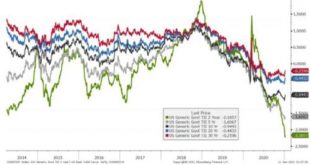

Swiss Franc The Euro has risen by 0.21% to 1.1018 EUR/CHF and USD/CHF, February 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The sharp recovery in US shares yesterday that saw the S&P 500 snap a five-day slide failed to carry into Asia Pacific trading earlier today. All the markets fell save India and Singapore. Losses were led by a 3% drop in Hong Kong as the first increase in the stamp duty...

Read More »The Death Of Logic

Just over four years ago, as Bitcoin was making its first big moves in both price and public perception, John Hussman of Hussman Investment Trust penned a lengthy as well as seminal report entitled, “Three Delusions: Paper Wealth, a Booming Economy, and Bitcoin.” The core themes set forth in his report (as in any well-reasoned, blunt analysis) are refreshingly evergreen in their ongoing applicability. Rather than re-invent an already functioning wheel, I’ve opted to...

Read More »Devisen – Euro kostet erstmals seit Ende 2019 mehr als 1,10 Franken

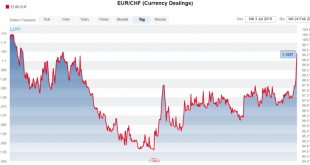

Dieses Niveau hatte es letztmals Ende 2019 gegeben. Auch der US-Dollar hat in den letzten Wochen weiter Boden gut gemacht und nähert sich mittlerweile der 0,91er Marke an. Der Franken habe derzeit keinen leichten Stand bei den Anlegern, hiess es am Markt. Die Risikobereitschaft sei gestiegen, was nicht zuletzt an den geopolitischen Entspannungen liege. Sogenannt sichere Häfen wie der Schweizer Franken seien in diesem Umfeld weniger gefragt. Darüber hinaus sei in den...

Read More »Socialist America?

The idea of socialism is still alive and well in 2021. Looking at the progressives on the fringes of the Democratic Party – the likes of Bernie Sanders and Elizabeth Warren, one might think they are the real culprits keeping the idea alive. Yet, just looking at the 2020 Democratic Party presidential debates, we can see just how alive socialism truly is. Almost all candidates promised ‘free’ stuff and demanded centrally planned solutions to practically all...

Read More »For The Dollar, Not How Much But How Long Therefore How Familiar

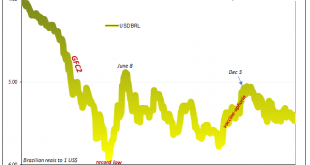

Brazil’s stock market was rocked yesterday by politics. The country’s “populist” President, Jair Bolsonaro, said he was going to name an army general who had served with Bolsomito (a nickname given to him by supporters) during that country’s prior military dictatorship as CEO of state-owned oil giant Petróleo Brasileiro SA. Gen. Joaquim Silva e Luna is being installed, allegedly, to facilitate more direct control of the company by the federal government. With the...

Read More »Just Leave Cuba Alone

Unfortunately, Joe Biden is your prime example of a standard Washington, D.C., politician. As such, as president he will just accept the status quo, defer to the national-security establishment, and do his best to make the welfare-warfare state function efficiently. That means that the U.S. policy of interventionism and regime change toward Cuba will continue to remain the same as it has been since Cuban revolutionaries ousted the U.S. dictator Fulgencio Batista in...

Read More »Swiss tourism boss says ski resort openings have been justified

Off-piste in Klosters, canton Graubünden. © Keystone / Christian Beutler The head of the Switzerland Tourism organisation reckons the decision to open ski resorts in the country this winter has – so far – proven to be a good one. “There were no big [virus] outbreaks, no ski resort became a hotspot, there was no major reputational damage for Switzerland – none of these fears materialised,” said Martin Nydegger in an interview with the CH-Media group on Tuesday....

Read More »FX Daily, February 23: Dramatic Market Adjustment Continues

Swiss Franc The Euro has risen by 0.38% to 1.0931 EUR/CHF and USD/CHF, February 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Rising rates continue to spur a rotation and retreat in stocks. Yesterday the NASDAQ sold-off by nearly 2.5% while the Dow Industrials eked out a minor gain. Equities are mostly higher in the Asia Pacific region while Japanese markets were on holiday. Hong Kong led the advancers, but...

Read More »Pandemic pushes Swiss away from cash

Will cash machines soon be a thing of the past? © Keystone / Christian Beutler Cash has lost its appeal among the Swiss population as the coronavirus pandemic led more people to pay by bank card, mobile app or online, a recent survey has found. The survey by financial services website moneyland.ch found that for the first time, cash is no longer people’s preferred method of payment. “Moneyland.ch expects that cash will continue to lose in importance,” said...

Read More »Swiss Producer and Import Price Index in January 2021: -2.1 percent YoY, +0.3 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org