The US created 211k net new jobs in April, a sharp bounce back from the downwardly revised 79k gain in March. It is the third month this year that the US created more than 200k new jobs. United States Nonfarm payrolls Government payrolls increased by 17k. As we noted with the Administration’s federal hiring freeze, the real growth in government employment is on the state and local level. In April the federal...

Read More »FX Daily, May 05: Mixed Dollar Ahead of US Jobs Data and Fed Talk

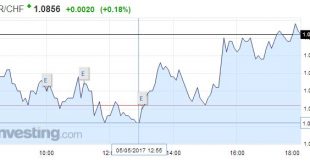

Swiss Franc EUR/CHF - Euro Swiss Franc, May 05(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is narrowing mixed as the employment data, and Fed speeches are awaited. Six Fed officials speak today, including Yellen and Fischer. Regional Presidents Williams, Rosengren Evans and Bullard also speak. It will be the first flurry of speeches since the FOMC meeting. Lastly, we note some chunky...

Read More »FX Daily, May 04: Greenback Struggles to Sustain Upticks, Though Odds of June Hike Rise

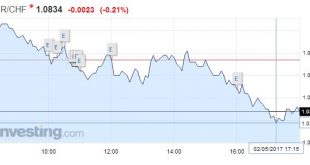

Swiss Franc EUR/CHF - Euro Swiss Franc, May 04(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is struggling to maintain even modest upticks against the euro and sterling despite the recognition of the increased likelihood of a June Fed hike. Bloomberg sees current pricing in the Fed funds as making a hike in June a near certainty (97.5%), while the CME and our own calculation...

Read More »What is the Bank of Japan to Do?

Summary: Policy is on hold. There is several areas which the BOJ can adjust its forecast or forward guidance. BOJ is more likely to err on the side of caution. The Bank of Japan is unlikely to change policy. Its current policy of targeting 10-year bond yields and expanding the balance sheet by JPY80 trillion is aimed at boosting core inflation to 2%. However, the risk is that BOJ Governor Kuroda surprises the...

Read More »FX Daily, May 03: Marking Time

Swiss Franc EUR/CHF - Euro Swiss Franc, May 03(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The global capital markets are relatively calm. Japan, South Korea, and Hong Kong markets are closed for national holidays. Investors await the FOMC statement, though expectations could not be much lower. The disappointing US auto sales, and poor Apple sales figures reported yesterday have had little impact...

Read More »Euro Drivers

Summary: Correlation between the change in the US-German two-year differential and euro remains robust. The German two-year yield has jumped in recent weeks but looks poised to slip back lower. US two-year yield has eased but is knocking on 1.30%, an important level. There is one variable that explains the euro movement better than any other single variable we have found. The US-Germany two-year interest...

Read More »FX Daily, May 02: Dollar and Yen Heavy, Equities Trade Higher and Bonds Lower

Swiss Franc EUR/CHF - Euro Swiss Franc, May 02(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is sporting a softer profile against most of the major and emerging market currencies. The Japanese yen is the main exception. The greenback is rising against the yen for the fourth session and the sixth of the past seven. The dollar’s gains against the yen coincide with the 10-12 bp recovery...

Read More »Weekly Speculative Positions (as of April 25): Bulls Take Charge of 10-year Note Futures, while Sterling Bears Hang On

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Daily, May 01: May Day Calm

Swiss Franc Switzerland Retail Sales YoY, March 2017(see more posts on Switzerland Retail Sales, ) Source: Investing.com - Click to enlarge FX Rates Many financial centers are closed for May. Japanese markets were open today, but will be closed for three sessions beginning Wednesday for the Golden Week celebrations. The US dollar is narrowly mixed. The yen is the weakest of the majors, off about 0.3% as the...

Read More »FX Weekly Preview: Looking Through the FOMC Meeting as it Looks Past Poor Q1 GDP

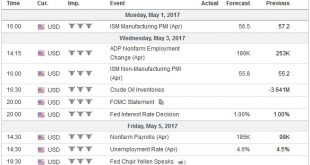

Summary: US jobs and auto sales data may be more important than the FOMC meeting. Norway and Australia’s central bank meets. Neither is expected to change policy. All three large countries that reported Q1 GDP figures last week – US, UK, France – disappointed expectations. A Federal Reserve meeting always draws market interest, as investors are on guard for policy signals. However, the statement from this...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org