Judging from investors’ reactions, the only thing worse that than the low volatility environment is when volatility spikes higher, as it did yesterday. Higher volatility is associated with weakening equity markets, falling interest rates, pressure on emerging markets, a strengthening yen and, sometimes, as was the case yesterday, heavier gold prices. A fragile stability has enveloped the markets after US equities...

Read More »FX Daily, May 18: Some Respite from US Politics as Sterling Surges Through $1.30

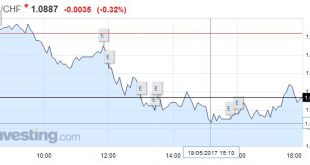

Swiss Franc EUR/CHF - Euro Swiss Franc, May 18(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Yesterday’s dramatic response to the political maelstrom in Washington is over. The appointment of a special counsel to head up the FBI’s investigation into Russia’s attempt to influence the US election appears to have acted a circuit breaker of sorts. It is not sufficient to boost confidence that the Trump...

Read More »FX Daily, May 17: Drama In Washington Adds To Dollar Woes

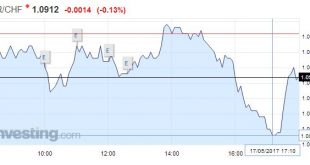

Swiss Franc EUR/CHF - Euro Swiss Franc, May 17(see more posts on EUR/CHF, ). GBP/CHF Inflation data weakens Sterling. Yesterday saw the release of Consumer Price Index (CPI) data. CPI is a measure of inflation and yesterday we saw a rise from 2.3% to 2.7% month on month. Usually a rise in inflation is deemed as good for an economy, but on this occasion it is a worrying sign. The rapid rise is a direct result of the...

Read More »Cool Video: Oil, US Inflation

I was on Bloomberg’s Day Break with the team and guest Anne Lester from JP Morgan discussing oil and inflation. Oil prices had bounced back at the end of last week and were lifted further on news that Saudi Arabia and Russia were inclined to support extending output cuts not just until the end of the year, but through Q1 18. I make two points. First, that US yields seem to be largely decoupled from the oil prices. This...

Read More »FX Daily, May 16: Greenback and Dollar Bloc Lose Ground to Europe and Yen

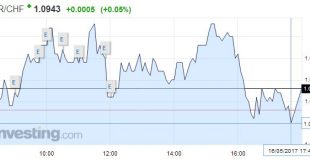

Swiss Franc EUR/CHF - Euro Swiss Franc, May 16(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Dollar selling pressure emerged at the end of last week, partly in response to disappointing US economic data. This selling pressure carried over into yesterday’s activity. It appeared to have been trying to stabilize yesterday in the North American session. News that President Trump may have shared...

Read More »FX Daily, May 15: Softer Dollar and Yen to Start the Week

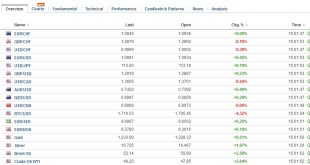

Swiss Franc . FX Rates The US dollar has opened the week softer against the major currencies, except for the Japanese yen. The disappointing US inflation and retail sales data before the weekend have not been shrugged off, even though the US 10-year yield is a little higher and expectations for a Fed hike next month continue to be elevated. There is more focus on positive developments elsewhere, especially in...

Read More »Weekly Speculative Positions (as of May 09): Significant Position Adjustment in the Currency Futures

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »Yen is the Weakest Currency in the World over the Past Month

Summary: Yen was the strongest currency in the world from mid-March to mid-April. Yen has been the weakest currency over the past month. US rates have risen relative to Japan. Japan has shifted away from QE and toward targeting interest rate. USD/JPY From March 10 through April 11, the Japanese yen was the strongest currency in the world. It appreciated 4.7% against the dollar. Among the majors, sterling...

Read More »FX Weekly Preview: Two Known Unknowns

Summary: The Trump Administration seems to be trying to cast the US as a revisionist power. Or perhaps it is like Roman emperors long ago trying to draw greater tribute from others. The outlook of US interest rates is critical to the outlook of the dollar. The main risk to investors in the week ahead comes from two unknowns. On the international stage, the biggest change in the last six months is not China or...

Read More »FX Weekly Review, May 08-13: Euro rises far above 1.09 CHF, for how long?

Swiss Franc The Swiss franc was the weakest of the majors. Its 1.7% fall was the largest in six months. Over the past month, the euro has rallied strongly against the Swiss franc. The 3.2% rally has seen the euro reach heights not see since last September. Thanks to the win of the pro-euro Macro, FX traders went long Euro and short CHF. The euro rose up to 1.0980. How long this momentum will last is still the question,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org