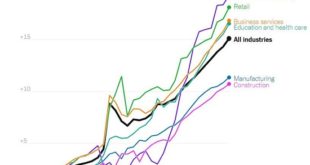

The clear winners in inflation are those who require little from global supply chains, the frugal, and those who own their own labor, skills and enterprises. As the case for systemic inflation builds, the question arises: who wins and who loses in an up-cycle of inflation? The general view is that inflation is bad for almost everyone, but this ignores the big winners in an inflationary cycle. As I’ve explained here and in my new book Global Crisis, National Renewal,...

Read More »Overwhelming majority of ICU patients in Switzerland unvaccinated, show data

© Sudok1 | Dreamstime.com On 25 January 2022, a study published by Zurich University Hospital found that 97% of Covid-19 ICU patients since the start of Switzerland’s Covid-19 vaccination campaign were unvaccinated. The study evaluated hospital data from 964 Covid-19 patients who were treated in intensive care units in Swiss hospitals in the nine months since the start of Switzerland’s vaccination campaign. Of these only 33 (3%) were vaccinated with one of the two...

Read More »The Fed Has No Real Plan, and Will Likely Soon Chicken Out On Rate Hikes

The Fed’s Federal Open Market Committee (FOMC) released a new statement today purporting to outline the FOMC’s plans for the next several months. According to the committee’s press release: With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate. The Committee decided to continue to reduce the monthly pace of its net asset purchases, bringing them to an end...

Read More »FX Daily, January 26: Federal Reserve and Bank of Canada Meet as Risk Appetites Stabilize

Swiss Franc The Euro has risen by 0.04% to 1.0378 EUR/CHF and USD/CHF, January 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After a slow and mixed start in Asia, where Australia and India are on holiday, equity markets have turned higher. Europe’s Stoxx 600 is up around 1.9% near midday in Europe, which if sustained would be the biggest gain of the year. US futures are snapping backing too, with the...

Read More »Higher tax deductions for parents in Switzerland starting in 2023

© Zsv3207 | Dreamstime.com This week, Switzerland’s government set a date for the introduction of more generous tax deductions for childcare. From 1 January 2023, parents will be able to deduct up to CHF 25,000 per child in childcare costs from their annual taxable income, reported RTS. Currently, the maximum is CHF 10,100 per child. The change is the result of a new law that was created in autumn last year. Only external expenses incurred for the care of children...

Read More »Pakistan will Cryptomarkt komplett aussperren

Weltweit versuchen Staaten den Cryptomarkt in den Griff zu bekommen. Die dezentralen Cryptocoins sorgen vor allem in kleinen Ländern für eine Kapitalflucht, welche die ohnehin wacklige Stabilität zahlreicher nationaler Währungen bedroht. Pakistan versucht es nun mit einem kompletten Verbot des Marktes. Crypto News: Pakistan will Cryptomarkt komplett aussperren Die Strategie Pakistans ist es, den Markt einfach auszusperren und so für eine komplette Verbannung zu...

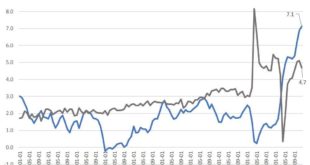

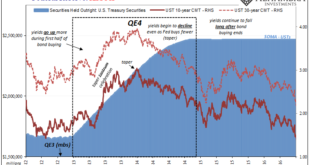

Read More »The Hawks Circle Here, The Doves Win There

We’ve been here before, near exactly here. On this side of the Pacific Ocean, in the US particularly the situation was said to be just grand. The economy was responding nicely to QE’s 3 and 4 (yes, there were four of them by that point), Federal Reserve Chairman Ben Bernanke had said in the middle of 2013 it was becoming more than enough, creating for him and the FOMC coveted breathing space so as to begin tapering both of those ongoing programs.A full and complete...

Read More »Botswana: Regierung wird Gesetzentwurf für virtuelle Vermögenswerte dem Parlament vorlegen

Die Regierung von Botswana will dem Parlament des Landes ein Gesetz über virtuelle Vermögenswerte vorlegen. Damit könnte Botswana eines der ersten Länder Afrikas werden, das Kryptowährungen gesetzlich reguliert. Ein Entwurf der Regierung von Botswana, der vorschlägt, neue und sich entwickelnde Geschäfte mit virtuellen Vermögenswerten zu regulieren sowie eine Regulierungsbehörde mit ihren Funktionen und Befugnissen auszustatten, soll nun den Gesetzgebern des Landes...

Read More »Vote against Swiss “Netflix tax” passes signature hurdle

© Bekirugur Bekir Ugur | Dreamstime.com In October 2021, Switzerland’s government created a law requiring online streaming services to pay money into a Swiss cinema fund. Under the law, from 2024, streaming services such as Netflix and Disney+ will need to pay a levy equivalent to 4% of their Swiss turnover into the fund, which would be spent on producing Swiss films. A group of young politicians objecting to the 4% surcharge on streaming services decided to organise...

Read More »The Cult of Speculation Is a Cult of Doom

Surely the Fed gods will affirm the cult’s most revered articles of faith. But false gods eventually fail, even the Fed. Every once in awhile the zeitgeist sets up an either / or: either the zeitgeist is crazy or I’m crazy. (OK, let’s agree I’m crazy; see, it’s not that hard to find something to agree on, is it?) What strikes me as crazy is the global Cult of Speculation which has recruited virtually the entire human populace in a bizarre cult in which speculating...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org