Overview: US stocks built on the recovery started on Monday and Powell’s suggestion of letting the balance sheet shrink later this year eased some speculation of a fourth hike this year, which seemed to allow the Treasury market to stabilize. What amounts to a greater appetite for risk is carrying over into Asia Pacific activity today. Many of the large bourses advanced more than 1%, with the Hang Seng up almost 2.8% and the Nikkei up nearly as much. Bond...

Read More »Gold Price News: Gold Down 1% in Wake of More Hawkish Federal Reserve Meeting Minutes

Gold price fell to $1,808 an ounce in the wake of the release of the minutes of the December Federal Reserve meeting, having hit an intra-day high of $1,829. Silver price fell to $22.72 an ounce from an intra-day high of $23.26. Gold and silver have continued to sell off this morning with gold trading as low as $1,794 and silver trading down to $22.14. The FOMC minutes showed a much more hawkish Fed than markets had been expecting. The minute suggests that the Fed...

Read More »Inflation and Geopolitics in the Week Ahead

The Omicron variant may be less fatal than the earlier versions, but it is disrupting economies. The surge in the Delta variant well into Q4 in the US and Europe was already slowing the recoveries. Investors will likely take the high-frequency real sector data with the proverbial pinch of salt until January data available beginning later this month. While the tribalist approach, exemplified by “team transition” and “team permanent” debates about inflation, the...

Read More »Start Long With The (long ago) End of Inflation

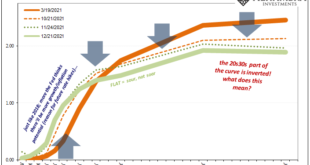

With the eurodollar futures curve slightly inverted, the implications of it are somewhat specific to the features of that particular market. And there’s more than enough reason to reasonably suspect this development is more specifically deflationary money than more general economic concerns. What I mean is, those latter have come later (“growth scare”) only long after the world’s real money truly began to dry up. Money then economy. How do we know? For one, sequence...

Read More »The Chagrin of Beijing and the Problem of Time

The central bank meeting cycle is over. Most of the important high-frequency data has been released until early January. The US debt ceiling has been lifted, avoiding an improbable default. A year ago, there was a sense of optimism, with a couple of vaccines being announced and monetary and fiscal stimulus boosting risk-appetites. Populism, which had been in the ascendancy after the Great Financial Crisis, seemed to be retreating in Europe and the United...

Read More »Testing The Supply Chain Inflation Hypothesis The Real Money Way

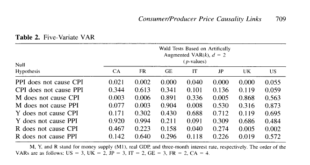

Basic intuition says this is a no-brainer. Producer prices rise, businesses then pass along these higher input costs to their customers in the form of consumer price “inflation” so as to preserve profits. This is the supply chain hypothesis. Statistically, we’d therefore expect the PPI to lead the CPI. And this was expected for much of Economics’ history, taken for granted as one of those self-evident truths (kind of like the Inflation Fairy). After the dreadful...

Read More »FOMC Sets New Course

The Fed delivered what it was expected to do: double the pace of tapering and project a more aggressive interest rate response with its individual forecasts. The dollar initially rallied on the headlines, and new sessions highs were recorded, but the price action was a bit of a head-fake, as it were. The greenback's gains were quickly pared, though it remained above JPY114 ahead of Chair Powell's press conference. The market had already discounted two hikes and...

Read More »Weekly Market Pulse: Has Inflation Peaked?

The headlines last Friday were ominous: Inflation Hits Highest Level in Nearly 40 Years Inflation is Painfully High… Groceries and Christmas Presents Are Going To Cost More Inflation is Soaring.. America’s Inflation Burst This morning on Face The Nation, Mohamed El-Erian, former Harvard endowment manager, former bond king apprentice, economist and the man who seems to have a permanent presence on CNBC, had this to say: The characterization of inflation as transitory...

Read More »Weekly Market Pulse: Discounting The Future

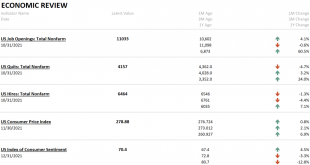

The economic news recently has been better than expected and in most cases just pretty darn good. That isn’t true on a global basis as Europe continues to experience a pretty sluggish recovery from COVID. And China is busy shooting itself in the foot as Xi pursues the re-Maoing of Chinese society, damn the economic costs. But here in the US, the rebound from the Q3 slowdown is in full bloom. Just last week we had pending home sales, ADP employment, both ISM reports,...

Read More »Fragile Calm Returns and Powell’s Anti-Inflation Rhetoric Ratchets Up

Overview: Into the uncertainty over the implications of Omicron, the Federal Reserve Chairman injected a particularly hawkish signal into the mix in his testimony before the Senate. These are the two forces that are shaping market developments. Travel restrictions are being tightened, though the new variant is being found in more countries, and it appears to be like closing the proverbial barn door after the horses have bolted. Equities are higher. The MSCI Asia...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org