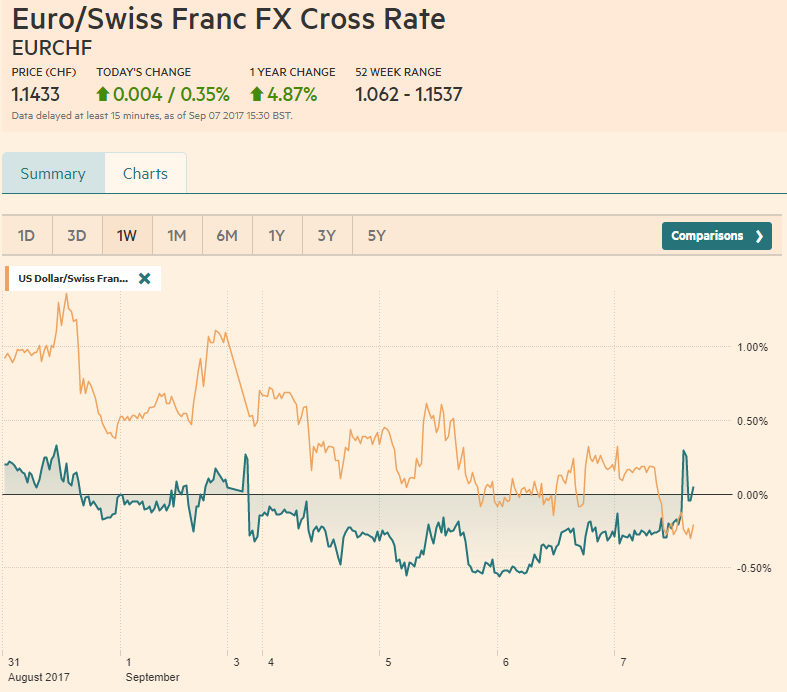

Swiss Franc The Euro has risen by 0.35% to 1.1433 CHF. FX Rates The US dollar is trading broadly lower. The ECB meeting looms large. Many, like ourselves, expected that when Draghi said in July that the asset purchases would be revisited in the fall, it to meant after the summer recess, not a legalistic definition of when fall begins. Still, there have been some reports, citing unnamed sources close to the ECB, that have played down such expectations, and warn a decision on next year’s intentions may not be announced until October or even December. Such reports have helped steady the euro below .20. It traded above there only on one day (August 29). It had appeared that at the end of last week, the euro was

Topics:

Marc Chandler considers the following as important: ECB, EUR, EUR/CHF, Eurozone Gross Domestic Product, Featured, FX Trends, GBP, JPY, newsletter, NZD, SEK, U.S. Crude Oil Inventories, U.S. Initial Jobless Claims, USD, USD/CHF, Yuan

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.35% to 1.1433 CHF. |

|

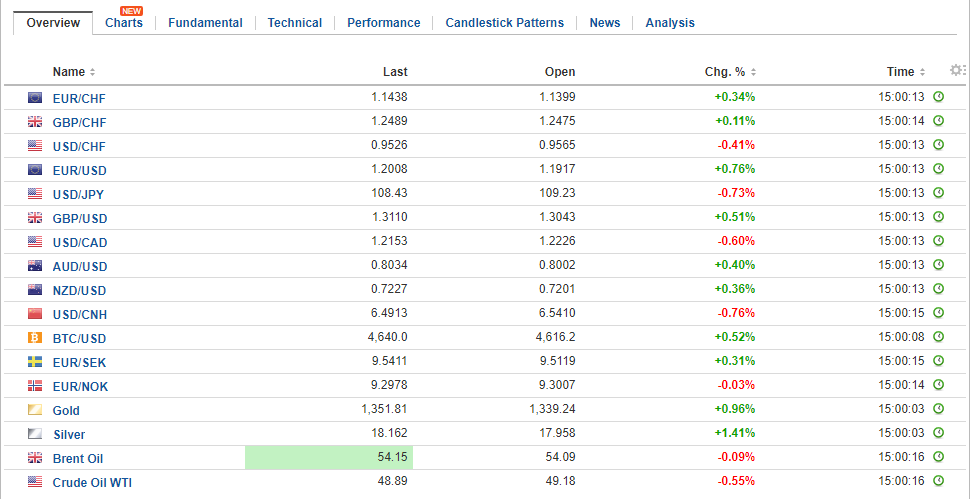

FX RatesThe US dollar is trading broadly lower. The ECB meeting looms large. Many, like ourselves, expected that when Draghi said in July that the asset purchases would be revisited in the fall, it to meant after the summer recess, not a legalistic definition of when fall begins. Still, there have been some reports, citing unnamed sources close to the ECB, that have played down such expectations, and warn a decision on next year’s intentions may not be announced until October or even December. Such reports have helped steady the euro below $1.20. It traded above there only on one day (August 29). It had appeared that at the end of last week, the euro was heading there after the disappointing US jobs data, but was turned back by one of those reports citing anonymous officials. Despite the poor close last week (~$1.1860), the euro has recorded higher lows each day thus far this week and higher highs. |

FX Daily Rates, September 07 |

| There are two large euro options that expire today 90 minutes after Draghi’s press conference starts. Based on DTCC data, there are nearly 730 mln euro struck at $1.1950 that will be cut today, and 920 mln euros struck at $1.20. The two-year high set at the end of August was $1.2070, and we have suggested the $1.2170 area as the next key target, which corresponds to a 61.8% retracement of the euro’s decline from the mid-2014 high near $1.40.

Only the New Zealand dollar is trading weaker than the krona today. The Kiwi has been underperforming. It is the only major currency that has lost ground (2.2%) against the US dollar over the past month. The key driver appears to be prospects that the September 11 national election leads to a new Labour government. |

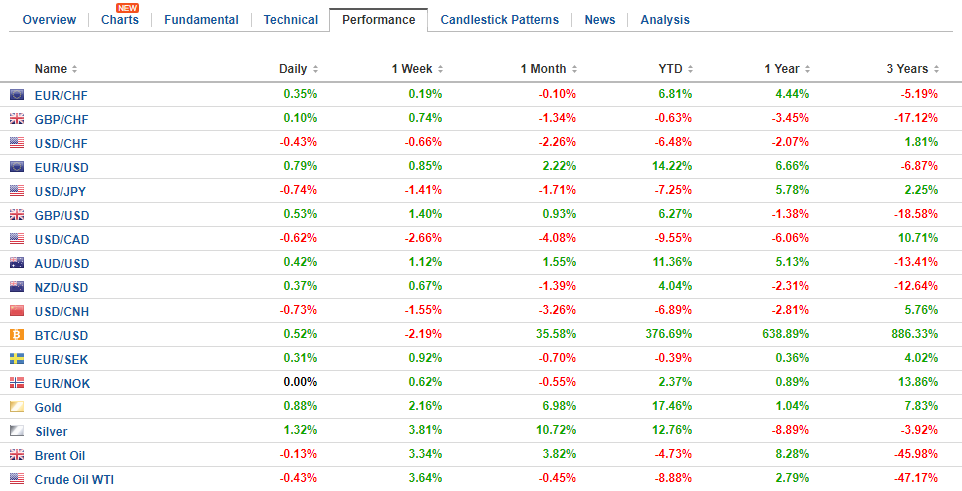

FX Performance, September 07 |

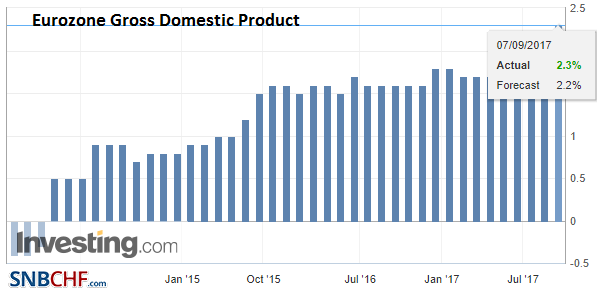

EurozoneThe ECB meeting provides new staff forecasts. The supposed leaks warn that GDP may be tweaked higher, but inflation shaved. Lowering inflation forecasts is more dovish than raising GDP is hawkish. Barring a hard stop, which has been dismissed as potentially disruptive, the ECB must extend its purchases. The evolving language of the ECB’s statement suggests a tapering. We suggest that the consensus view of a reduction of monthly purchases to 40 bln euros for six months would be a dovish signal as it points to continued purchases in H2 18, while a cut to 30 bln euros would give officials flexibility to end the program at mid-year. The failure of the ECB to make such an announcement today could spur pullback in the euro, but it may prove short-lived if the delay is just until next month. There is little doubt that Draghi will address the strength of the euro. And even if he discusses it in his prepared remarks, surely reporters will pepper him with questions about it at the press conference. Draghi, as other ECB officials have done, will likely recognize that part of the euro’s appreciation is a function of better economic and political prospects in the euro area. We imagine he will also caution that continued appreciation could pose a headwind to the recovery. |

Eurozone Gross Domestic Product (GDP) YoY, Q2 2017(see more posts on Eurozone Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

United StatesThere are two main developments in the US. The first is about the Fed. Vice Chairman Fischer announced he wouldstep down early next month. His term as Vice Chair ends in the middle of next year. He cited personal reasons for expediting his departure. It leaves the Board of Governors very short staffed. A team of seven is down to three (Yellen, Brainard, and Powell). Quarles is yet to join. |

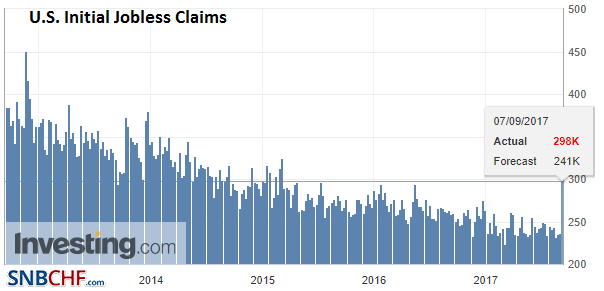

U.S. Initial Jobless Claims, 07 September 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

| At the same time, some reports have suggested that Cohn will not be named to replace Yellen. The press reports suggest Cohn’s criticism of the White House handling of recent events involving white nationalism irked key decision makers. On the other hand, we had seen the changes slip when the White House moved away from initial plans to offer a detailed blueprint for tax reform. Tax reform has seen a Cohn’s main task. Outside of Cohn and Yellen, former Fed Governor Warsh is seen as a third candidate. |

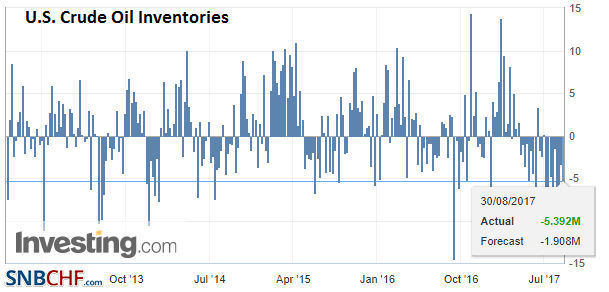

U.S. Crude Oil Inventories, September 2017(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

Sweden’s Riksbank seemed to pay no heed to the fact that the ECB may taper. It stuck with its dovish tone, suggesting no hike until the middle of next year. Its current asset purchase program is slated to continue until the end of this year. The dovish posture saw the krona ease. The euro traded to almost SEK9.55, a level it has not closed above since mid-August. Of note, the Riksbank announced it was shifting its preferred inflation measure from the headline to the underlying rate (CPIF) which excludes mortgage costs. There are no policy implications. CPIF rose 2.4% year-over-year in July, while the headline stood at 2.2%. On September 12, Sweden will report the August figures.

In the UK, Parliament will take up the Great Repeal bill today. It is the first reading. It is mostly theater. It is Monday’s second reading that will be more dramatic. It is there that the cost of the loss of the Tory majority will be most acutely felt. The prospects for a longer transition phase than the Tories have pushed seem to have helped sterling this week. Yesterday it reached a one month high a little above $1.3080, which is also the 61.8% retracement of the down move since the early August high near $1.3270. Technical indicators suggest the odds favor a return toward the highs.

The Canadian dollar is consolidating its outsized gains scored yesterday in response to the 25 bp rate hike. There was not the “buy the rumor sell the fact” activity we thought likely. Instead, many read the short statement that accompanied the hike to signal a low bar to another hike. A move at the October 25 meeting would seem particularly aggressive. It would be the third hike in as many meetings. Rather, barring a marked change in conditions, further accommodation, which was said to be considerable before yesterday’s hike, would likely be removed in December (BoC last meeting of the year is December 6).

The Bank of Canada attributed the strength of the Canadian dollar to favorable developments in Canada and negative developments for the US. The Canadian dollar is the strongest currency in the world over the past three months. It has risen 10.7% against the US dollar. The Scandis are next (NOK +9.3% and SEK +9.0%), followed by the Chilean peso (+8.2%).

The second main development in the US relates to fiscal policy. It appears that a deal is in the works to extend the debt ceiling and spending authorization until mid-December. This saw an immediate adjustment to the T-bill market. In our understanding of the dollar’s decline since March, the drawing down of the Treasury’s deposits, which helped end the H2 2016 dollar shortage, had an under-appreciated role. The Treasury may replenish those funds over the next three months, allowing another round of maneuvering (drawing down cash) after mid-December. However, we understand that the Treasury’s cash position needs to be about the same as it is now. That means that debt to be issued is simply tocover expenditures. The agreement also removes a possible hurdle to the Fed’s plans to allow the balance sheet to begin shrinking in Q4.

US Treasury yields rose 4.5 bp yesterday to 2.105% after falling 10.5 bp on Tuesday. The yield is a little softer today as it struggles to sustain a rise above 2.1%. When yields rose yesterday, the dollar recovered toward JPY109.40, but with yields back off today, the dollar is back below JPY109. There are about $1.2 bln in options struck at JPY108.75 and JPY109 that expire today.

Lastly, we note that Chinese reserves rose for the seventh consecutive month in August. The value of reserves rose $11 bln (to $3.009 trillion). It is nearly three times more than the Bloomberg survey suggested. The yuan itself had the best month in many years, rising nearly 2.1% against the dollar, which fell about 0.6% against the euro and 0.25|% against the yen. As China’s reserves have increased, so has its appetite for US Treasuries.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,ECB,EUR/CHF,Eurozone Gross Domestic Product,Featured,newsletter,NZD,SEK,U.S. Crude Oil Inventories,U.S. Initial Jobless Claims,USD/CHF,yuan