When will precious metals markets finally make their move? It’s a question that has frustrated many investors in 2021. Gold and silver prices have remained stubbornly rangebound for the past several months. There is no way to know exactly when this consolidation period will end. Long-term investors would be wise to hold their core positions regardless of market conditions (and grow them when feasible). However, there are signs both technical and fundamental that...

Read More »Swiss energy bills contained, but future crunch looms

As energy prices rocket, the meter is ticking on Switzerland’s future electricity security. © Keystone / Christian Beutler Households and businesses across Europe are facing a huge rise in electricity and heating costs this winter. Price hikes in Switzerland have so far been comparatively cushioned, but there are warnings of a potential energy crunch in the next few years. My specialty is telling stories, and decoding what happens in Switzerland and the world...

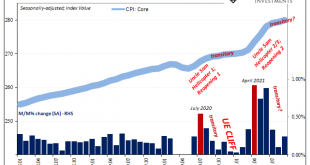

Read More »The Wile E. Powell Inflation: Are We Really Just Going To Ignore The Cliff?

Last year did not end on a sound note. The initial rebound after 2020’s recession was supposed to be a straight line, lifting upward for the other side of the infamous “V” shape. Such hopes had been dashed, though, and as the disappointing year wound toward its own end yet another big problem loomed. In December 2020, millions of Americans still out of work were going to lose government benefits. The Department of Labor would later tally up the scale of this...

Read More »Employer Vaccine Mandates: When the Feds Pay the Piper, they Call the Tune

Advocates for vaccine mandates—led by the Biden Administration—are apparently unconcerned that the mandates are likely to drive down total employment and reduce access to government services. In many cases these are the same services that mandate-pushing politicians have always insisted are utterly “critical” and must be expanded. Instead, the party is taking the position that the drive for vaccination must be placed before all other values in society, including...

Read More »Nationalbank – SNB-Devisenreserven sinken im Oktober deutlich

Per Ende des Berichtsmonats lag der Wert bei 922,98 Milliarden Franken, nachdem es Ende September noch 939,29 Milliarden Franken gewesen waren. Der Gesamtbestand der Reserven (exkl. Gold) erreichte Ende Oktober 936,68 Milliarden nach 953,09 Milliarden Franken im Vormonat, wie die SNB am Freitag auf ihrer Internetseite mitteilte. Das ist der erste Rückgang seit Juli. Damals war der Devisenberg um 19 Milliarden Franken geschrumpft. Ob und allenfalls wie stark die SNB...

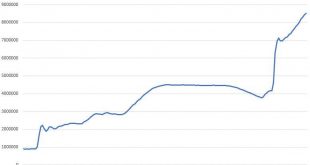

Read More »Bitcoin Mining Hashrate hat sich fast vollständig erholt

Viel wurde diskutiert als China das Bitcoin Mining aus dem eigenen Land verbannte. Doch es hat nur wenige Monate gedauert und die Mining Community hat sich von diesem Bann erholt. Daten zeigen, dass nur noch 16 Prozent zum Allzeithoch fehlen. Bitcoin News: Bitcoin Mining Hashrate hat sich fast vollständig erholt China kontrollierte mehr als die Hälfte des weltweiten Mining Marktes – bevor es zu einem landesweiten Verbot für Crypto Mining kam. Es wurde befürchtet,...

Read More »Geldcast Update: Monetary policy and the climate crisis

Fabio Canetg completed his doctorate in monetary policy at the University of Bern and the Toulouse School of Economics. Today he is a lecturer at the University of Bern and hosts the monetary policy podcast “Geldcast”. swissinfo.ch For years, central banks have been called upon to do more to combat climate change. Now a new monetary policy instrument is being discussed as a way forward. The climate strike is back: Last week, thousands of people demonstrated in Bern...

Read More »Thanks to Central Banks, the Old Investment Rules Don’t Apply Anymore

Thanks to central banks’ easy money policies, historically low interest rates and a desperate search for yield have created new danger zones for investors trying to stay out of trouble. Original Article: “Thanks to Central Banks, the Old Investment Rules Don’t Apply Anymore” Sixty percent equities, 40 percent bonds. What has been considered the golden rule of portfolio theory for decades is of less and less value to investors today. Because central banks have...

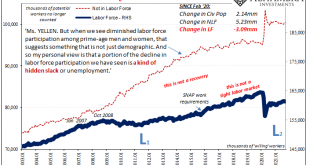

Read More »What Does Taper Look Like From The Inside? Not At All What You’d Think

Why always round numbers? Monetary policy targets in the post-Volcker era are changed on even terms. Alan Greenspan had his quarter-point fed funds moves. Ben Bernanke faced with crisis would auction $25 billion via TAF. QE’s are done in even numbers, either total purchases or their monthly pace. This is a messy and dynamic environment, in which the economy operates out of seeming randomness at times. Yet, here we have something that is “quantitatively” determined...

Read More »Credit Suisse to shrink investment bank

Keystone / Urs Flueeler The Credit Suisse Group says it will shrink its investment bank and shift more resources to the wealth management unit. It is part of a restructuring plan intended to draw a line under a tumultuous year in which it was rocked by the Archegos Capital Management and Greensill scandals. The Zurich-based bank is exiting most of its prime services business after the implosion of Archegos and shifting about $3 billion of capital from the investment...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org