Swiss Franc The Euro has risen by 0.04% to 1.1418 CHF. EUR/CHF and USD/CHF, September 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates As the markets head into the weekend, global equities are firmer, benchmark 10-year yields are mostly lower, and the dollar is consolidating after North American pared the greenback’s gains yesterday. Manufacturing PMIs from China, EMU, and the UK have been reported, while in the US, the August jobs data stand in the way of the long holiday weekend for Americans. FX Daily Rates, September 01 - Click to enlarge There are several large options that expire in New York today that could impact spot. There are 2.8 bln euros struck

Topics:

Marc Chandler considers the following as important: CAD, China Caixin Manufacturing PMI, EUR, Eurozone Manufacturing PMI, Featured, France Manufacturing PMI, FX Trends, GBP, Germany Manufacturing PMI, Italy Manufacturing PMI, Japan Manufacturing PMI, JPY, newslettersent, Spain Manufacturing PMI, Switzerland SVME PMI, U.K. Manufacturing PMI, U.S. Average Earnings, U.S. Manufacturing PMI, U.S. unemployment rate, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

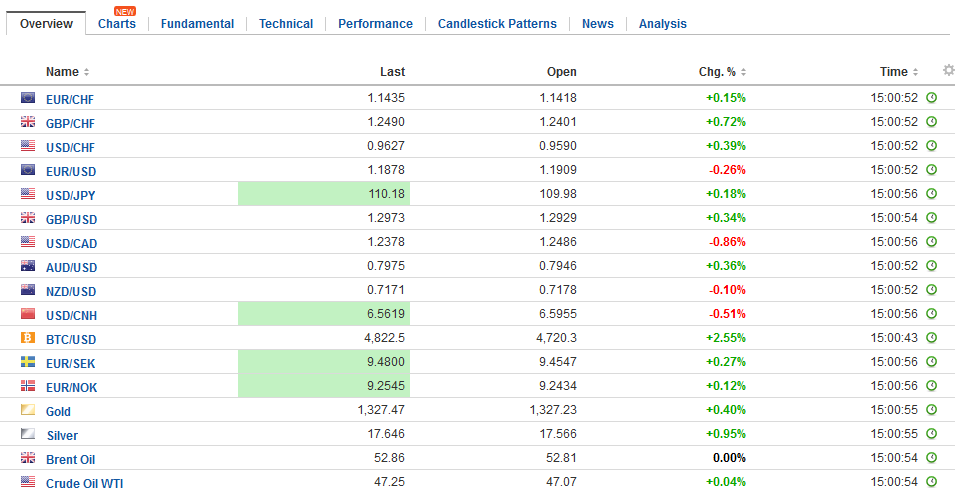

Swiss FrancThe Euro has risen by 0.04% to 1.1418 CHF. |

EUR/CHF and USD/CHF, September 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

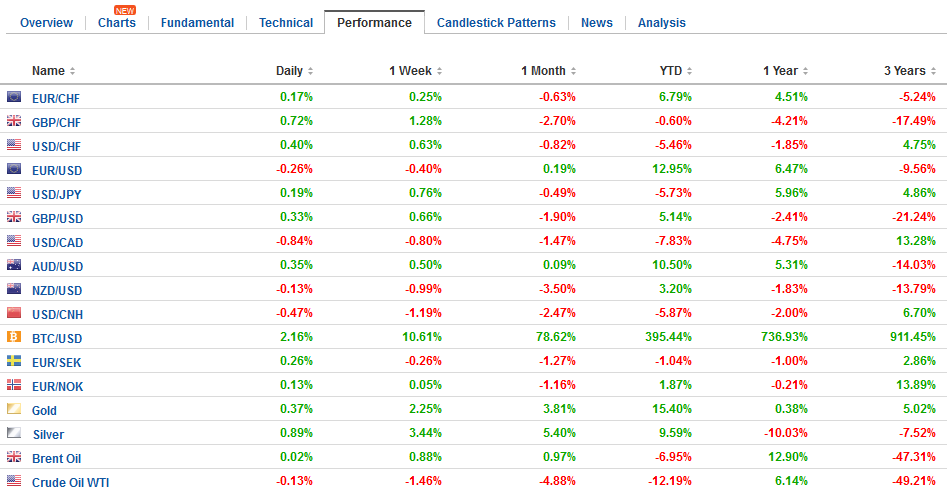

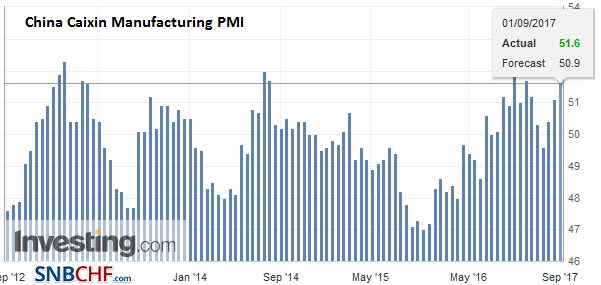

FX RatesAs the markets head into the weekend, global equities are firmer, benchmark 10-year yields are mostly lower, and the dollar is consolidating after North American pared the greenback’s gains yesterday. Manufacturing PMIs from China, EMU, and the UK have been reported, while in the US, the August jobs data stand in the way of the long holiday weekend for Americans. |

FX Daily Rates, September 01 |

| There are several large options that expire in New York today that could impact spot. There are 2.8 bln euros struck between $1.1850 and $1.1870 and another 2.7 bln euros struck between $1.19 and $1.1930 that could be in play. There are also $2.4 bln struck between JPY109.90 and JPY110.25. There is another $765 mln struck at JPY110.50 that will be cut today.

The Canadian dollar was consolidating its sharp gain yesterday (1%+) recorded on the back of a stronger than expected Q2 GDP. The strength of the economy has encouraged many to bring forward the rate hike penciled in for October to next week. The yield of the September BA futures contract is at its highest level since the middle of 2015. The US dollar held a few ticks above the week’s low near CAD1.2440 from August 29. Key support is seen at CAD1.24. |

FX Performance, September 01 |

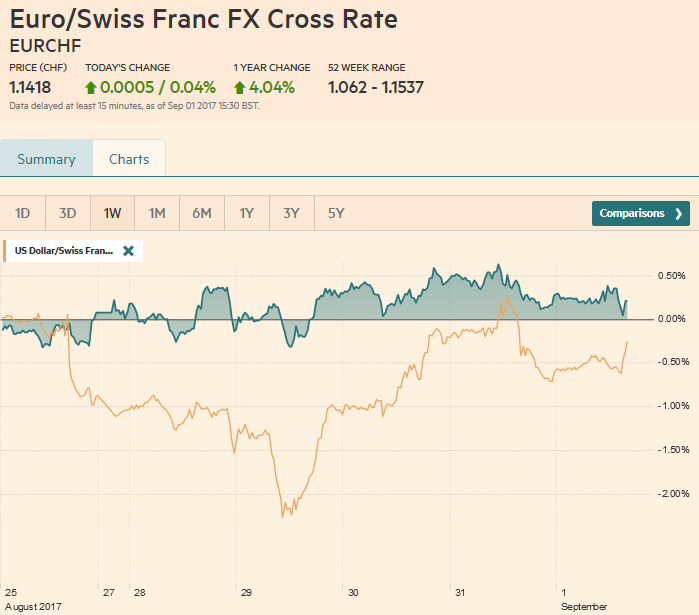

ChinaChina’s Caixin manufacturing PMI ticked to 51.6 from 51.1, confirmed the improvement seen in the official measure. The resilience of China’s economy is one of this year’s pleasant surprises. The years high was set at 51.7 in February, just below the cyclical peak last December at 51.9. |

China Caixin Manufacturing PMI, Aug 2017(see more posts on China Caixin Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

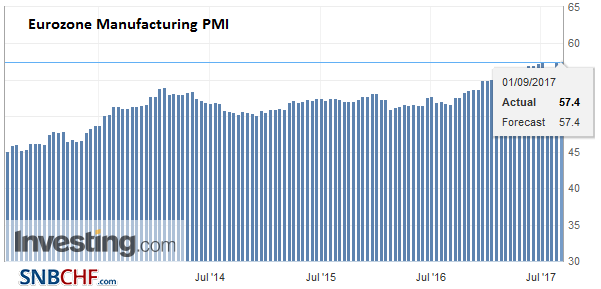

EurozoneEMU’s manufacturing PMI was unchanged from the flash reading of 57.4 after 56.6 in July. Export orders and firm domestic demand point underpin the European factories. The news is unlikely to change expectations for next week’s ECB meeting. Many, like ourselves, expect the ECB to announce that its asset purchases will be extended though at a slower pace in 2018. Others expected a hint of this next week, but a formal decision may not be made until October. In terms of amounts, we have argued that by cutting the amount in half to 30 bln a month, it would give the central bank the maximum flexibility to stop in June. However, a reduction to 40 bln euros a month would likely mean the buying spills over into H2 18. |

Eurozone Manufacturing PMI, Aug 2017(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

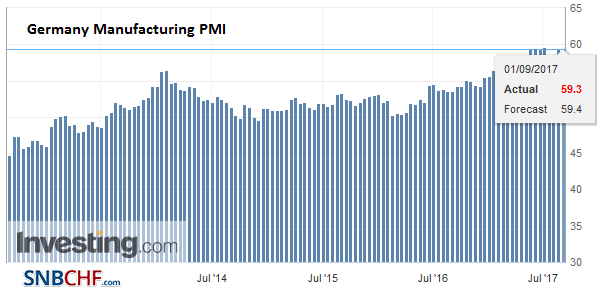

GermanyIn terms of country breakdown, German’s flash reading of 59.4 was shaved to 59.3. It is still quite strong. |

Germany Manufacturing PMI, Aug 2017(see more posts on Germany Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

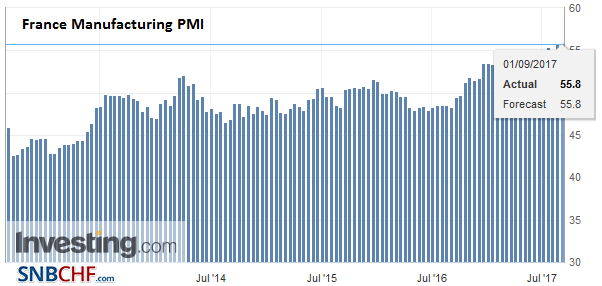

FranceFrance was unchanged from the flash reading of 55.8. The new news was from Spain and Italy. |

France Manufacturing PMI, Aug 2017(see more posts on France Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

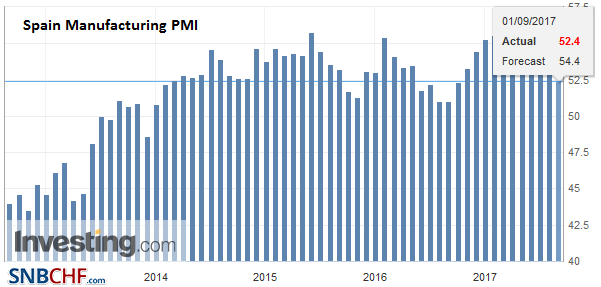

SpainSpain disappointed with a 52.4 manufacturing PMI, down from July’s 54.0. |

Spain Manufacturing PMI, Aug 2017(see more posts on Spain Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

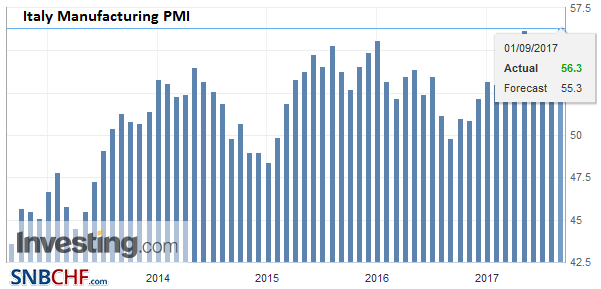

ItalyItaly offered an upside surprise, with a jump to 56.3 from 55.1, a new multi-year high. |

Italy Manufacturing PMI, Aug 2017(see more posts on Italy Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

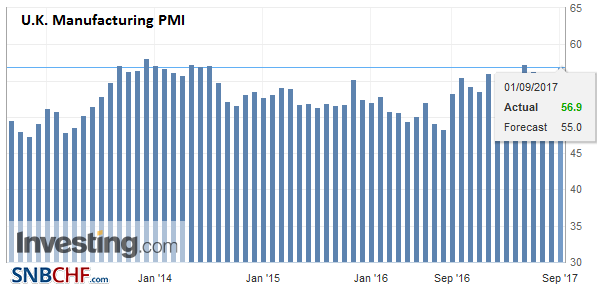

United KIngdomNews that the UK’s manufacturing PMI unexpectedly rose to 56.9 from a revised 55.3 (from 55.1 originally) helped lift sterling briefly before it slipped back. The cyclical high was recorded in April at 57.0. New orders were the strongest since May. Job creation was the highest in three years. The public barbs between the EU and the UK over Brexit may give a pre-taste of this month has in store, ahead of the October EU Summit. Reports in some of the British press has played up the moderation of the UK government’s stance. From the EU’s point of view, the UK still acts as if it controls the agenda and resisting EU’s demand that the conditions of the severing are decided (or substantial progress is made) before talking about how the two areas will be related afterward. |

U.K. Manufacturing PMI, Aug 2017(see more posts on U.K. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

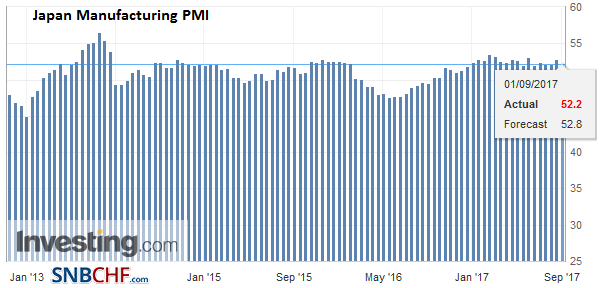

JapanJapan reported a soft Q2 capex report. It rose 1.5% in Q2. The Bloomberg consensus was for a nearly 8% gain after a 4.5% increase in Q1. This warns of a substantial revision to Q2 GDP that will be reported next week. Rather than expand by 1% quarter-over-quarter, the pace is likely to slow to a still robust 0.7%. |

Japan Manufacturing PMI, Aug 2017(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

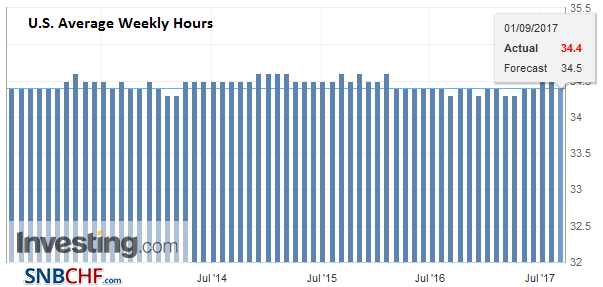

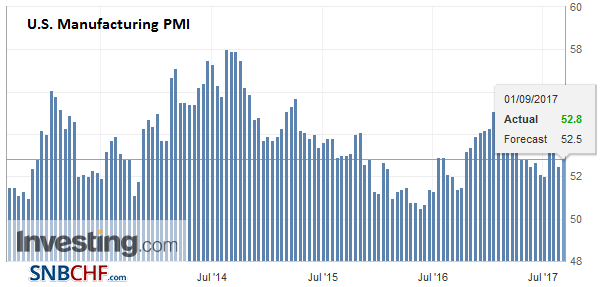

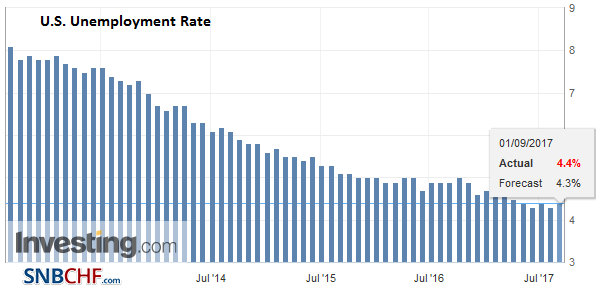

United StatesMany economists had been braced for a slowing of US jobs growth as the expansion matures. However, jobs growth in the first seven months averaged 184k which is essentially the same as last year’s average (187k). Over the past three months, jobs growth has averaged 195k, and some reversion to the mean is expected. Barring a significant downside surprise, the focus will not be on the job creation itself. The key is average hourly pay. A 0.2% increase in August would lift the year-over-year pace to 2.6%, which is the 12 and 24-month average. It may require a a stronger increase to have a sustained impact. |

U.S. Average Weekly Hours, Aug 2017(see more posts on U.S. Average Earnings, ) Source: Investing.com - Click to enlarge |

| Meanwhile, investors are trying to assess the likely impact of the Harvey storm on the larger US economy and policies. Reports suggest that the lifting of the debt ceiling may added as an amendment to the relief package for Texas. The head of the conservative Liberty Caucus argued against doing so, but it is not clear if it can be blocked. Nearly $6 bln of emergency aid, mostly for FEMA. The Treasury’s maneuvering around the debt ceiling included a movement of about $400 bln into the market earlier this year, which seemed to break the shortage of dollars that had helped lift the greenback last year. When the debt ceiling is lifted, those funds will again be drained, and we suspect, the net result could be positive for the dollar. |

U.S. Manufacturing PMI, Aug 2017(see more posts on U.S. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

| Today’s employment report is unlikely to see much impact from the storm. The survey had been conducted before it hit. Next week’s initial jobless claims will be among the first signs. Given the impact of large storms in recent years, an 80k-100k increase in initial claims would not be surprising but then unwound in a few weeks.

Back-of-the-envelop calculations warn that Q3 GDP may be cut by 1% and Q4 by 0.5% before rebounding in 2018. We do not think it impacts the Fed’s decision to begin reducing its balance sheet. We expect that announcement on Sept 20 to begin in Q4. By the December meeting, the rebuilding will be underway, and we don’t expect the GDP impact to prevent the Fed from hiking again. We emphasize the continued strength of the labor market and the broader financial conditions, which have evolved in the opposite direction than the Fed sees fit. |

U.S. Unemployment Rate, Aug 2017(see more posts on U.S. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

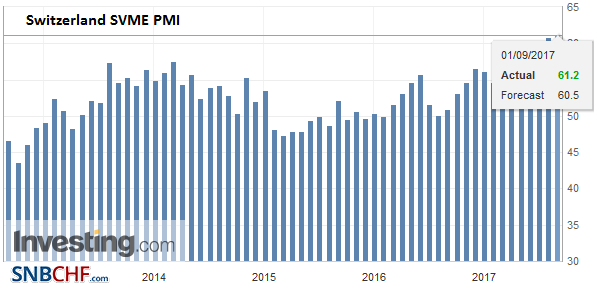

Switzerland |

Switzerland SVME PMI, Aug 2017(see more posts on Switzerland SVME PMI, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CAD,$EUR,$JPY,China Caixin Manufacturing PMI,Eurozone Manufacturing PMI,Featured,France Manufacturing PMI,Germany Manufacturing PMI,Italy Manufacturing PMI,Japan Manufacturing PMI,newslettersent,Spain Manufacturing PMI,Switzerland SVME PMI,U.K. Manufacturing PMI,U.S. Average Earnings,U.S. Manufacturing PMI,U.S. Unemployment Rate