Summary If conditions are exceptional, isn’t BOJ intervention more likely? If conditions are exceptional, the ban on European government supporting banks might not be valid. Italy is leading the charge in Europe. How exceptional are market developments? Much rests on the answer. If these are extraordinary circumstances, then Japanese intervention becomes more likely. Of course, Japanese policymakers have been...

Read More »In Gold We Trust, 2016

The 10th Anniversary Edition of the “In Gold We Trust” Report As every year at the end of June, our good friends Ronald Stoeferle and Mark Valek, the managers of the Incrementum funds, have released the In Gold We Trust report, one of the most comprehensive and most widely read gold reports in the world. The report can be downloaded further below. The report celebrates its 10th anniversary this year. As always, a...

Read More »Vive la Revolution! Brexit and a Dying Order

A Dying Order Last Thursday, the Brits said auf Wiedersehen and au revoir to the European Union. On Friday, the Dow sold off 611 points – a roughly 3.5% slump. What’s going on? In Europe and the U.S., the masses are getting restless. Mr. Guy Wroble of Denver, Colorado, explained why in a short letter to the Financial Times: The old liberal world order is dying because the cost-benefit ratio for the average person in...

Read More »Great Graphic: Sterling Monthly Chart and Outlook

Summary Sterling’s losses are not simply a product of thin liquidity or panic. Both main political parties are in disarray just when strong leadership is needed. The rough projection pre-vote of what could happen on Brexit suggests $1.20-$!.2750. This Great Graphic shows sterling’s monthly performance since 1971, according to Bloomberg data. There have been several powerful trends. The rally from $1.40 to $1.50...

Read More »10 Ways The UK Could Leave The EU

Authored by Alastair Macdonald, originally posted at Reuters.com, Stalemate between Britain and the European Union over what happens next following Britons’ referendum vote to leave has opened up a host of possible scenarios. Here are some that are (in some cases, barely) conceivable: 1. BY THE BOOK Prime Minister David Cameron, who said he will resign after losing his gamble to end British ambivalence about...

Read More »South China Sea: Storm in an Indian Ocean Teacup

With global attention focused on BREXIT calamity, potentially more important questions are being overlooked, and especially in the South China Sea where storms are currently brewing between China and a range of littoral states for strategic control of territorial waters. To be clear, our long term geostrategic position remains unchanged; China moving towards the ‘nine dash’ line China will gradually secure control of...

Read More »FX Daily, June 27: Post-Referendum Confusion Continues

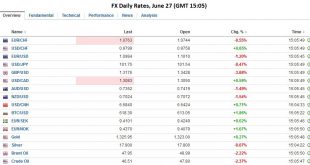

Summary Sterling falls through last week’s low. Spanish election results suggest a UK is not necessarily a harbinger to anti-globalization forces. Yuan sells off and China breaks diplomatic contact with Taiwan. FX Rates Sterling has been sold beyond the panic low seen when it became clear that UK voters were choosing to leave the EU though nearly every economists warned of at least serious short- to...

Read More »UK Seeks Divorce, Rajoy Needs a Shotgun Marriage

Summary Center-right PP won the Spanish election. Anti-EU forces were setback. Rajoy needs a coalition partner. The UK has decided to seek a divorce from the EU after a 43-year rocky marriage. It was not an overwhelming decision. Brexit won by 52%-48% margin, seemingly too small for such a momentous decision. The UK has not decided exactly when it will formally begin the divorce proceedings, and it wants to be...

Read More »Brexit Drives Gold Frenzy

He should have known… (the cartoon shows a list of polls of “Dewey wins by landslide” or “Trump will never win the primaries” quality…) Markets Blindsided by Brexit The big news this week was that the British voted to exit the European Union. This was not the outcome expected by pundits, or the polls. “Risk on” assets were relentlessly bid up prior to the vote. For example, S&P 500 index futures had closed the...

Read More »Quitting the Cucumber Affair

Winners and Quitters Vince Lombardi, the famous American football coach, once said, “Winners never quit and quitters never win.” Maybe he meant that winners overcome obstacles to reach their goals while quitters give up and fall short… or something to that effect. Certainly, this makes for a good bumper sticker. Perhaps it’s a helpful quote for the first time marathon runner to repeat come mile 20. Saying it aloud...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org