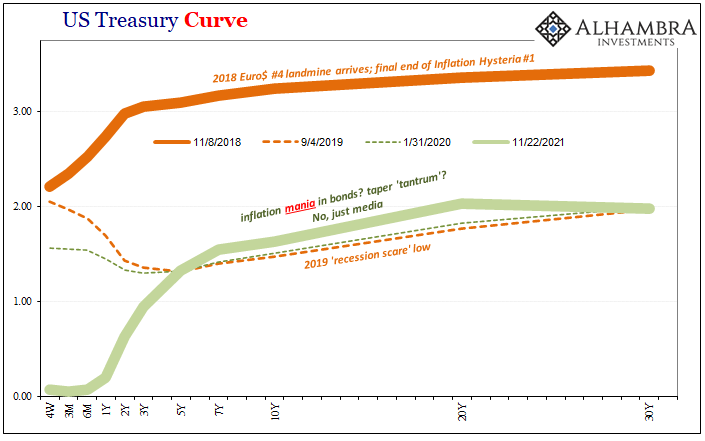

China. Germany. Japan. It isn’t China suffering Chinese problems, or Germany plagued by its own set of supplies, and certainly Japan isn’t a victim of pandemic politics of its own making. We’ve seen this particular trio behave this way before, just a few years ago when the whole world eventually turned out like those rather than the inflation-y recovery confidently guaranteed in especially the US and Europe. |

|

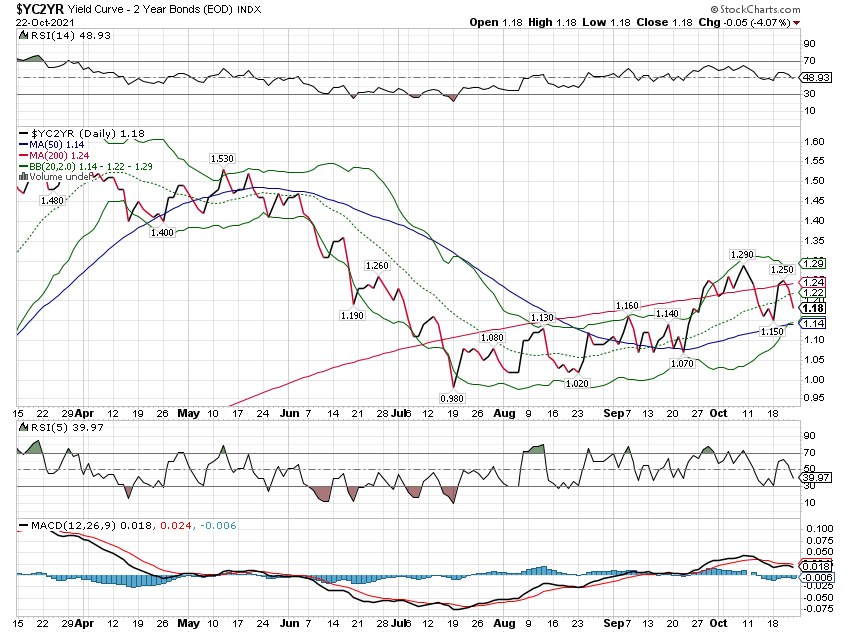

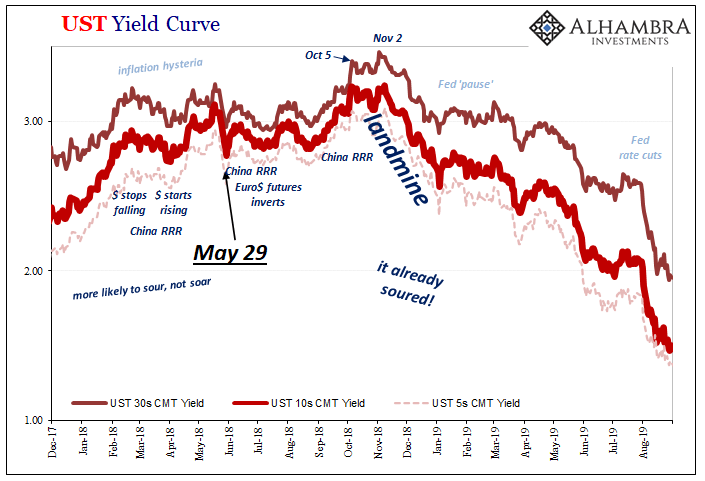

| Not coincidentally, this was the last time Jay Powell’s Fed grew confidently hawkish because for him, and the media, they don’t think properly in these global economic (and money) terms.

The only difference thus far in 2021 has been the earlier “inflation” which, since it isn’t inflation, only means the shroud of prices eventually drops probably like a hammer. Maybe even a landmine. |

Tags: Bonds,China,currencies,economy,exports,Featured,Federal Reserve/Monetary Policy,Germany,global trade,growth expectations,industrial production,inflation,Japan,Markets,newsletter,U.S. Treasuries,Yield Curve