Silver gets the Saruman question…(see further below) Photo credit: New Line Cinema Precious Metals Surge The price of gold bumped up thirty bucks, and that of silver about one buck. Is this liftoff — when the dollar falls sharply, and the price of each metal in dollar terms skyrockets? Is this the denoument when the gold bug does not get rich, because although his net worth measured in dollar is massively up, the dollar is down in equal measure? It’s complicated. But we doubt it. Perhaps a labor report will come out, or news of a government doing something even more insane than irredeemable paper currency (such as giving the power to outright print currency to the legislature) will cause a rush to gold hoarding. Fundamental Developments In the meantime, read on for the only true picture of the supply and demand fundamentals. Prices of gold and silver But first, here’s the graph of the metals’ prices. Prices of gold and silver – click to enlarge. Gold-silver ratio Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was down about two and a half points. Gold-silver ratio – click to enlarge. For each metal, we will look at a graph of the basis and co-basis overlaid with the price of the dollar in terms of the respective metal.

Topics:

Keith Weiner considers the following as important: dollar price, Featured, Gold and its price, gold basis, Gold co-basis, gold price, gold ratio, newsletter, Precious Metals, silver basis, Silver co-basis, silver price, silver ratio

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Precious Metals Surge

The price of gold bumped up thirty bucks, and that of silver about one buck. Is this liftoff — when the dollar falls sharply, and the price of each metal in dollar terms skyrockets?

Is this the denoument when the gold bug does not get rich, because although his net worth measured in dollar is massively up, the dollar is down in equal measure?

It’s complicated.

But we doubt it. Perhaps a labor report will come out, or news of a government doing something even more insane than irredeemable paper currency (such as giving the power to outright print currency to the legislature) will cause a rush to gold hoarding.

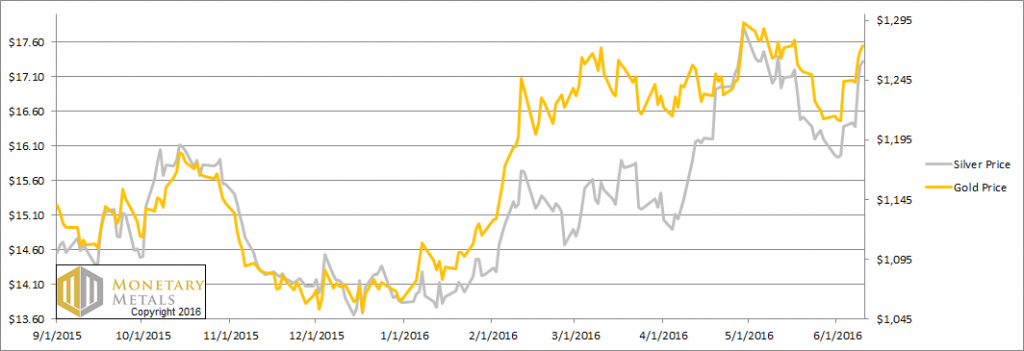

Fundamental DevelopmentsIn the meantime, read on for the only true picture of the supply and demand fundamentals. Prices of gold and silverBut first, here’s the graph of the metals’ prices. | |

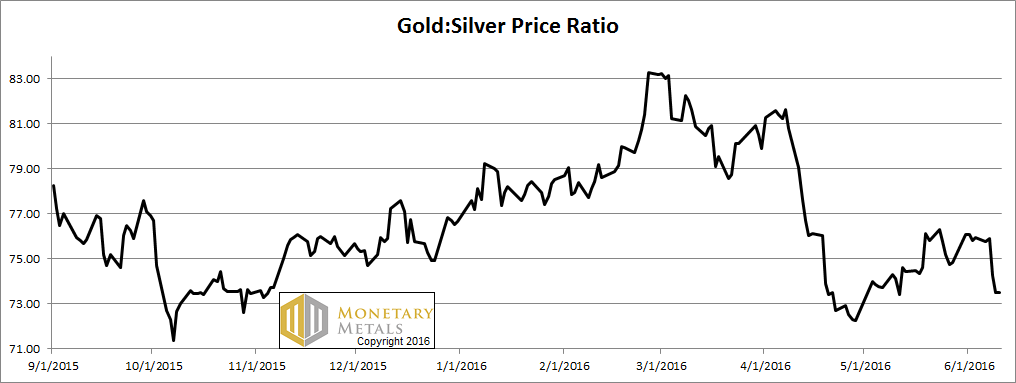

Gold-silver ratioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was down about two and a half points. | |

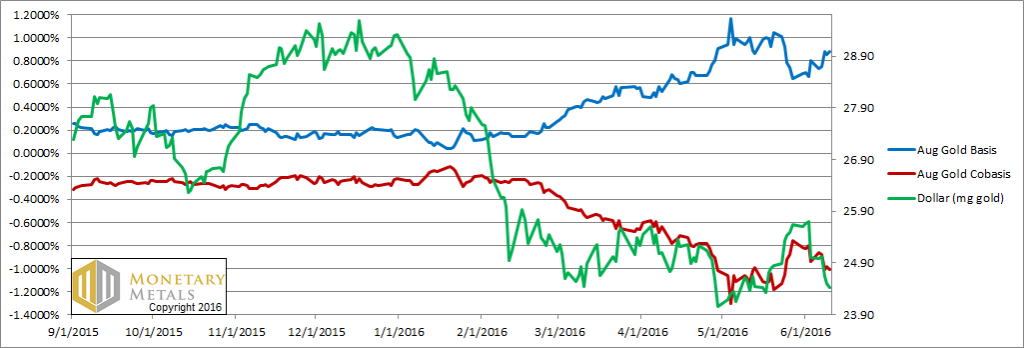

Gold basis and co-basis and the dollar priceHere is the gold graph. The price of the dollar is down (i.e. the price of gold is up). Along with it, the abundance of gold (blue line) is up. More gold is available at the higher price. But not quite proportionally. Our calculated fundamental price is up $11. It’s now about ninety bucks below the market. We would never recommend to anyone to naked short a monetary metal (see the above for the kind of insanity that could cause a big spike in the price). However, we would not be buyers when gold is selling at such a premium. At least not for a trade — for those who don’t have any, we would always recommend getting some regardless of price. Note that little changed from last week. The price blipped up, but it was primarily speculators buying. | |

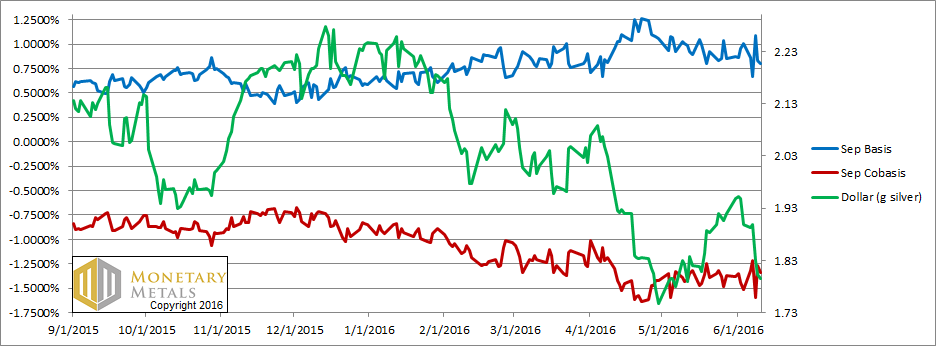

Silver basis and co-basis and the dollar priceNow let’s turn to silver. In silver, the price of the dollar is down sharply and silver became slightly more scarce. Note that we have switched from following the July to following the September contract, as July has become too volatile. We regard the co-basis to be bouncing along at the bottom. Yes, it is higher than it was last week, and yes the price of silver is up sharply, and yes the fundamental price is up from last week. It is still about two bucks below the market. Two bucks is a premium of almost 11.5% to its fundamental price. For now, it seems trading momentum favors silver. “And if that fails, where then will you go, silver?” (paraphrasing Saruman addressing Gandalf in Lord of the Rings). Charts by: Monetary Metals |