– Global debt bubble may be understated by $13 trillion: BIS – ‘Central banks central bank’ warns enormous liabilities have accrued in FX swaps, currency swaps & ‘forwards’ – Risk of new liquidity crunch and global debt crisis – “The debt remains obscured from view…” warn BIS Global debt may be under-reported by around $13 trillion because traditional accounting practices exclude foreign exchange derivatives used...

Read More »Global Debt Bubble Understated By $13 Trillion Warn BIS

– Global debt bubble may be understated by $13 trillion: BIS – ‘Central banks central bank’ warns enormous liabilities have accrued in FX swaps, currency swaps & ‘forwards’ – Risk of new liquidity crunch and global debt crisis – “The debt remains obscured from view…” warn BIS Global debt may be under-reported by around $13 trillion because traditional accounting practices exclude foreign exchange derivatives used...

Read More »One-Tenth Of Global GDP Is Now Held In Offshore Tax Havens

Accurately measuring the scope of global wealth inequality is a notoriously difficult undertaking – a fact that was brought to light last year when the International Consortium of Investigative Journalists published the Panama Papers, exposing clients of Panamanian law firm Mossack Fonseca. As the papers revealed, Mossack Fonseca, which is only the world’s fourth-largest provider of offshore financial services, boasted...

Read More »Scam cryptocurrency shut down by Swiss regulator

The Swiss financial regulator is investigating multiple cases of suspected cryptocurrency fraud The Swiss financial regulator has closed down three companies linked to a fake cryptocurrency E-Coin amid fears that investors may have been conned out of millions of francs. The Swiss Financial Market Supervisory Authority (Finma) said the probe is one of 12 it is conducting into cryptocurrencies. Finma has seized or blocked...

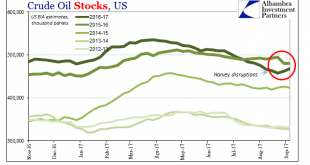

Read More »Harvey’s Muted (Price) Impact On Oil

The impact of Hurricane Harvey on the Gulf energy region is becoming clear. There have been no surprises to date, even though the storm did considerable damage and shuttered or disrupted significant capacity. Most of that related to gasoline, which Americans have been feeling in pump prices. According to the US Department of Energy, as of August 31, 10 refineries had been shut down with a combined capacity of 3.01...

Read More »FX Daily, September 18: More Thoughts from Berlin

Swiss Franc The Euro has risen by 0.03% to 1.1468 CHF. EUR/CHF and USD/CHF, September 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The unexpected weakness in US retail sales and industrial production reported before the weekend did not prevent US yields and stocks from rising. Asia followed suit, and with Japanese markets closed, the MSCI Asia Pacific Index rallied a...

Read More »Bitcoin Price Falls 40percent In 3 Days Underling Gold’s Safe Haven Credentials

– Bitcoin price action shows cryptos vulnerable to commentary and government policies– Bitcoin falls to low of $2,980, down by $1,000 in week as China flexes muscles– Volatility major issue: In 3 days btc fell 40% before bouncing 25% off lows– BIS state risks of cryptos cannot yet be fully assessed and says technology still unproven– Apple and Google developing a payment API for cryptos – may give governments full...

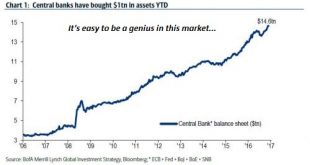

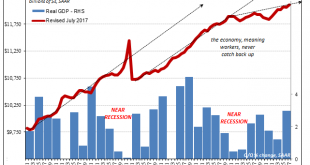

Read More »Yes, This Time It Is Different: But Not in Good Ways

Yes, this time it’s different: all the foundations of a healthy economy are crumbling into quicksand. The rallying cry of Permanent Bulls is this time it’s different. That’s absolutely true, but it isn’t bullish–it’s terrifically, terribly bearish. Why is this time it’s different bearish going forward? The basic answer is that nothing that is structurally broken has actually been fixed, and the policy “fixes” have...

Read More »When You Are Prevented From Connecting The Dots That You See

In its first run, the Federal Reserve was actually two distinct parts. There were the twelve bank branches scattered throughout the country, each headed by almost always a banker of local character. Often opposed to them was the Board in DC. In those early days the policy establishment in Washington had little active role. Monetary policy was itself a product of the branches, the Discount Rate, for example, often being...

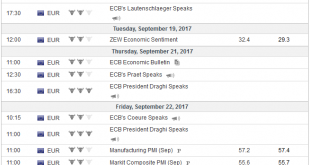

Read More »FX Weekly Preview: FOMC Highlights Big Week

New Zealand holds elections at end the of next week as well. While the German contest does not appear close and the odds on the most likely scenario are a return of the Grand Coalition, in New Zealand, the center-right’s decade-long rule is being seriously challenged by a resurgent Labour Party. The New Zealand dollar fell by around 5.7% in August. The pullback was twice as deep and lasted twice as long the as the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org