In Switzerland, Phase II of Project Helvetia has been completed, successfully demonstrating that it is possible to integrate a wholesale CBDC (wCBDC) running on a distributed ledger technology (DLT) platforms into existing core banking systems. Kickstarted in 2020, Project Helvetia is an experimental initiative by the Bank for International Settlements (BIS) Innovation Hub Swiss Centre, the Swiss National Bank (SNB) and financial infrastructure operator SIX that...

Read More »Is NATO a Dead Man Walking?

While geopolitical commentators are fixated on Russia’s border with Ukraine, a more interesting development is slowly boiling underneath the surface of the Russo-Ukrainian conflict that could potentially reorder international relations—namely, the death of the North Atlantic Treaty Organization (NATO). Founded in 1949, NATO began with only twelve member nations. Presently, NATO counts on thirty member nations, with national security elites in the Anglo-American...

Read More »SWISS suspends flights to Ukraine

Other airlines in the Lufthansa Group also announced plans to halt flights to the country. © Keystone / Christian Beutler Amid further escalations of the crisis in Ukraine, Swiss International Airlines has decided to temporarily suspend flights to Ukraine from next week. This affects flight connections in Kyiv. This content was published on February 19, 2022 – 17:22February 19, 2022 – 17:22 Keystone-SDA/jdp All flights will be cancelled from Monday, February 21...

Read More »Google Cloud Meets Digital Assets and Crypto Payments

Blockchain technology is yielding tremendous innovation and value creation for consumers and businesses around the world. As the technology becomes more mainstream, companies need scalable, secure, and sustainable infrastructure on which to grow their businesses and support their networks. Google Cloud believes it can play an important role in this evolution. Building on their existing work with blockchain developers, exchanges, and other companies in this space,...

Read More »Covid: weekly cases and hospitalisations fall further as Switzerland drops nearly all measures

This week, 118,555 new Covid-19 cases were reported in Switzerland, down 25% from the 157,683 cases reported a week earlier. The reported number of Covid-19 patients hospitalised also fell 20% from 492 to 392 across the week. Photo by Polina Tankilevitch on Pexels.comCovid-19 deaths were also down. Across the week, 61 Covid-19 related deaths were reported, a figure 13% lower than the 70 reported the week before. In addition, the number of Covid-19 patients in...

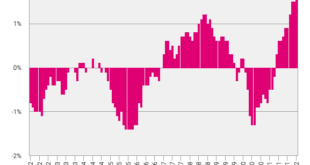

Read More »Consumer prices increased by 0.2% in January

Swiss consumer price inflation increased in January, data from the Federal Statistical Office showed on Friday. Consumer prices rose 1.6 percent in January, following a 1.5 percent increase each in December and November. Economists had forecast inflation to remain unchanged at 1.5 percent. On a monthly basis, consumer prices grew 0.2 percent in January, after a 0.1 percent fall in the previous month. Prices for hotel accommodation and second-hand cars increased in...

Read More »Money and Savings Are Not the Same Thing

In the National Income and Product Accounts (NIPA), savings are established as the difference between disposable money income and monetary outlays. Disposable income is defined as the summation of all personal money income less tax payments to the government. Personal income includes wages and salaries, transfer payments, income from interest and dividends, and rental income. The NIPA framework is based on the Keynesian view that spending by one individual becomes...

Read More »Bitcoin-Spenden an Freedom Convoy auf Blacklist

In Kanada hat Premiere Minister Trudeau eine Art Notfallsituation im Zusammenhang mit Trucker-Protesten ausgerufen. Diese Maßnahme erlaubt es der Regierung Bankkonten ohne Gerichtsbeschluss zu beschlagnahmen. Doch wie versucht die kanadische Regierung an die Bitcoin-Spenden an die Trucker des Freedom Convoys zu kommen? Bitcoin News: Bitcoin-Spenden an Freedom Convoy auf Blacklist Ohne die Keys für Bitcoin-Wallets, kommt die Regierung zwar nicht an die gespendeten...

Read More »Glencore sets aside $1.5bn to settle UK, US and Brazil probes

Glencore says that the market is deteriorating for lead smelters with no active mine. (Image of Sudbury nickel smelter.) Courtesy of Glencore. Glencore expects to resolve bribery and corruption investigations in the UK, US and Brazil this year and has set aside $1.5 billion (CHF1.4 billion) to cover potential fines and costs. Neil Hume, Financial Times News of the provision came as the London-listed miner and commodity trader announced record earnings on the...

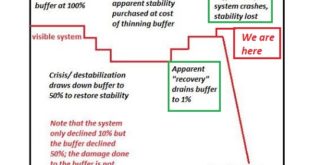

Read More »How Empires Die

When the state / empire loses the ability to recognize and solve core problems of security and fairness, it will be replaced by another arrangement that is more adaptable and adept at solving problems. From a systems perspective, nation-states and empires arise when they are superior solutions to security compared to whatever arrangement they replace: feudalism, warlords, tribal confederations, etc. States and empires fail when they are no longer the solution, they...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org