(Disclosure: Some of the links below may be affiliate links) I keep track of all my expenses. And monthly, I publish my expenses on this blog. But once a year, I also a full analysis of my expenses for the past year. It helps me put things in perspective. And it also gives me an idea of where my expenses are going for an entire year. For me, it is an essential part of the way I am managing my money. I do not really budget, but I track all our expenses. And seeing...

Read More »Japan’s Well-Fed Zombie Corporations

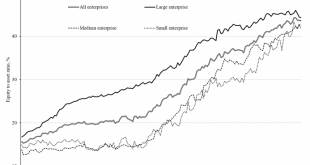

The corona crisis has intensified the discussion about the zombification of the economy; enterprises have become more dependent on government bailouts, loans, subsidies, short-time working benefits, and loans from central banks. Governments around the world claim the measures to be only temporary. Yet Japan’s experience suggests that the reliance of enterprises on public support can continue in one form or another. Japan’s enterprises have long relied on the state...

Read More »The PRO Act Is Not Just a Union Handout—It’s an Assault on the Freedom of Association Itself

On February 4, 2021, Democrats in the House and Senate introduced the Protecting the Right to Organize (PRO) Act. Like many names in Washington, this one is an Orwellian misnomer that does the exact opposite of what it claims to be doing. If passed, the bill, which is basically a union wish list, would radically transform the nature of the labor market in the US with numerous sweeping and heavy-handed changes. Andy Levin (MI-09), a sponsor of the bill, doesn’t bother...

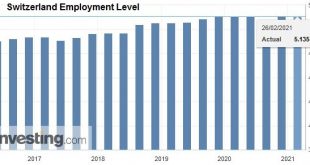

Read More »Employment in Switzerland fell in 4th quarter 2020 for the third consecutive time

26.02.2021 – In the 4th quarter 2020, the total employment (number of jobs) fell by 0.4% in comparison with the same quarter a year earlier (+0.1% with previous quarter). Among women, the decrease was 0.6%, while employment among men fell by 0.3%. In full-time equivalents, employment in the same period declined also by 0.4%. The Swiss economy counted 12 600 fewer vacancies than in the corresponding quarter of the previous year (-16.1%) with the employment outlook...

Read More »Former Swiss central banker throws in towel to lead OECD

Hildebrand had to concede defeat having failed to generate enough support for his candidacy. Keystone / Peter Klaunzer Former Swiss National Bank (SNB) chairman, Philipp Hildebrand, has pulled out of the race to become the next secretary-general of the Organisation for Economic Co-operation and Development (OECD). Hildebrand announced that he had withdrawn his candidacy on Twitter on Thursday evening. “It was a privilege and an honour to have been Switzerland’s...

Read More »Die Artikel auf Mises Deutschland – Februar 2021

Rückblick auf die Artikel des Ludwig von Mises Institut Deutschland im Monat Februar: ***** „Der archimedische Punkt bei Anthony de Jasay ist die Freiheitsvermutung.“ Interview mit Burkhard Sievert, 1, Februar 2021 Ich bin über die Bücher von Roland Baader auf Anthony de Jasay aufmerksam geworden, der ihn als einen herausragenden freiheitlichen Philosophen hervorhob. Um es mit Gerhard Radnitzky zu sagen: „Im intellektuellen Bereich haben nur sehr wenige mehr für die...

Read More »Bulls, Bears, and Beyond: In Depth with James Grant

James Grant is editor of Grant’s Interest Rate Observer, which he founded in 1983. He is the author of nine books, including Money of the Mind, The Trouble with Prosperity, John Adams: Party of One, The Forgotten Depression, and more recently Bagehot: The Life and Times of the Greatest Victorian. In 2015 Grant received the prestigious Gerald Loeb Lifetime Achievement Award for excellence in business journalism. James Grant is an associated scholar of the Mises...

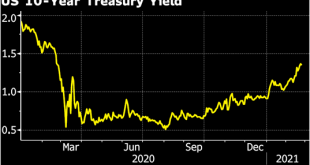

Read More »How High is Too High for Rising Government Bond Yields?

The two day rise in the gold price of more than US$50 fizzled out on Tuesday. The gold price is down about 7% (in US dollar terms) since its year-to-date high set on January 6. It is also down 13% from its all-time high set in August 2020. The silver price, boosted by social media attention, did not set its year-to-date high until February 1. Since then the silver price has slid about 5% from that high. Chairman Powell testified to Congress on Tuesday stating that...

Read More »FX Daily, February 26: Fed Hike Ideas Give the Beleaguered Greenback Support

Swiss Franc The Euro has fallen by 0.31% to 1.0977 EUR/CHF and USD/CHF, February 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge Overview: A poor seven-year note auction and ideas that the first Fed hike can come as early as the end of next year spurred a steep sell-off in bonds and equities. Technical factors like the triggering of stops losses, large selling in the futures market, which some also link to hedging of mortgage...

Read More »The end of central banking as we know it

The severest crisis the European Central Bank (ECB) ever faced coincided with the early days of a new Executive Board. Over the past year and a half, the board’s six members, including the ECB’s president and vice president, have all been replaced, either because they resigned, or because their eight-year mandate expired. New team By order of appointment, the new board consists of: Luis de Guindos, who replaced Vitor Constancio as vice president in June 2018...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org