The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Low Inflation, Crashes and Central Bank Money Printing The crisis caused by the Covid19 virus,is a typical crisis with low inflation (at least for now). During such a crisis, central bank money printing helps asset price to rise again. This applies to all assets on the SNB balance sheet: Government and corporate bonds Stocks Gold The Corona crisis is just one of these low inflation crisis. Therefore SNB profits have recovered; this time far more quickly than during the Financial Crisis. As

Topics:

George Dorgan considers the following as important: 1.) SNB Press Releases, 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The increasing volatility of SNB EarningsAnnual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Low Inflation, Crashes and Central Bank Money PrintingThe crisis caused by the Covid19 virus,is a typical crisis with low inflation (at least for now). During such a crisis, central bank money printing helps asset price to rise again. This applies to all assets on the SNB balance sheet:

The Corona crisis is just one of these low inflation crisis. Therefore SNB profits have recovered; this time far more quickly than during the Financial Crisis. As opposed to 2009 until early 2011, the Swiss Franc is currently not overvalued. Therefore the SNB did not let the Swiss franc appreciate. Without an a franc appreciation, however, the SNB must make profits during a period of central bank money printing. But a prolonged crisis, will again put pressure on SNB to let the franc appreciate. Franc will rise again with inflationWith a big rise of inflation, the run into the Swiss franc will start again. And this at an exchange rate that is not digestible for the SNB.

And this will lead to a massive SNB loss around 150 billion CHF. However, we are not there yet: Inflation is low and interest rates even lower. |

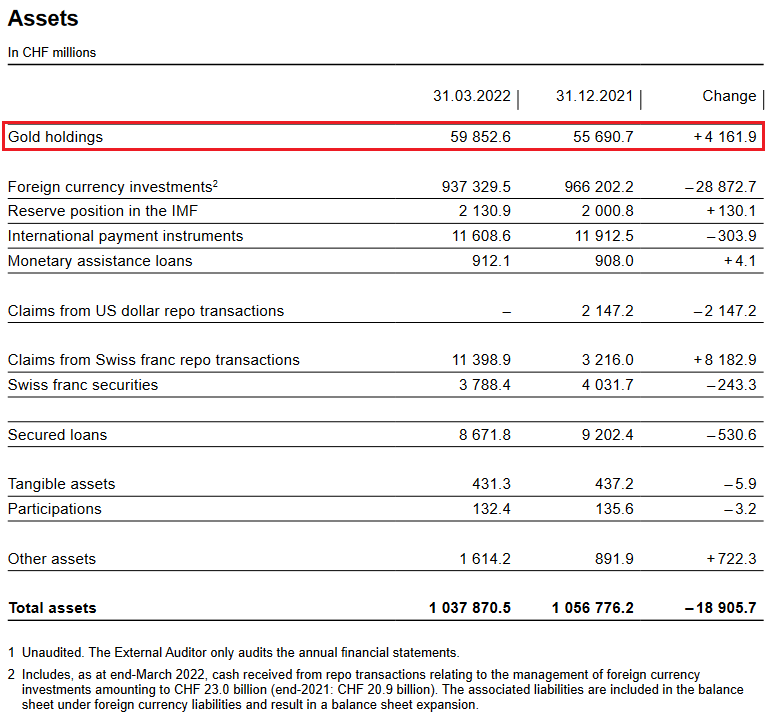

Some extracts from the official statement.

|

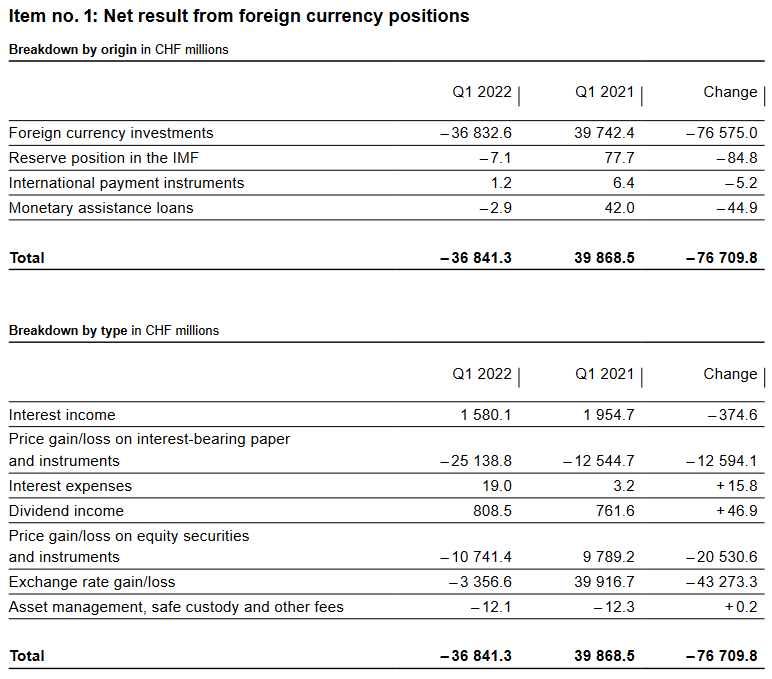

Income statement, 1 January–30 March 2022 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

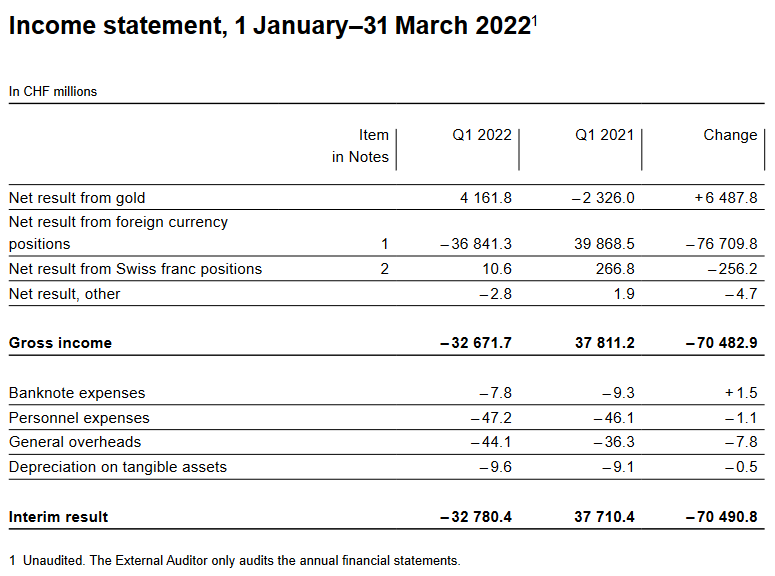

Loss on foreign currency positionsThe loss on foreign currency positions was CHF 36.8 billion. Interest and dividend income amounted to CHF 1.6 billion and CHF 0.8 billion respectively. A price loss of CHF 25.1 billion was recorded on interest-bearing paper and instruments. In the case of equity securities and instruments, this loss came to CHF 10.7 billion. Exchangerate-related losses totalled CHF 3.4 billion. The following numbers are in billion Swiss Francs.

|

SNB Profit on Foreign Currencies |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation gain on gold holdings

Percentage of gold to balance sheetThe percentage of gold has risen to 5.77%.

Balance Sheet The balance sheet has expanded by 138.1 bn. francs, this is 16.04%.

|

SNB Balance Sheet for Gold Holdings for Q1 2022 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

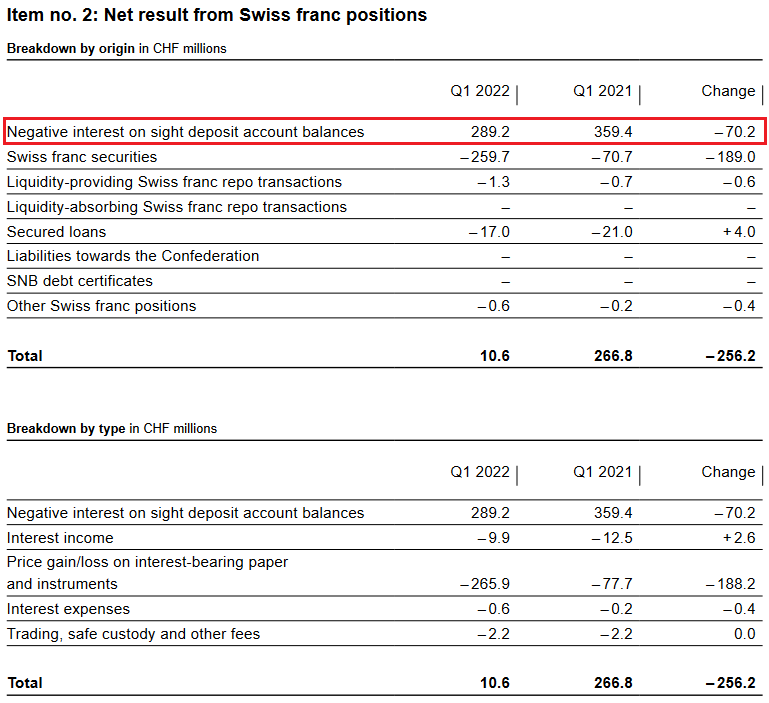

Profit on Swiss franc positionsThe SNB maintains its profitability, last but not least, thanks to the reduction of the profitability of banks. When too many funds arrive on their accounts, they must deposit them on their sight deposit account at the SNB.

Profit on Negative Interest ratesFurthermore, the SNB harms the Swiss economy, when it reduces the profits of Swiss banks by negative interest rates, currently -0.75%. But with this measure she maintains her own profitability. The SNB obtained far less money for negative rates, while sight deposits were slightly up (see below). The reason is this time the Corona crisis and that banks lend more money and did not put on the accounts of the central bank. Still, as compared to the FX profits or gains on equities and bonds above, this number is relatively low.

|

SNB Result for Swiss Franc Positions for Q1 2022 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

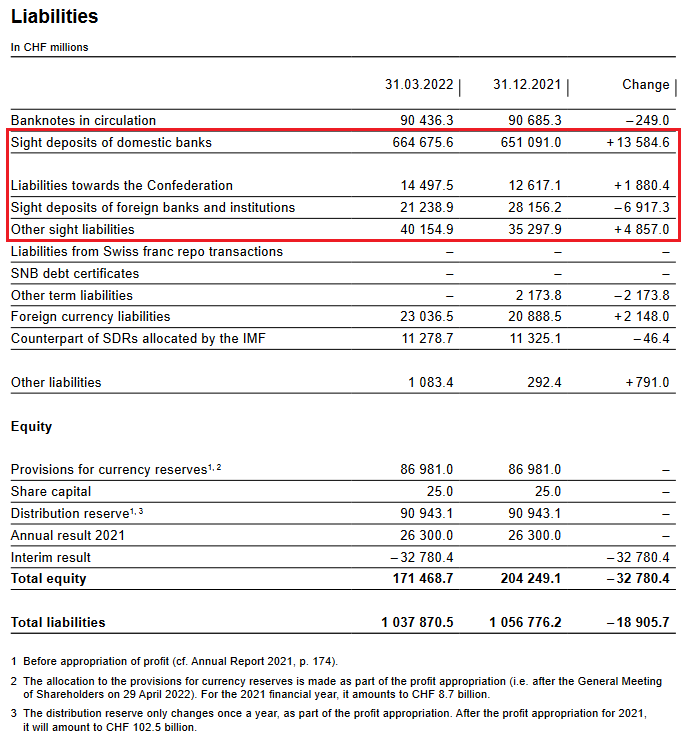

SNB LiabilitiesElectronic Money Printing: Sight Deposits Sight deposits is the biggest part of SNB interventions. Sight deposits increased more strongly (19%) than the total balance sheet. The increase was on domestic banks.

Paper PrintingBanknotes in circulation: -0.25 bn francs to 90.4 bn. CHF. This old form of a printing press, today a less important form of central bank interventions. It showed that safe-haven Swiss francs, e.g. 1000 franc bank notes are currently less in demand than previously. Provisions for currency reservesAs at end-March 2022, the SNB recorded a loss of CHF 32.8 billion before the allocation to the provisions for currency reserves. In accordance with art. 30 para. 1 of the National Bank Act (NBA), the SNB is required to set aside provisions permitting it to maintain the currency reserves at the level necessary for monetary policy. The allocation for the current financial year is determined at the end of the year. |

SNB Liabilities and Sight Deposits for Q1 2022 Source: snb.ch - Click to enlarge |

Tags: Featured,newsletter