Monetary Metals has been covering gold and silver markets for over ten years. Throughout that time, there’s been no shortage of new and old commentators talking about the drivers of gold and silver prices. Unfortunately, the vast majority of this analysis is just plain wrong. Whether it’s a company trying to sell you something, or a big investment bank. Gold and silver defy conventional commodity analysis. And plotting the gold price against the money supply, or...

Read More »SNB Jordan: Strong Swiss Franc limits Swiss inflation

SNBs Jordan Strong CHF limits swiss inflation See no sign swiss wage price cycle Inflation stubbornly above 2% would lead to policy tightening Difficult to say whether global rates have turned, much still depend on economic development CHF has remained stable in real terms Asked about real estate prices, Jordan says monetary policy aims primarily at price stability The SNB is not investing in crypto currencies The USDCHF has moved to new session lows (higher CHF)...

Read More »What to do with abandoned stables? A thorny issue in Switzerland

This old farm building in the Valais has been converted into a holiday home. Hallenbarter AG Many people dream of owning a mountain home, especially in Switzerland, where the Alps are within easy reach of major towns and cities. But few come on the market and, when they do, they can be quite expensive. Trained as a picture journalist at the MAZ media school in Lucerne. Since 2000 she has worked as a picture editor in various media concerns and as a freelancer....

Read More »When Higher Prices Are Not Inflation

Monetary inflation results in a general rise in prices, often called “price inflation.” But rising prices are not always “inflation.” In any case, more government regs and subsidies won’t help. Original Article: “When Higher Prices Are Not Inflation” Back to 2020, the federal government’s covid-mandated shutdown of meat production plants hobbled the nation’s meat production capabilities, leaving farmers with nowhere to send their beef. This resulted in them...

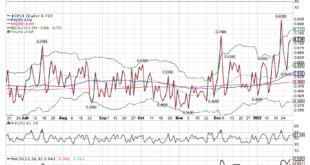

Read More »Weekly Market Pulse: Are We There Yet?

I’ll just get this out of the way right at the beginning. The question in the title of this post refers to the end of the ongoing stock market correction and the answer is likely no. There are no sure things in this business so it isn’t an unequivocal no, but based on history, the odds favor more weakness. I know a lot of people liked that rally into the close on Friday and it was a nice way to end a wild week but it also shows that traders/investors are all too...

Read More »Russland wird Bitcoin nicht verbieten

Viele Staaten haben die Schrauben zuletzt angezogen und den Cryptomarkt angezählt. Auch in Russland wurden Stimmen laut, die ein komplettes Verbot forderten. Da hier sogar die russische Zentralbank involviert war, wurde befürchtet, dass Bitcoin und Co. schon bald in Russland verboten werden könnte. Nun gibt es jedoch Entwarnung. Bitcoin News: Russland wird Bitcoin nicht verbieten Die russische Regierung selbst hat angekündigt, kein Verbot auszusprechen – und damit...

Read More »Switzerland remains in top 10 for lowest corruption

[caption id="attachment_858222" align="alignleft" width="400"] © Szabolcs Stieber | Dreamstime.com[/caption] Switzerland was ranked tenth in the latest 2021 Corruption Perception Index (CPI) published by Transparency International this week. The index ranks 180 countries and territories around the world by their perceived levels of public sector corruption, with results ranging from 0 (highly corrupt) to 100 (very clean). This year’s...

Read More »The ‘Fed Put’ – Gone Until There’s Blood in the Streets

The ‘Fed put’ – gone until there’s blood in the streets Well, it’s happening. Bitcoin (and other cryptocurrencies are sharply down, along with equity markets in many advanced economies. And the Federal Reserve (the U.S. Central Bank) statement and press conference on Wednesday didn’t indicate any backing down from raising interest rates, maybe as soon as the March meeting. The Fed’s stance pivot from ‘the economy needs additional stimulus’ to ‘it is time to start...

Read More »The Cold War Racket Never Ended for the U.S.

There is something important to recognize about the Cold War: It was not ended by the U.S. government. Instead, it was ended by the Soviet Union. If it had been up to the U.S. national-security establishment, the Cold War would have gone on forever because it is the best racket in U.S. history, one that continually expanded the tax-funded largess, power, and influence of the Pentagon, the CIA, and the NSA. In a sense, the U.S. national-security establishment...

Read More »Price of wood pellets rises sharply in Switzerland

© Stocksolutions | Dreamstime.com The price of wood pellets in Switzerland is up 20% over the last 12 months, according to Patrick Schmutz, a wood pellet expert, reports RTS. According toSchmutz, the price rise is due to a cold 12 months, especially last spring, and the success of wood pellet heating. More and more pellet-based heating systems are being installed in Switzerland. In addition, global demand for wood has been high, particularly in the US where the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org