Dirk Niepelt ist der Direktor des Studienzentrums Gerzensee und Professor für Makroökonomie an der Universität Bern. Hier im Gespräch mit Geldcast-Host Fabio Canetg. swissinfo.ch Swissinfo, December 14, 2020. HTML, podcast. We talk about CBDC, the Swiss National Bank, whether CBDC would render it easier to implement helicopter drops, and how central bank profits should be distributed. Dirk Niepelt ist weltweit einer der führenden Forscher auf dem Gebiet der...

Read More »This Global Growth Stuff, China Still Wants A Word

Before there could be “globally synchronized growth”, it had been plain old “global growth.” The former from 2017 appended the term “synchronized” to its latter 2014 forerunner in order to jazz it up. And it needed the additional rhetorical flourish due to the simple fact that in 2015 for all the stated promise of “global growth” it ended up meaning next to nothing in reality. Oddly the same for 2017’s update heading into 2018 and 2019. If currency wars are the...

Read More »Covid, December 16: declaring extraordinary situation pointless right now, says Swiss minister

Speaking to broadcaster RTS, Swiss health minister Alain Berset said the pandemic was under control and that it currently made no sense to declare an extraordinary situation, a provision in Swiss law on managing infectious diseases that allows the Federal Council to take charge of the situation over and above cantonal governments. Declaring an extraordinary situation would be pointless right now, said Berset. We currently have all the tools we need to act and we must...

Read More »FX Daily, December 15: The Bulls are Emboldened

Swiss Franc The Euro has risen by 0.12% to 1.0775 EUR/CHF and USD/CHF, December 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P fell for the fourth consecutive session yesterday, the longest losing streak of the quarter, and this seemed to encourage profit-taking in the Asia Pacific region today. The MSCI Asia Pacific Index slipped for the second consecutive session, and even confirmation of the...

Read More »Swiss Producer and Import Price Index in November 2020: -2.7 percent YoY, -0.1 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

Read More »Switzerland and UK sign agreement on mobility of service suppliers

The UK market is being opened up to Switzerland in more than 30 service sectors Keystone An agreement that secures reciprocal, facilitated market access for service providers from Switzerland and Britain from January 1 has been signed by Economics Minister Guy Parmelin and Liz Truss, the British Secretary of State for International Trade. The Services Mobility Agreement (SMA), signed in London on Monday, regulates the mutual access and temporary stay of service...

Read More »FOMC Preview

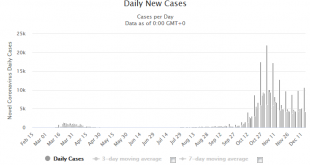

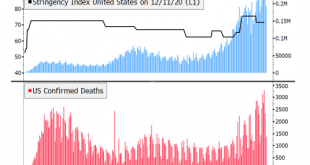

The two-day FOMC meeting starts tomorrow and wraps up Wednesday afternoon. While no policy changes are expected, we highlight what the Fed may or may not do. We expect a dovish hold, with Powell underscoring the growing downside risks facing the US economy in the coming months. RECENT DEVELOPMENTS The US outlook has worsened since the November FOMC meeting. Infection numbers are making new highs with no sign of abating. There is no national strategy to contain the...

Read More »Entrepreneurial Empowerment: You Are Only as Good as Your Employees

Abstract: As employees are increasingly recognized as an important source of ideas and inspiration, contemporary leadership research finds that the central task of leaders is to empower employees to realize their skills and talents to achieve an organizations’ visions and goals. Drawing on this leadership premise, this study develops the concept of entrepreneurial empowerment (EE). EE has structural and psychological dimensions that empower employees to utilize...

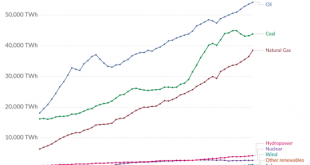

Read More »Professor Dr. Hans-Werner Sinn: „Das Klimaproblem und die deutsche Energiewende“

14. Dezember 2020 – Am 10. Oktober 2020 fand im Hotel „Bayerischer Hof“, München, die 8. Jahreskonferenz des Ludwig von Mises Institut Deutschland statt. Das Thema lautete: „Wie der Markt Umwelt und Ressourcen schützt“. Einen Konferenzbericht von Rainer Bieling finden Sie hier. Nachfolgend sehen Sie den Vortrag „Das Klimaproblem und die deutsche Energiewende“ von Professor Dr. Hans-Werner Sinn. Hans-Werner Sinn, geboren 1948, ist emeritierter Professor für...

Read More »One Little Problem with the “All-Electric” Auto Fleet: What Do We Do with all the “Waste” Gasoline?

Regardless of what happens with vaccines and Covid-19, debt and energy–inextricably bound as debt funds consumption– will destabilize the global economy in a self-reinforcing feedback. Back in the early days of the oil industry (1880s and 1890s), the product that the industry could sell at a profit was kerosene for lighting and heating. Since there was no automobile industry yet, gasoline was a waste product that was dumped into streams. Why couldn’t the refiners...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org