Why always round numbers? Monetary policy targets in the post-Volcker era are changed on even terms. Alan Greenspan had his quarter-point fed funds moves. Ben Bernanke faced with crisis would auction billion via TAF. QE’s are done in even numbers, either total purchases or their monthly pace. This is a messy and dynamic environment, in which the economy operates out of seeming randomness at times. Yet, here we have something that is “quantitatively” determined which always ends pleasingly in so many zeroes. Why don’t more people question this? Previewing The Taper Theater The question on the minds of monetary policymakers in December 2013 was, again, round numbers. Having first bucked expectations a few months before, when “everyone” said the FOMC would begin

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bank reserves, bill dudley, bond yields, bonds, currencies, economy, eurodollar futures, Featured, Federal Reserve/Monetary Policy, FOMC, Markets, money printing, newsletter, QE, taper, U.S. Treasuries, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Why always round numbers? Monetary policy targets in the post-Volcker era are changed on even terms. Alan Greenspan had his quarter-point fed funds moves. Ben Bernanke faced with crisis would auction $25 billion via TAF. QE’s are done in even numbers, either total purchases or their monthly pace.

This is a messy and dynamic environment, in which the economy operates out of seeming randomness at times. Yet, here we have something that is “quantitatively” determined which always ends pleasingly in so many zeroes.

Why don’t more people question this?

The question on the minds of monetary policymakers in December 2013 was, again, round numbers.

Having first bucked expectations a few months before, when “everyone” said the FOMC would begin its tapering to QE’s 3 and 4 (yes, there were four to that point) beginning that September, the last meeting for the year had presented officials with an opportunity no available previously.

If this was money printing, as everyone somehow still believes, then answer for why those discussing the levels of printed money didn’t discuss money. That specific word was mentioned just 14 times in 245 pages of transcript text. Of those, ten referred to “money market funds”, three were about money in a very , non-technical sense.

Only once, on page 62, did the committee refer to broad money supply and even then barely in passing; a total throwaway.

Instead, the FOMC argued extensively about whether a $10 billion reduction in the pace of QE purchases would express enough confidence without risking sending too much of a “tightening” signal to markets. Their other given options were either $20 billion or zero (wait for March 2014).

These people do something very different than what the public is led to believe; they’re entire regime is based on manipulating emotion. And not all emotions are theoretically as useful. Such as inquisitiveness:

MR. BULLARD. I’ve been worried during the last few years that the Committee’s promises to stay low for a long time were inadvertently sending a very pessimistic signal about the future of the U.S. economy. Today, however, we will take a concrete action that expresses some confidence in the prospects for U.S. growth and labor markets going forward… but my judgment is that the labor market improvement has become too compelling to ignore, and, therefore, that it’s wise to taper a small amount at this meeting.

It’s not that the economy needs X number dollars of “base money” from the Fed in order to run fluidly, or to generate a surplus margin of liquidity, rather monetary policy is designed to make it easy for the regular folks who policymakers see as knuckle-dragging morons to understand how the FOMC wishes brainless economic agents should behave.

How would the public feel differently about Fed tapering QE’s in December 2013 by $10 billion rather than $20 billion beginning March 2014? This is the kind of questions debated around the exquisitely-appointed conference table at Non-money HQ.

Thus, they spend countless hours obsessing over language.

MR. EVANS. If we include the language in paragraph 2 that indicates that we’re not complacent about the low inflation—that’s really important for me in assessing that this tapering is not likely to lead to greater tightening…So, Mr. Chairman, I can support alternative B as long as there’s no dilution of the important message about our concern over low inflation and as long as the strengthened forward-guidance language is not altered in a way that makes it appear to be a tightening.

They really believe that taper becomes tightening if they don’t describe their plan in just the right way. And you probably though monetary tightening would have to do with, you know, not enough money.

In this dreamland of “money printing”, they’ll parse adverbs for days on end.

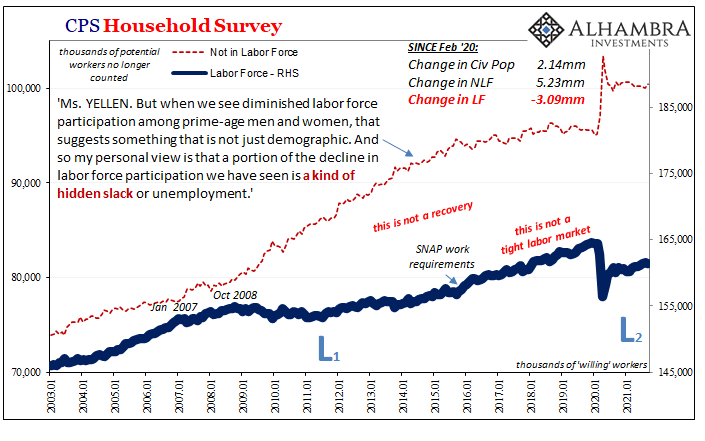

What it all truly boils down to is nothing more than confidence – and a specific kind of confidence laser-focused on a specific indicator. Not the money supply number, for non-money monetary policy – QE on/QE off – it is entirely about the unemployment rate.

MR. STEIN. As a couple of other people have noted, I think just purely in terms of messaging, I think it’s an opportune time to taper. Recent news has been positive, and doing it now allows us to come across with a relatively upbeat message. We’re doing it because the outlook has improved, more or less full stop…So I think now we’ve been basically dealt a reasonably good hand in terms of messaging. So I think it’s a good time to play it.

But what good is it to project confidence in a number that doesn’t mean much in reality? Economics says you make reality out of emotion. These are the kinds of problems which the FOMC deals with mostly in private, so as to not trouble what they believe are the small-minded sensibilities of regular idiots.

|

Put a round number on the message to make it all appear as clean, simple, and positively straightforward as possible. Better to make the signal easy for the public to avoid otherwise digging under the hood of the labor data:

But because there is no money, nor any solid idea about how money actually works in the economy, they’re stuck trying to stick to imprecise measures of this same dynamic space; to interpret the economy’s way forward from subjective, self-biased guesswork. In terms of the unemployment rate, there was no “gimme” then, either.

|

. |

| The FOMC’s fate was sealed when breezily dismissing this one statement for fear of “inadvertently sending a very pessimistic signal about the future of the U.S. economy.” Maybe it wouldn’t have been inadvertent?

Without knowing a damn thing about money, then, how would the “money printers” figure out otherwise just how to accurately resolve these grand dilemmas? The only answer would have been for the monetarily illiterate, the central bankers, to turn instead to the money system itself.

This, however, would require some useful working knowledge of interest rates, banking, and actual history; each is visibly in short supply at every single one of these ridiculous Federal Reserve gatherings (and, as always, you don’t have to take my word for it; just read for yourself). |

|

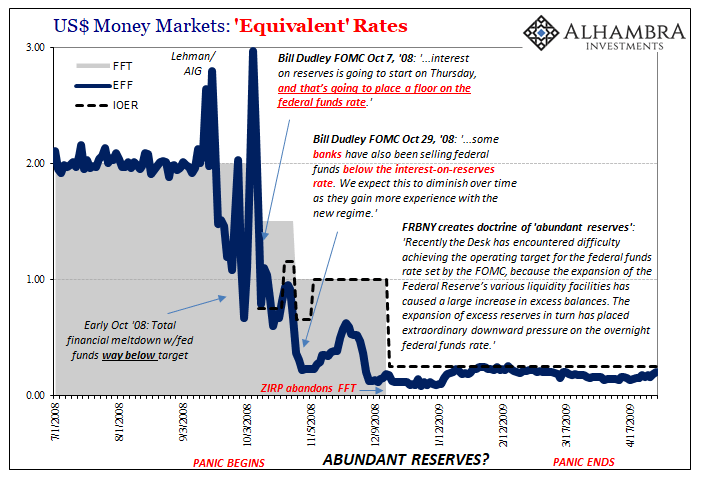

What these people think about interest rates is, well, distressing. In light of this, who else would we turn to next in our sordid little review? None other than Bill Dudley (failing upward after botching the entirety of the worst monetary crisis since 1929 first to President of FRBNY as well as a Vice position on the FOMC). Oh boy, this guy and eurodollar futures:

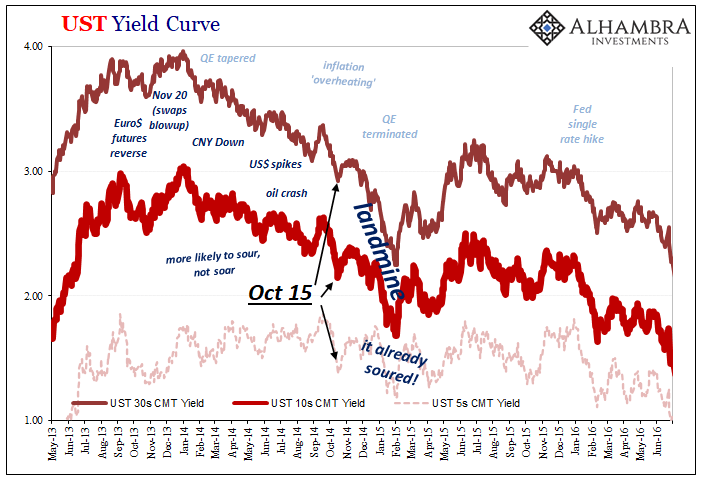

Dudley was attempting to calm any fears that the Fed’s tapering message might upset markets, particularly bonds, which were supposedly not, again, expecting a December 2013 taper. An “early” reduction in the amount of bonds being purchased, everyone presumes, would be a “bond bad” kind of thing.

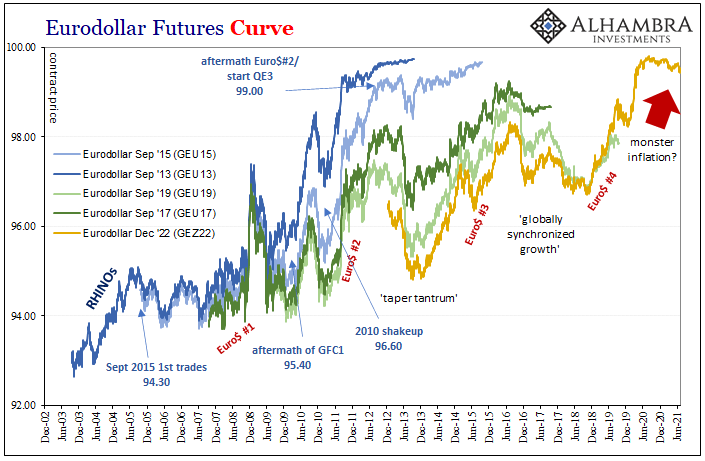

Partly in response to English, Dudley asserted that eurodollar futures had been bid (they had) since that missed taper in September 2013 as if higher eurodollar futures prices were pricing the anticipated forward guidance of “lower for longer” rather than “taper is tightening.” |

Thus, in his view, rising nominal Treasury yields up to December 2013 were distinct from higher eurodollar futures prices (lower LIBOR in the future) as a matter of the market growing comfortable with fewer purchase (therefore rising yields) but a more patient liftoff (higher eurodollar futures prices).

But what about when Treasury yields joined eurodollar futures? And not in some distant future, from the very first day of 2014. Dudley’s interpretation was, as it had been in 2007, just bonkers.

Why?

Because none of this – not a single bit of it – made any difference whatsoever. Messaging. Confidence. Pedantry. Semantics. Round numbers. All for show. A bad puppet show.

In the real world, money makes it all go; lack of money makes it all slow down. The eurodollar futures curve was the first to jump out of taper tantrum celebration rather than anticipation how tapering might be tightening, surveying the actual circumstances around the world and concluding it looked a lot less like the US unemployment rate by the month.

This included perceptions of safety and risk – liquidity, meaning money – which drove the bid for eurodollar futures before then driving an equally unambiguous demand for those safe and liquid US Treasuries.

It’s here that China and emerging markets would like a word (using Urjit Patel’s 2018 term).

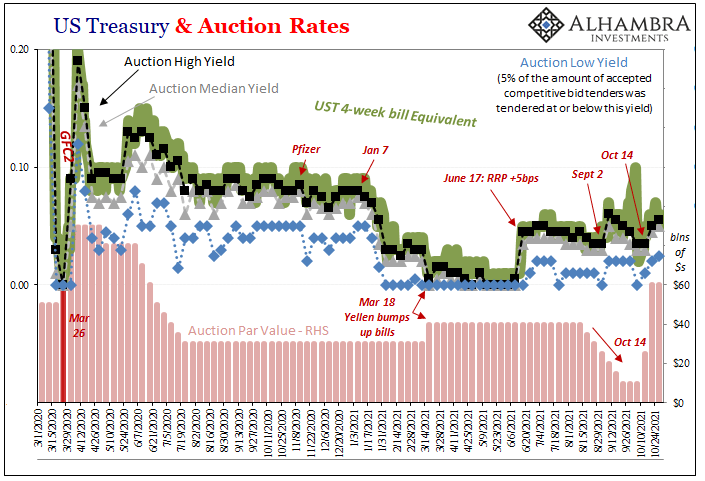

What has changed in November 2021 as taper again takes center stage, at least in the media? You can bet that five years from now we (or I) will find practically the same quotes as I’ve fished out from nearly eight years ago. I’d be shocked if most aren’t almost word for word.

Taper is a specific kind of illusion. The Fed today wants to project confidence in the same flawed unemployment rate, and the market is betting on those same flaws meaning the outcome not likely at all to be any different.

At least for the FOMC, tapering in UST’s will come at a nice, pleasing $10 billion reduced pace.

Tags: bank reserves,bill dudley,bond yields,Bonds,currencies,economy,eurodollar futures,Featured,Federal Reserve/Monetary Policy,FOMC,Markets,money printing,newsletter,QE,taper,U.S. Treasuries,Yield Curve