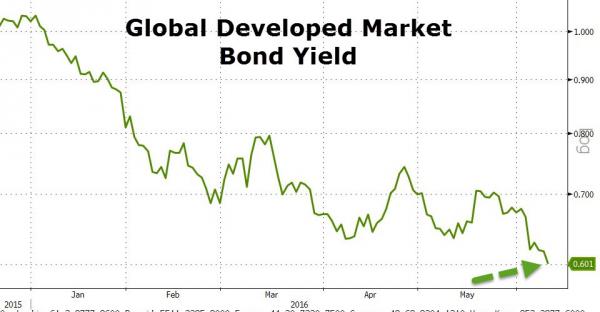

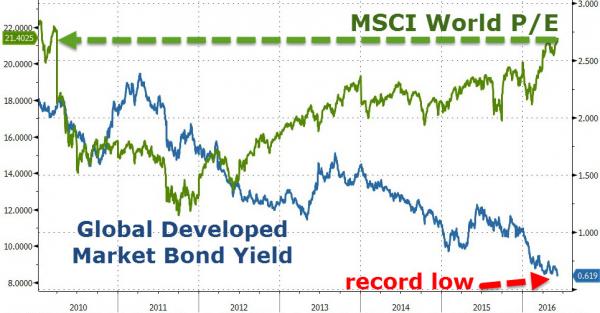

Well that escalated quickly…All-time highs within reach… everything is awesome…wait what… Quite a week: Gold +5.25% in last 2 weeks – best run in 4 months Silver +5.65% this week – best week since May 2015 Copper -4% this week to lowest weekly close since January Sterling -2.5% in last 2 weeks – worst drop in 3 months US Dollar Index +0.6% – up 7 of last 9 weeks 30Y Yields -21bps in last 8 days – best rally in 4 months 2Y Yields -17bps in last 7 days – biggest plunge since Jan 2015 Nasdaq -1.51% today – worst day since Feb 8th VIX +3vols in last 2 days – biggest spike since Feb 9th – highest close in 3 months… Bonds were the big news this week – as equities tried to ignore the message from the massive institutionalized buying of fixed income to record low yields…The yield on the Bloomberg Global Developed Sovereign Bond Index dropped to a record 0.601 percent Thursday. In April 2015, with 10Y German bond yields at 5bps, Bill Gross and Jeff Gundlach called Bunds the “short of a lifetime.” Just over a year later – having spiked to over 100bps – 10Y bund yields have crashed since The Fed hiked rates in December and The ECB escalated its bond-buying.

Topics:

Tyler Durden considers the following as important: Bill Gross, Bond, Copper, Crude, Featured, fixed, FX Trends, Germany, Gundlach, Japan, Jeff Gundlach, NASDAQ, newsletter, Reality, Switzerland, Twitter, Yen, Yield Curve, Yuan

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

Well that escalated quickly…All-time highs within reach… everything is awesome…wait what… Quite a week:

| |

|

Bonds were the big news this week – as equities tried to ignore the message from the massive institutionalized buying of fixed income to record low yields…The yield on the Bloomberg Global Developed Sovereign Bond Index dropped to a record 0.601 percent Thursday. | |

|

In April 2015, with 10Y German bond yields at 5bps, Bill Gross and Jeff Gundlach called Bunds the “short of a lifetime.” Just over a year later – having spiked to over 100bps – 10Y bund yields have crashed since The Fed hiked rates in December and The ECB escalated its bond-buying. Today marked a dramatic moment as Germany almost joined Switzerland (-50bps) and Japan (-17bps) with a 10Y bond yield below zero… as Bunds traded to 0.9bps. | |

|

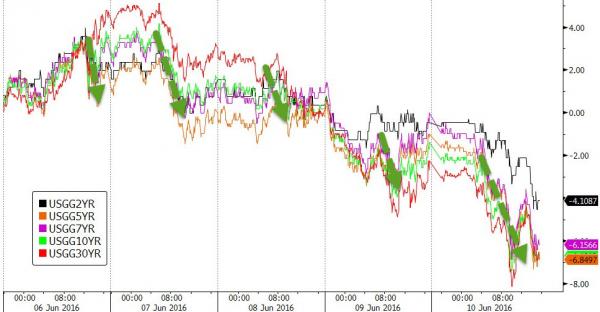

And Treasury yields tumbled…and the curve flattened | |

|

It appears renewed turmoil in Chinese currency markets started rippling through markets…as Yuan hits 4month lows… | |

|

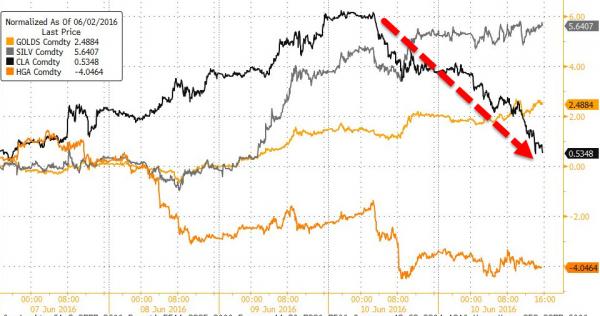

But Gold and bonds are leading the way post-payrolls, with S&P and WTI lagging… | |

|

On the week, Nasdaq was the biggest loser… | |

|

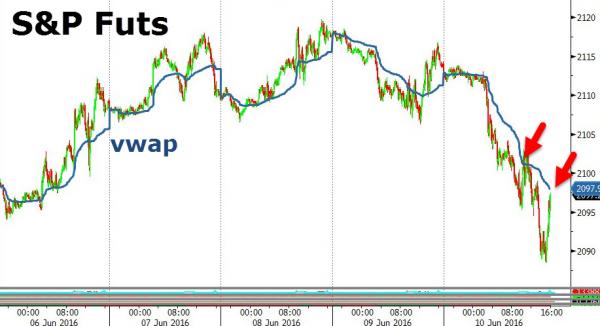

They did try to ramp it in the last 30 – managing to get close to VWAP (but missing out on 2,100 and unch on the week)… | |

|

And stocks finally caught on to the weak growth, event risk concerns priced into bonds…gold.. and FX carry… Who could have seen this coming? | |

|

Financials appear to be waking up to the reality of a collapsing yield curve… | |

|

Today’s weakness started when Europe opened, as it seems “sell the news.. AND EVERY BANK” was the meme, but really accelerated when the Brexit poll hit this afternoon… | |

|

We’ve been warning about VIX decoupling and it snapped above 17 today…as S&P lost 2100… | |

|

VIX decoupled… | |

|

Make Vix Great Again |

|

|

FX markets went turbo today following the Brexit poll with USDJPY snapping lower (Yen strength) and Cable plunging (sterling weakness)… | |

|

Copper crumbled on the week (inventory spike) and crude slid back to almost unchanged as production rose again. Gold and Silver surged… | |

|

WTI Crude ended the week below the payrolls level with a $48 handle.. | |

|

and gold broke above $1280… | |

|

Charts: Bloomberg Bonus Chart: What Could Go Wrong? |