Like most central banks the Swiss National Bank (SNB) is tasked with monetary stability. However, in the process it can inadvertently generate large profits and losses. SNB – BernWhen monetary policy is expansionist and the resulting assets held by the SNB rise in value it can generate large profits as it has over the last few years. However, when the Swiss franc strengthens and asset values slump the bank can generate large losses as it did in the first half of...

Read More »Interim results of the Swiss National Bank as at 30 June 2022

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Low Inflation, Crashes and Central Bank Money Printing The crisis caused by the Covid19 virus,is a typical crisis with low inflation (at least for now). During such a crisis, central bank money...

Read More »EMU GDP Surprises, while the Yen’s Short Squeeze Continues

Overview: The month-end and slew of data is making for a volatile foreign exchange session, while the rash of earnings has generally been seen as favorable though weakness was seen among the semiconductor chip fabricators. China, Hong Kong, and Japanese equities fell but the other large markets in the region rose. Europe’s Stoxx 600 is up around 0.8%. It is the eighth advance in the past 10 sessions. US futures are higher and the S&P 500’s advance of nearly 7.6%...

Read More »Swiss National Bank reports massive losses

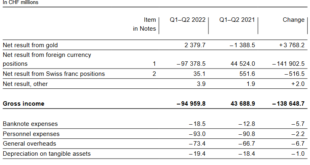

High losses had been expected, but the figure is higher than economists had predicted. © Keystone / Peter Klaunzer The Swiss National Bank (SNB) has taken a hit of CHF95.2 billion ($100 billion) for the first half of this year, mainly owing to losses on foreign currency positions. After a loss of CHF32.8 billion in the first quarter, another CHF62.4 billion was added in the second quarter. High losses had been expected, but the figure is higher than economists had...

Read More »A muddled message from The Fed

If you have decided to buy gold bullion or to buy silver coins in the last few months then you may have been delighted with how last night’s Fed press conference went. If you’re still wondering if or how to invest in gold then it might be worth paying attention to what central banks are doing in the coming weeks. After all, how do central banks make their decisions when it comes to monetary policy? In years before it might have been quite straightforward...

Read More »Swiss Retail Sales, June 2022: +3.2 percent Nominal and +1.2 percent Real

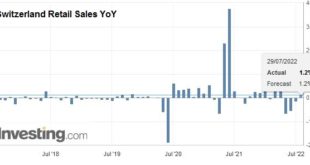

29.07.2022 – Turnover adjusted for sales days and holidays rose in the retail sector by 3.2% in nominal terms in June 2022 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.1% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover adjusted for sales days and holidays rose in the retail sector by 1.2% in June 2022 compared with the previous year. Real growth takes...

Read More »The Government Runs the Ultimate Racket

“Seniors hurt in Ponzi scam” headlined the story of elderly Southern Californians bilked in a pyramid scheme. While sad, the story reminded me of Social Security, since it is also a Ponzi scheme involving those older, with high payoffs to early recipients coming from pockets of later participants. With Social Security, however, it benefits those older at others’ expense. Pyramid scams collapse when they run out of enough new “investors” to pay earlier promises. Some...

Read More »Inflation Takings Require Just Compensation: Slash Governments!

“If you don’t expect too much from me You might not be let down.” — Gin Blossoms, “Hey Jealousy” Inflation is a mechanism that government people use to fund wars, tyrannical governments, and favors to cronies. Inflation takes away significant fractions of the real value of savings. Savings are accumulated slowly. People add value, earn income, and defer purchases. Inflation depletes savings’ real value quickly. People then have to spend more to satisfy even their...

Read More »Attention Turns to US GDP, Ahead of Tomorrow’s EMU GDP and CPI

Overview: The Federal Reserve delivered its second consecutive 75 bp rate hike, and Chair Powell left the door open for another large hike at the next meeting in September. Yet, the market took away a dovish message and the dollar suffered, rates slipped, and equities rallied. Central banks with currencies pegged to the dollar had to hike too. This includes Hong Kong, Saudi Arabia, Bahrain, and UAE, which matched the move in full. Kuwait and Qatar hiked by 25 bp and...

Read More »US-Zentralbank kündigt Zinserhöhung an und Bitcoin steigt über 23.000 US-Dollar

Das Federal Reserve Banking System (kurz: Fed) hat angekündigt, den Leitzins weiter zu erhöhen. Damit ist der Zins in den USA zwischen 2,25 und 2,5 Prozent angestiegen. Auch in Deutschland wurde eine Anhebung des Zinses durch die Zentralbanken angekündigt. Bitcoin News: US-Zentralbank kündigt Zinserhöhung an und Bitcoin steigt über 23.000 US-DollarMit der Erhöhung wird es jetzt sogar wieder Zinsen aufs Tagesgeld bei vielen Sparkassen und Banken geben. Der Schritt...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org