Imposing economic sanctions upon Russia is tantamount to throwing gasoline on a raging fire. The sanctions will not end the Russian invasion of Ukraine and only will make things worse. Original Article: “The Economic Sanctions against Russia Are Destructive and Counterproductive: We Must Oppose Them” The Western sanctions against Russia seem to shock very few Westerners. Yet, for several reasons, these sanctions should at least be the subject of lively debate...

Read More »Time for a Silver Trade?

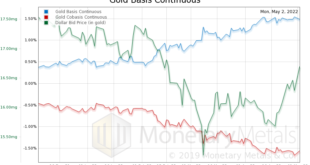

The price of silver has been going down, and then down some more. From over $28 a year ago, and over $26.50 a month ago, it’s now at a new low under $22.50. Four bucks down in a month. However, it’s been behaving differently than gold behind the scenes. Let’s look at the gold and silver basis charts to see. Gold Fundamentals – Gold Basis Analysis The gold basis (i.e. abundance to the market) was humming along around 0.5%. Then, as the price began to rise, it rose...

Read More »Aktien – Wie «Amateure» sich an der Börse selber helfen können

Die Kolumne «Gopfried Stutz» erschien zuerst im Credit Suisse und UBS liefern uns ein schönes Lehrstück. Die UBS verspekulierte sich in den USA derart, dass die Schweizerische Nationalbank deren faule Kredite in der Finanzkrise von 2008 übernehmen und somit die Grossbank vor dem Kollaps retten musste. Derweil vermochte die Credit Suisse die Verluste selber zu stemmen und erhielt dafür Anerkennung. Heute ist es gerade umgekehrt: Die UBS schreibt wieder ansprechende...

Read More »Covid loan claims fuel rise in suspected fraud cases

There have been some 1,700 cases of suspected Covid-19 loan frauds reported since the start of the pandemic. © Keystone / Ennio Leanza The number of reported suspicious financial transactions continued to rise in Switzerland in 2021, but at a lower rate than in the first year of the pandemic. Switzerland’s Money Laundering Reporting Office (MROS) saw a 12% increase of suspicious activity reports last year to reach 5,962. For the second year in a row, a significant...

Read More »Coinbase CEO glaubt an eine Milliarde Crypto-Nutzer

Aktuell geht man von 200 Millionen aktiven Crypto-Nutzern weltweit aus. Laut Brian Armstrong, CEO von Coinbase, wird diese Zahl innerhalb der nächsten 10-20 Jahre deutlich ansteigen und sich mehr als verfünffachen. Crypto News: Coinbase CEO glaubt an eine Milliarde Crypto-Nutzer in dieser DekadeSeine Annahme untermauert er damit, dass sich der GDP (das Brutto-Inlands-Produkt) immer mehr im Cryptomarkt abspielt. Betrachtet man den relativen Anteil des Marktes im GDP...

Read More »RBA Surprises with a 25 bp Hike

Overview: The large bourses in Asia Pacific except Hong Kong eased. Japan and China’s mainland markets are closed for the holiday. Europe’s Stoxx 600 is up about 0.6%. It gapped lower yesterday and has not entered the gap today. US futures are a little softer. The 10-year Treasury nicked the 3%-mark yesterday and is just below there now. European benchmark yields are mostly 1-3 bp higher, but the UK Gilt yield has jumped eight basis points, and Australia’s surged 13...

Read More »Gold: A use case for the modern era

Part I of II For decades, physical gold investors have had to contend with superficial, naive and wholly ahistorical “arguments” from the mainstream financial press, from economists and experts of all stripes, claiming that gold is nothing but a barbarous relic. To them, the yellow metal is akin to investment superstition. It has no yield, it serves no practical purpose and the only attraction they could conceive of is merely symbolic, or perhaps,...

Read More »Wie das unsolide Finanzsystem extreme Kreditzyklen auslöst, die zum Kollaps führen

Ein staatliches Fiat-Währungssystem mit einer nur teilweisen Deckung des Geldumlaufs durch die Bankreserven macht es möglich, dass die Geschäftsbanken mehr Geld als in Umlauf bringen als sie an Bargeld halten. Das sogenannte Giralgeld wird als Bankeinlagen gleichsam aus dem Nichts geschaffen. So ein Währungssystem ist nicht nur äußerst volatil, sondern auch anfällig für lange und extreme Phasen der Kreditausweitung und der Kreditkontraktion. ...

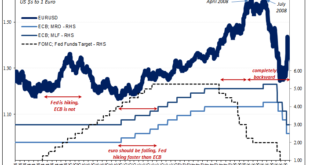

Read More »What Really ‘Raises’ The Rising ‘Dollar’

It’s one of those things which everyone just accepts because everyone says it must be true. If the US$ is rising, what else other than the Federal Reserve. In particular, the Fed has to be raising rates in relation to other central banks; interest rate differentials. A relatively more “hawkish” US policy therefore the wind in the sails of a “strong” dollar exchange regime. How else would we explain, for example, the euro’s absolute plunge since around May last year?...

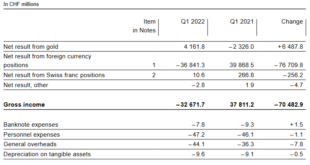

Read More »Interim results of the Swiss National Bank as at 31 March 2022

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Low Inflation, Crashes and Central Bank Money Printing The crisis caused by the Covid19 virus,is a typical crisis with low inflation (at least for now). During such a crisis, central bank money...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org