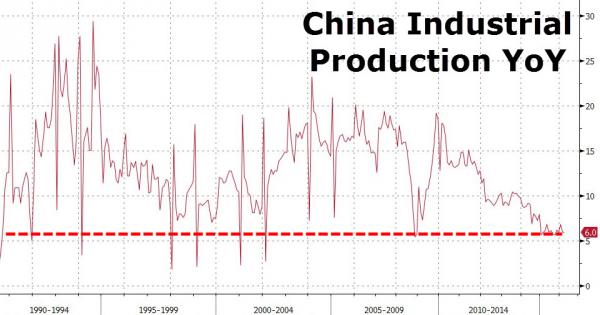

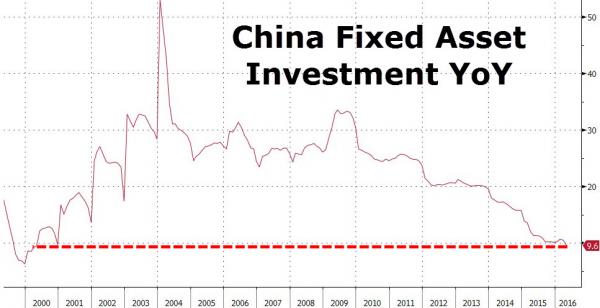

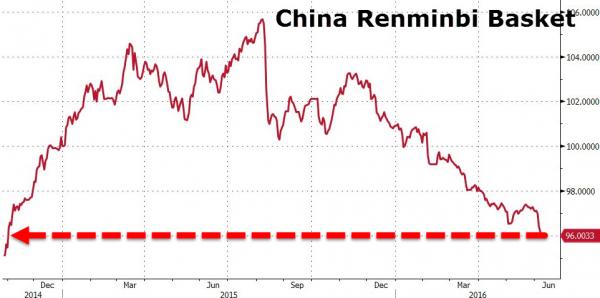

A chart-up from China and Japan. Growth of Chinese industrial production, retail sales, fixed asset investment is at lows not seen since the Asian financial crisis. The Yuan is falling. Economic data from Japan is not a lot better. Economic Data from China Then Chinese data largely disappointed. A “meet” in Industrial Production – hovering at multi-year lows… *CHINA MAY INDUSTRIAL OUTPUT RISES 6.0% FROM YEAR EARLIER Click to enlarge. Retail Sales missed…*CHINA MAY RETAIL SALES RISE 10.0% FROM YEAR EARLIER (lowest since 2006) Click to enlarge. And FAI missed… *CHINA JAN.-MAY FIXED-ASSET INVESTMENT EXC. RURAL RISES 9.6% (lowest since 2000) And if the anxiety over global growth and Brexit were not enough, this China data has sparked even more turmoil in markets as Asia gets going… Click to enlarge. Yuan Charts In China, as we could have guessed by Bitcoin’s surge, the Yuan is tumbling… PBOC devalues the Yuan fix by over 2 handles – back near 5 year lows… Click to enlarge. As the Yuan basket plunged to lowest since Nov 2014 Chinese stocks are down most in 6 weeks: *HANG SENG INDEX FALLS 2% *CHINA’S SHANGHAI COMPOSITE INDEX FALLS 1.3% TO 2,889.91 AT OPEN Click to enlarge. Economic Data and Charts from Japan First Japanese manufacturing data was a disaster… Click to enlarge.

Topics:

Tyler Durden considers the following as important: BIS, Bitcoin, Bond, China, Crude, Featured, Germany, Japan, newsletter, Nikkei, Switzerland, Yuan

This could be interesting, too:

investrends.ch writes Bitcoin nach Kurseinbruch mit fulminantem Comeback

investrends.ch writes Welche Rolle spielen gehebelte Produkte beim jüngsten Einbruch der Krypto-Währungen?

investrends.ch writes «Die Nerven liegen derzeit blank»

investrends.ch writes Bitcoin fällt unter 90 000 US-Dollar

A chart-up from China and Japan. Growth of Chinese industrial production, retail sales, fixed asset investment is at lows not seen since the Asian financial crisis. The Yuan is falling. Economic data from Japan is not a lot better.

Economic Data from ChinaThen Chinese data largely disappointed. A “meet” in Industrial Production – hovering at multi-year lows… *CHINA MAY INDUSTRIAL OUTPUT RISES 6.0% FROM YEAR EARLIER | |

|

Retail Sales missed…*CHINA MAY RETAIL SALES RISE 10.0% FROM YEAR EARLIER (lowest since 2006) | |

|

And FAI missed… *CHINA JAN.-MAY FIXED-ASSET INVESTMENT EXC. RURAL RISES 9.6% (lowest since 2000) And if the anxiety over global growth and Brexit were not enough, this China data has sparked even more turmoil in markets as Asia gets going… | |

Yuan ChartsIn China, as we could have guessed by Bitcoin’s surge, the Yuan is tumbling… PBOC devalues the Yuan fix by over 2 handles – back near 5 year lows… | |

|

As the Yuan basket plunged to lowest since Nov 2014 Chinese stocks are down most in 6 weeks:

| |

Economic Data and Charts from JapanFirst Japanese manufacturing data was a disaster… | |

|

First, Japan…

| |

|

Japanese stocks shorts biggest since 2008… | |

|

And Japanese 10Y Yields record lows (along with 20Y and 5Y)… But it’s not just Japan, Germany, and Switzerland…

|