Swiss Franc EUR/CHF - Euro Swiss Franc, May 04(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is struggling to maintain even modest upticks against the euro and sterling despite the recognition of the increased likelihood of a June Fed hike. Bloomberg sees current pricing in the Fed funds as making a hike in June a near certainty (97.5%), while the CME and our own calculation estimates the market is discounting around 70%-75% chance of a hike. The dollar-bloc currencies continue to underperform the majors except for the yen. The firm US Treasury yields (~2.33%) the upper end of the two-week range has helped keep the dollar’s uptrend against the yen intact. The dollar has gained against the yen for six consecutive sessions, counting today’s upticks and eight of nine sessions. The downtrend line from the January and March highs comes in near JPY113.00. FX Daily Rates, May 04 - Click to enlarge The euro and sterling have recovered from earlier weakness. The euro eased to .0875, the low since April 28, but rebounded quickly to the upper end of the nine-day range that is seen near .0950. The US premium over Germany on two-year money has recovered to 203 bp today, the most in three weeks.

Topics:

Marc Chandler considers the following as important: AUD, China Caixin Services PMI, EUR, EUR/CHF, Eurozone Markit Composite Purchasing PMI, Eurozone Retail Sales, Eurozone Services PMI, Featured, France Services PMI, FX Daily, FX Trends, GBP, Germany Composite PMI, Germany Services PMI, JPY, Metals, newslettersent, Spain Services PMI, TLT, U.K. Services PMI, U.S. Trade Balance, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

EUR/CHF - Euro Swiss Franc, May 04(see more posts on EUR/CHF, ) |

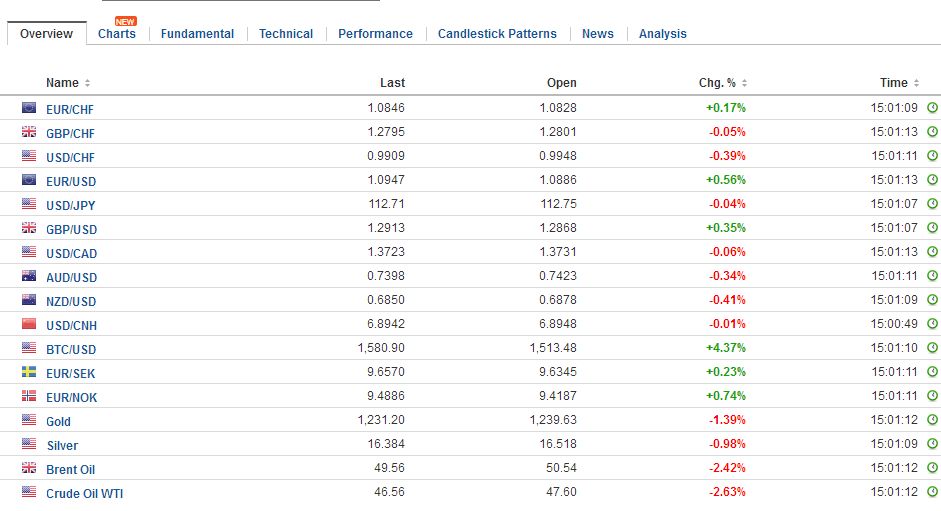

FX RatesThe US dollar is struggling to maintain even modest upticks against the euro and sterling despite the recognition of the increased likelihood of a June Fed hike. Bloomberg sees current pricing in the Fed funds as making a hike in June a near certainty (97.5%), while the CME and our own calculation estimates the market is discounting around 70%-75% chance of a hike. The dollar-bloc currencies continue to underperform the majors except for the yen. The firm US Treasury yields (~2.33%) the upper end of the two-week range has helped keep the dollar’s uptrend against the yen intact. The dollar has gained against the yen for six consecutive sessions, counting today’s upticks and eight of nine sessions. The downtrend line from the January and March highs comes in near JPY113.00. |

FX Daily Rates, May 04 |

| The euro and sterling have recovered from earlier weakness. The euro eased to $1.0875, the low since April 28, but rebounded quickly to the upper end of the nine-day range that is seen near $1.0950. The US premium over Germany on two-year money has recovered to 203 bp today, the most in three weeks. If the premium continues to widen, we expect the dollar to get better traction. Sterling was sold to nearly $1.2830, the low since April 26, but also snapped back. News that Prince Philip will step back from royal duties that involve extensive travel seemed to have a little perceptible impact.

Norway’s central bank was the third major central bank that met this week and decided to keep the current policy settings. This was widely expected. The euro has been rallying against the krone since late February and is up about 7.5%. Indeed it has been nearly straight up for the past three weeks. Today’s gains extend the streak to the fifth consecutive session and 11of 13 sessionsstarting April 18. Technical indicators are getting stretched and look for some reversal pattern to indicate a top is in place as the euro approaches NOK9.50, a level not seen since last July. |

FX Performance, May 04 |

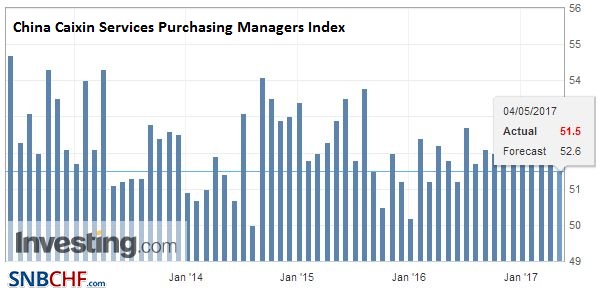

ChinaThe main economic news today comes in the form of service PMIs. China got the ball rolling. Caixin measures of services slipped to 51.5 from 52.2. It has slipped every month this year so far and is at the lowest level since last May. The composite eases to 51.2 from 52.1. It is the lowest since last June. The data, like the official PMI, warn that the world’s second-largest economy has lost momentum. It is yet to be seen whether the weaker growth impulses translate to increased debt stress and new capital outflows. Elsewhere, we note that metal prices are suffering their biggest single-day decline this year. Iron ore and steel futures in China were limit down. Copper extended yesterday’s 3.5% decline as stockpiles at the LME jumped by the most in two months. Nickel fell 2% today after a 3% drop yesterday. Weakness in China’s manufacturing PMI was a catalyst. Oil prices are giving back yesterday’s modest gain as US inventories fell less than expected, while gasoline inventories rose less than expected. |

China Caixin Services Purchasing Managers Index (PMI), April 2017(see more posts on China Caixin Services PMI, ) Source: Investing.com - Click to enlarge |

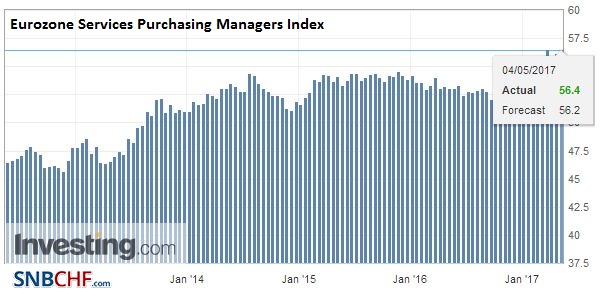

EurozoneClearly, it is unreasonable to expect that it will get as good of a deal or a better one outside the EU than inside. A hard exit, by which it is mean the loss of access and privileges, seems to be the most likely scenario, in exchange for more control over its borders, domestic regulations, and free to enter other trade agreements. Moreover, in the current context, where Russia is accused of trying to influence not only US elections but some European elections as well, May’s accusation seems to equate the two. The eurozone services rose to 56.4 from a flash reading of 56.2 (and 56.0 in March). It is a new multiyear high. |

Eurozone Services Purchasing Managers Index (PMI), April 2017(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

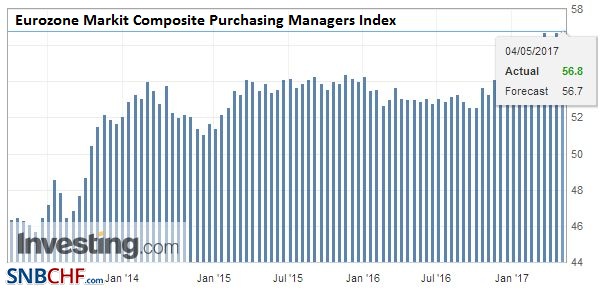

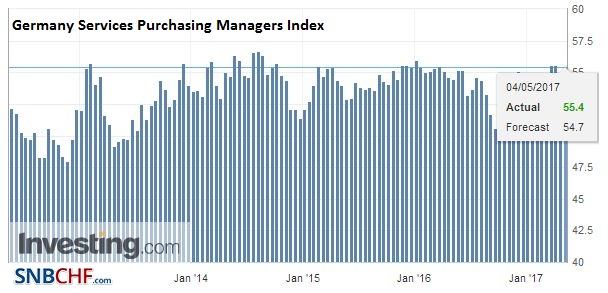

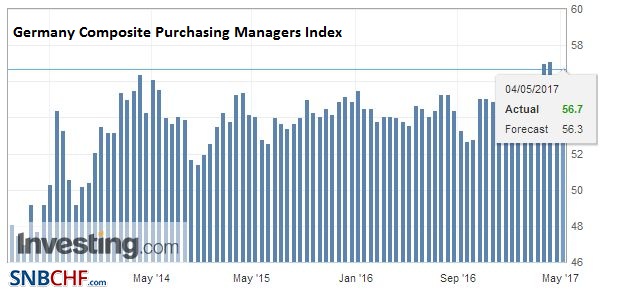

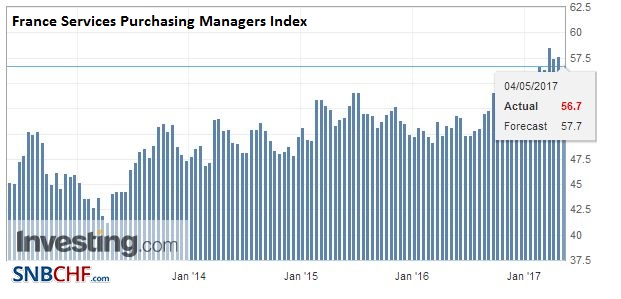

| The composite rose to 56.8 from 56.7 flash (and 56.4 in March). It suggests the regional economy is off to a strong start to Q2. In terms of country breakdown, German services beat the flash (55.4 vs. 54.7), but France did not. Its final services reading was 56.7 rather than the 57.7 flash report. |

Eurozone Markit Composite Purchasing Managers Index (PMI), April 2017(see more posts on Eurozone Markit Composite Purchasing PMI, ) Source: Investing.com - Click to enlarge |

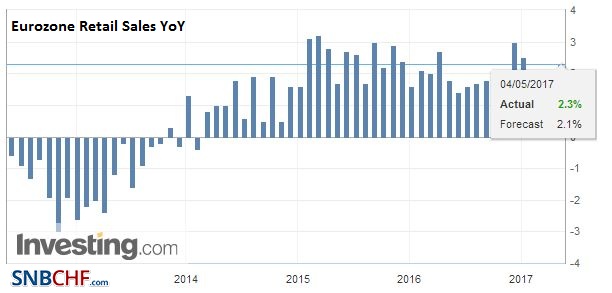

| Separately, the eurozone March retail sales rose 0.3% for a 2.3% year-over-year pace. Although the February data were revised lower, the year-over-year pace is the strongest since last October. |

Eurozone Retail Sales YoY, March 2017(see more posts on Eurozone Retail Sales, ) Source: Investing.com - Click to enlarge |

Germany |

Germany Services Purchasing Managers Index (PMI), April 2017(see more posts on Germany Services PMI, ) Source: Investing.com - Click to enlarge |

Germany Composite Purchasing Managers Index (PMI), April 2017(see more posts on Germany Composite PMI, ) Source: Investing.com - Click to enlarge |

|

France |

France Services Purchasing Managers Index (PMI), April 2017(see more posts on France Services PMI, ) Source: Investing.com - Click to enlarge |

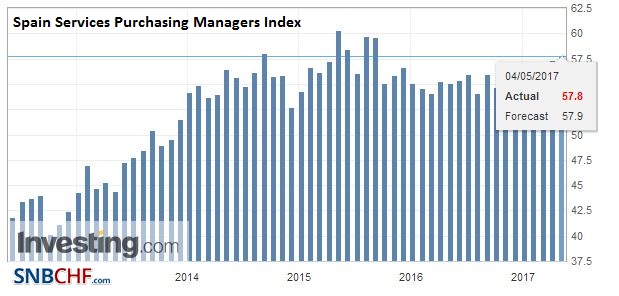

SpainSpain and Italy offered upside surprises. Italian service PMI was 56.2 up from 52.9. The composite reading of 56.8 (from 54.2) is new multiyear highs. We suspect that if Italy’s composite PMI translates into stronger growth, investors will be surprised at how much seemingly structural problems, including non-performing loans, can be eased. Spain goes from good news to better. Its service PMI rose to 57.8 from 57.4, and the composite rose to 57.3 from 56.8. Spain reported a 129.3k drop in its unemployment. Typically, Spain enjoys strong employment gains in the April-May period. |

Spain Services Purchasing Managers Index (PMI), April 2017(see more posts on Spain Services PMI, ) Source: Investing.com - Click to enlarge |

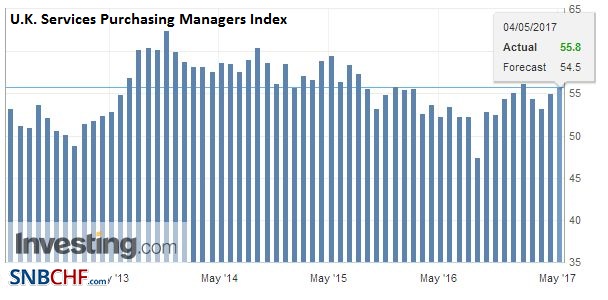

United KingdomThe UK made it a trifecta. With today’s news on the service sector, all three of the UK’s PMIs this week defied expectations and rose. The service PMI rose to 55.8 from 55.0 (expectations for more a 54.5 reading|). The composite rose to 56.2 from a revised 54.8. It is the second consecutive increase and the highest reading here in 2017. March consumer lending and mortgage approvals were also stronger than expected. UK Prime Minister May’s claim that the EU was interfering with the UK election seems wide of the mark. Last week EU meeting was planned long before May’s reversal and call for a snap election. After rejecting calls for an election, May gave in, in part to strengthen her hand in EU negotiations. Essentially, the EU said it would not work. Juncker and Merkel’s claims that the UK had illusions about what was possible is not an endorsement of any candidate or program. The UK has formally triggered Article 50, and the amputation process will begin. |

U.K. Services Purchasing Managers Index (PMI), April 2017(see more posts on U.K. Services PMI, ) Source: Investing.com - Click to enlarge |

United States |

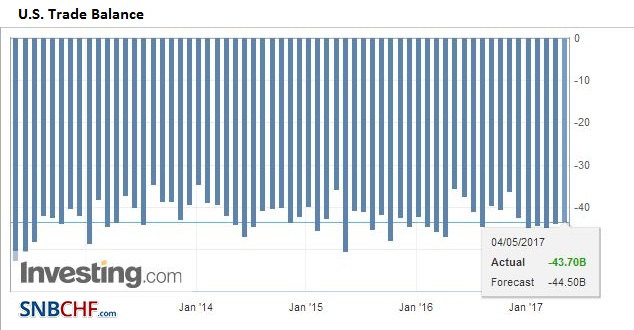

U.S. Trade Balance, March 2017(see more posts on U.S. Trade Balance, ) Source: Investing.com - Click to enlarge |

Since Q1 US GDP is behind us, monthly data from the first three months of the year may be of little consequence except for economists trying to anticipate revisions. Ahead of tomorrow’s non-farm payroll report, investors may watch the progress of the health care reform bill that is expected to come up for a vote today. It is very close, and even if it passes today, the next hurdle is formidable: the Senate. The idea, however, is to work out the differences in reconciliation and this process requires a simple majority.

Unlike the budget bill for the remainder of the fiscal year that was a bipartisan effort, the health care is unlikely to get a Democrat vote. The health care savings initially were going to free up $1 trillion that the GOP wanted to use to fund tax reform. The new proposals do not show that that level of savings. This will force tax reform to be scaled back, rely more on inflated growth prospects, or get moderate Democrat support.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$EUR,$JPY,$TLT,China Caixin Services PMI,EUR/CHF,Eurozone Markit Composite Purchasing PMI,Eurozone Retail Sales,Eurozone Services PMI,Featured,France Services PMI,FX Daily,Germany Composite PMI,Germany Services PMI,Metals,newslettersent,Spain Services PMI,U.K. Services PMI,U.S. Trade Balance