Opponents of the Swiss Basic Income Initiative demonstrate in front of parliament This weekend the Swiss population was called upon to make a historic decision, when Switzerland became the first country worldwide to put the idea of free money for everyone, technically known as Unconditional Basic Income (of CHF2,500 per month for every adult man and woman, and CHF625 for every child, for doing absolutely nothing) to a vote. As reported previously, the outcome of this referendum would set...

Read More »FX Weekly Preview: Macro Developments Will Not Stand in Way of Dollar Move Lower

Through the first part of the year, the swinging pendulum of expectations for the trajectory of Fed policy has been a major driver in the foreign exchange market. This is true even though the ECB and BOJ continue to ease monetary policy aggressively. The Australian and New Zealand dollars appear to influenced more by the shifting view of Fed policy than the expectations in some quarter that the RBA and RBNZ could cut interest rates as early as this week. Indeed, anticipation of Fed...

Read More »8 Lessons That We Can Learn From The Economic Meltdown In Venezuela

Submitted by Michael Snyder via The End of The American Dream blog, We are watching an entire nation collapse right in front of our eyes. As you read this article, there are severe shortages of just about anything you can imagine in Venezuela. That includes food, toilet paper, medicine, electricity and even Coca-Cola. All over the country, people are standing in extremely long lines for hours on end just hoping that they will be able to purchase some provisions for their hungry...

Read More »Weekly Speculative Positions: Little Adjustment ahead of ECB and US Jobs

The Swiss Franc net position was reduced from 4.0 contracts long to 0.1 thousand contracts long. Apart from the yen., other speculative position barely changed. We are keen on next week’s data that should reflect the dismal US jobs report. Even recognizing a holiday-short week, speculative position adjustments were minor in the days before the ECB meeting and the US jobs report. There were no gross position adjustments that met the 10k contract threshold. The largest gross...

Read More »Emerging Markets: What has Changed

Local press is reporting that RBI Governor Rajan does not want to serve another term The incoming Philippine government is signaling looser fiscal policies ahead Polish President Duda’s team of experts may present several plans for consideration A second cabinet minister in Brazil was forced to resign Colombia eliminated its FX intervention program The IMF boosted Mexico’s Flexible Credit Line (FCL) from $67 bln to $88 bln Equities In the EM equity space, China (+4.1%), Brazil...

Read More »Saudi-Arabia: Peg or Banking Crisis?

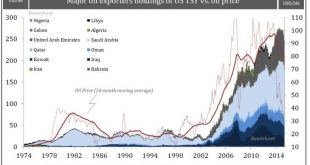

Oil exporters recycled their dollar in US treasuries During the reign of the mighty petro-dollar standard, it was necessary for major oil exporters to recycle their dollar holdings back into the dollar-based financial system to maintain their self-imposed exchange rate pegs. US government bonds are the very centrepiece of this elaborate system and it is thus no surprise to see the dollar price correlate well with overall OPEC TSY holdings. In other words, when oil prices were high, oil...

Read More »Swiss Referendum: The new World of Bread and Circuses

Preposterous Initiative BALTIMORE – No whining and kvetching about the Deep State today. Instead, we sit at its feet, admire the cut of its jaw, and sing its praises. We are grateful to it… and not just as a source of amusement. In short, we delight in its incompetence. What brings this to mind is a small item in the news, which, like a pool ball careening across a felted table, knocked two or three others in their pockets before coming to rest. We had to go pluck each one out of its...

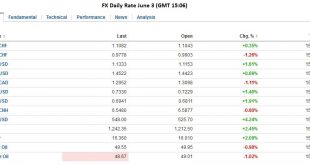

Read More »FX Daily, June 3: FX Market Shocked by Non-Farm Payrolls

Surprise NFP visible in FX rates The massive surprise in the US job report was reflected in currency rates. The EUR/CHF surprisingly increased, despite weak US data. This reflects the fact that the ECB is currently considered the most dovish central bank.Consequently the biggest short speculative position is in the euro, while traders are long CHF against USD. The dollar lost 2% against the yen, 1.6% against the euro and 1.3% vs. the Swiss franc. Click to enlarge. Longer term...

Read More »Twitter’s Other Growing Problem – A Surging Share Count

Home of the Anti-Bubble It seems like almost everybody has an opinion about Twitter (TWTR) – both the company and the stock. As for the company it seems that their “window of opportunity” to massively succeed has essentially closed as user growth and revenue have both slowed, quite dramatically, over the past 18 months. Plus management turnover is clicking at a rapid pace. Company executives typically do not leave if the firm’s future seems bright. Even the ubiquitous Co-Founder/CEO,...

Read More »Turning Stones Into Bread – The Japanese Miracle

Stuffing the Futon Our friend Ramsey Su just asked what Haruhiko Kuroda and Shinzo Abe are going to do now in light of the strong yen (aside from perhaps doing the honorable thing). Isn’t it time to just “wipe out some debt with the stroke of a pen”? We will return to that question further below, but first a few words on the new Samurai futon. Apparently the Japanese are becoming more than a little antsy about Kuroda-san’s negative interest rate policy (and the threats of more of the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org