Les Suisses ont accepté par 78,7% de compléter la Constitution par un article sur la sécurité alimentaire. Les Romands ont été les plus enthousiastes. Les Suisses sont très attachés à la sécurité alimentaire. Dimanche, 78,7% d’entre-eux ont dit «oui». Aucun canton n’a refusé. Environ 1’943’000 citoyens ont déposé un «oui» dans l’urne, contre un peu moins de 525’000 «non». Les cantons les moins convaincus ont été Schwyz...

Read More »“Backdrop For Gold Today Is As Bullish As It Has Been In A Long Time” – GoldCore Dublin

Gold finished sharply higher on Monday, recouping roughly half of last week’s loss, as declines in the U.S. stock market and growing tensions between the U.S. and North Korea lifted prices for the yellow metal to the highest settlement in more than a week. December gold rose $14, or 1.1%, to settle at $1,311.50 an ounce. Prices, which lost about 2.1% last week, saw their highest finish since Sept. 15, according to...

Read More »Swimming The ‘Dollar’ Current (And Getting Nowhere)

The People’s Bank of China reported this week that its holdings of foreign assets fell slightly again in August 2017. Down about RMB 21 billion, almost identical to the RMB 22 billion decline in July, the pace of forex withdrawals is clearly much preferable to what China’s central bank experienced (intentionally or not) late last year at ten and even twenty times the rate of July and August. The US Treasury Department...

Read More »Swiss Balance of Payments and International Investment Position: Q2 2017

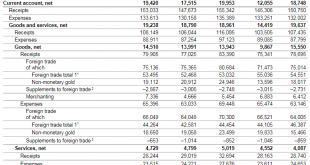

Q2/2017 Change vs. Q2/2016 Changein % Current Account +18.7 bn. +19.4 bn. -3.7% of which Goods Trade net +19.6 bn. +19.2 bn. +2.0% of which Services Trade net +4.1 bn. +4.7 bn. -14.6% of which Investment Income net +7.4 bn. +9.6 bn. -29.7% Financial Account +12.5 bn. +6.0 bn. +52% of which Direct Investments net -63.0 bn. +6.4 bn. -89.8% of which Portfolio Investments net +26.5 bn. -0.5 bn. +98.1% of...

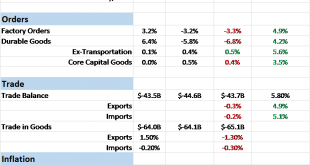

Read More »Bi-Weekly Economic Review: As Good As It Gets

The incoming economic data hasn’t changed its tone all that much in the last several years. The US economy is growing but more slowly than it once did and we hope it does again. It is frustrating for economic bulls and bears, never fully satisfying either. Probably more important is the frustration of the average American, a dissatisfaction with the status quo that permeates the national debate. The housing bubble...

Read More »FX Daily, September 25: Euro and Kiwi Dragged Lower

Swiss Franc The Euro has fallen by 0.37% to 1.1538 CHF. EUR/CHF and USD/CHF, September 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The end of the Grand Coalition in Germany and the need for a coalition in New Zealand are weighing on the respective currencies. The euro was marked down in Asia and briefly dipped below $1.19 before recovering to $1.1940 by the middle of...

Read More »Swiss expats buck the pension reform trend

Interior Minister Alain Berset was more successful at convincing Swiss abroad of his reforms than those at home (Keystone) - Click to enlarge Unlike their compatriots in Switzerland, Swiss voters who live abroad came out massively in favour of a wide-ranging overhaul of Switzerland’s old-age pension scheme. Eleven of Switzerland’s 26 cantons count the votes of Swiss expats separately. An analysis of Sunday’s...

Read More »First autonomous transport service in Switzerland inaugurated

The shuttles were designed by French company Navya with an operating platform developed by Swiss firm Bestmile (Marc Striffeler/tpf) - Click to enlarge The launch of two autonomous shuttle buses in Fribourg on Friday marks the first time in Switzerland that such vehicles have been inducted into the regular transport network. The “self-driving” electric minibuses link the Marly Innovation Center (MIC) in the...

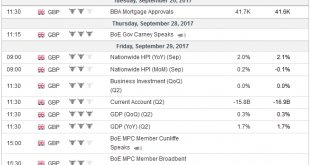

Read More »FX Weekly Preview: Old and New Drivers in the Week Ahead

Last week’s developments will continue to shape the investment climate in the week ahead, and at the same time, new inflation readings from the US, EMU, and Japan will add incrementally to investors’ information set. We do not expect the results of the German election to have much market impact. The most likely result is a strong signal of continuity with a return of the Grand Coalition. At the same time, French...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX was mostly firmer on Friday, but capped off a week of broad-based losses. US rates gave back some of post-FOMC rise, and that weighed on the dollar. Not much in the way of US data until Friday’s core PCE reading and Chicago PMI. Stock Markets Emerging Markets, September 20 Source: economist.com - Click to enlarge Singapore Singapore reports August CPI Monday, which is expected to remain...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org