Seven Year Achievement “Read the directions and directly you will be directed in the right direction.” — Lewis Carroll U.S. consumers are at it again. After a seven year hiatus they’re once again doing what they do best. They’re buying stuff. PCE: personal consumption expenditures up 1% According to the Commerce Department, personal consumption expenditures (PCE), which is the primary measure of consumer spending on goods and services in the U.S. economy, increased $119.2 billion in...

Read More »Three Political Events before the UK Referendum

“Every thinking person in America is going to vote for you Governor Stevenson,” said an enthusiastic voter.“I am afraid that won’t do. I need a majority,” reportedly quipped Stevenson (1952 or 1956). The UK referendum on June 23 is the most important political event of the first half of the year. A decision to leave could be a significant disruptive force. No one knows for sure. It is precisely that uncertainty that is fueling the demand for insurance in the options market that...

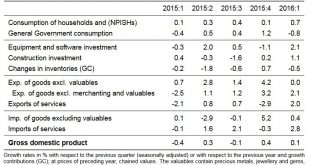

Read More »Swiss GDP Q1/2016, more Insights

Key points: Q/Q GDP growth: +0.1%, YoY GDP growth: +0.7% Until 2014, Swiss GDP was driven by net exports: Exports were rising more quickly than imports, which improved GDP. Positive change in the trade balance in goods: Recently only the trade balance of goods continued to increase (+8.1% YoY exports, +1.4% YoY imports in Q1/2016) Negative change in the trade balance for services (+6.7% YoY) increased more than the export of services (+2.0%). Exports of services are for example banking...

Read More »Grasping Parasites and Bernie the Underdog

The Parasite – easily the most terrifying Superman villain Image credit: Marvel The Parasites Begin to Attach Themselves BALTIMORE – “Tommy… who are you voting for?” We put the question to a local bulldozer operator whom we’ve known for at least half a century. Tommy, now 80 years old, is the last of a dying breed. He grew up plowing the earth to grow tobacco on Maryland’s Tidewater, on the western shore of the Chesapeake Bay. In the 1970s, when tobacco farming became unprofitable, he...

Read More »OPEC’s Game within a Game

The fact OPEC just agreed to agree on nothing in Vienna isn’t particularly surprising given Doha wounds are still festering from the last attempt at ‘petro-diplomacy’. But the engagement ultimately has to been knocked up as a partial success for Saudi Arabia, where it’s managed to put itself back at the centre of cartel politics by thawing the ‘freeze discussion’ on Riyadh’s terms. Confused? Don’t be. As we flagged in OPEC Politics, Doha’s failure left a very dangerous door open for...

Read More »Notes from ECB Press Conference

ECB press conference June 2 2016 Held in Vienna with Governor Nowotny Keep key ECB interest rates unchanged Will be kept at present or lower for an extended period of time, exceeding asset purchase program (80bn per month) which will end March 2017 sector program will start June 8 TLTRO start in June New measures will strengthen growth in euro area through credit expansion Very low inflation must not become entrenched in second round effects through effects on wages and prices. ECB...

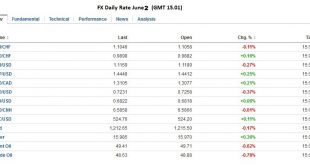

Read More »FX Daily, June 2: Greenback Mostly Softer Ahead of ECB and ADP

The US dollar remains under pressure. It is off for the third day against the yen and slipped below JPY109 for the first time in a little more than two weeks. The Nikkei struggled to cope with the foreign exchange developments, lost 2.3%, the most in a month, after gapping lower. At JPY108.50, the dollar would have given back 50% of its rally off the May 3 low near JPY105.50. Below there, the JPY107.80 is the 61.8% retracement. The euro is north of $1.12 after having briefly...

Read More »Swiss Retail Sales: -2.4 percent Y/Y nominal and Real -1.9 percent real

01.06.2016 09:15 – FSO, Economic Surveys (0353-1605-70) The Used Goods Question Retail sales in several countries like Germany, Italy, Japan and Switzerland continue to fall. In the United States they have strongly risen recently. We should remind readers, that used goods sold via Ebay or similar, are not contained in this statistics. Still they create economic value for the purchases. By mentality, Swiss, Germans or Japanese pay more attention so that used goods do not lose their value...

Read More »Gross domestic product in the 1st quarter 2016

Bern, 01.06.2016 – Switzerland’s real gross domestic product (GDP) grew by 0.1% in the 1st quarter of 2016.* GDP was underpinned by consumption expenditure from private households and investments in construction and equipment but curbed slightly by government consumption. On the production side, the picture was mixed: whilst financial services and the hotel and catering industry saw a decline, value added in manufacturing, construction and the healthcare sector increased. In comparison...

Read More »Claudio Grass Interviews Felix Zulauf

Felix Zulauf Photo credit: Sigi Tischler / Keystone Government Intervention is Making Things Worse Claudio Grass, the CEO of Global Gold, has recently interviewed legendary Swiss fund manager Felix Zulauf. A wide range of topics was discussed, including monetary policy, the market outlook, investment decisions and precious metals. About Felix Zulauf: Felix Zulauf started out as a trader for Swiss Bank. He joined Union Bank of Switzerland in 1977, ultimately becoming the head of the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org