Last week, the US GDP growth figure for Q3 came in lower than expected, while prices moved higher than anticipated and the US Employment Cost Index update rose at its fastest pace in 31 years. The headline increase was driven by the biggest surge in wages since 1982, up 1.5% in the third quarter. Substantial productivity gains would be required now to offset this rise in wages. Without gains in productivity and/or a fall in labour costs, there could be a risk to...

Read More »Controversial crypto exchange hopes for warm Swiss welcome

Two months after paying a $100 million fine in the US for illegal trading operations, cryptocurrency exchange BitMEX is lining up a test for Switzerland’s financial regulator. With a raft of recent legislative amendments, “Crypto Nation” Switzerland is bidding to become a global hub for legally-compliant cryptocurrency activities. Crypto derivatives exchange BitMEX wants to leverage this legal basis to launch a brokerage service. As I’ve said previously, the Swiss...

Read More »Marxism versus Libertarianism: Two Types of Internationalism

There are two main philosophical and ideological schools of thought that include the problem of internationalism in their principles. The first is liberal internationalism, which developed within the framework of classical liberalism. The second is orthodox Marxism and its various derivatives that entertain the idea of proletarian internationalism. The concept of internationalism has different origins, meanings, and practical implementations in the two schools of...

Read More »The Federal Reserve’s Assault on Savers Continues

The front-page headline in the Wall Street Journal on October 14 says it all, “Inflation Is Back at Highest in over a Decade.” The Labor Department reported that the Consumer Price Index (CPI) increased 5.4 percent from a year ago. This should not have been a surprise to Federal Reserve chairman Jerome Powell and his fellow board members nor to its hundreds of PhD economists who drill into the economic data to forecast the economy. In 2020, when the US economy...

Read More »COP26: rich Switzerland must take on more responsibility

Switzerland has enough money and technology to drastically reduce emissions and become a leader in international climate negotiations. But it needs to be more ambitious, says Ludwig Luz, president of the Swiss Youth for Climate group. This year’s UN climate conference (COP26) in Glasgow is the most important since COP21 in Paris in 2015. The latest IPCC publicationExternal link offers a dire outlook. Scientists do not contest climate change and the need to act...

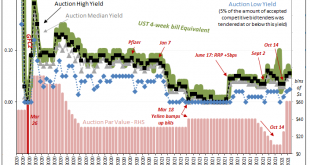

Read More »Bill Issuance Has Absolutely Surged, So Why *Haven’t* Yields, Reflation, And Other Good Things?

Treasury Secretary Janet Yellen hasn’t just been busy hawking cash management bills, her department has also been filling back up with the usual stuff, too. Regular T-bills. Going back to October 14, at the same time the CMB’s have been revived, so, too, have the 4-week and 13-week (3-month). Not the 8-week, though. Of the first, it’s been a real tsunami at this tenor, too. Up to early August, Treasury had regularly (weekly) sold $40 billion in one-month paper. From...

Read More »Apples Steve Wozniak spricht über Bitcoin

Steve Wozniak kann durchaus als das technische Genie hinter Apple bezeichnet werden. Während Jobs Marketing und Unternehmensführung perfektionierte, war es vor allem Wozniak, der im Hintergrund für die technologische Innovation sorgte. Nun wurde „The Woz“, wie er auch genannt wird, zum Bitcoin befragt. Bitcoin News: Apples Steve Wozniak spricht über Bitcoin Wozniak startet offenbar in den US-Medien seine eigene Show, die vom Konzept her an Die Höhle der Löwen...

Read More »“Idle Resources” Are Problems Caused by the Central Bank

It is not possible to replace productive credit by means of the easy monetary policies of the central bank. If this could have been done, then the world would have already ended poverty. Original Article: “‘Idle Resources’ Are Problems Caused by the Central Bank” Resources that are utilized to promote economic prosperity in normal times become underutilized during recessions. Some experts are of the view that what is required are policies which will increase the...

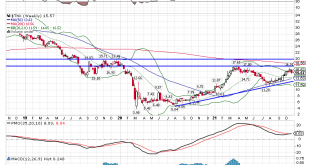

Read More »Weekly Market Pulse: Growth Scare?

A couple of weeks ago the 10 year Treasury note yield rose 16 basis points in the course of 5 trading days. That move was driven by near term inflation fears as I discussed last week. Long term inflation expectations were and are well behaved. I wrote nearly 2000 words last week about that change in inflation expectations and I’m so glad you took the time to read it. And now you can forget it because over the next four days all but 2 basis points of the move in the...

Read More »Covid: new cases up 30 percent this week in Switzerland

© Sergey Timofeev | Dreamstime.com This week, 10,148 new cases of Covid-19 were reported in Switzerland, up 30% from the 7,818 recorded the week before. On a 7-day moving average basis, the number of daily new cases was 1,450. The number entering hospital with Covid-19 was stable. Over the last 7 days, 119 Covid-19 patients were admitted to hospital with Covid-19 compared to 150 during the prior 7 days. This week Covid-19 deaths were up. 31 deaths were recorded over...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org