Q2/2017 Change vs. Q2/2016 Changein % Current Account +18.7 bn. +19.4 bn. -3.7% of which Goods Trade net +19.6 bn. +19.2 bn. +2.0% of which Services Trade net +4.1 bn. +4.7 bn. -14.6% of which Investment Income net +7.4 bn. +9.6 bn. -29.7% Financial Account +12.5 bn. +6.0 bn. +52% of which Direct Investments net -63.0 bn. +6.4 bn. -89.8% of which Portfolio Investments net +26.5 bn. -0.5 bn. +98.1% of which Reserve Assets (SNB interventions) +19.0 bn. +24.3 bn. +27.9% Additional information from the press release In the second quarter of 2017, the current account surplus amounted to CHF 19 billion, a reduction of CHF 1 billion on the year-back quarter. While the receipts surplus in goods trade

Topics:

Swiss National Bank considers the following as important: Featured, newsletter, SNB, SNB Press Releases, Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

| Q2/2017 | Change vs. Q2/2016 |

Change in % |

|

| Current Account |

+18.7 bn.

|

+19.4 bn.

|

-3.7% |

| of which Goods Trade net | +19.6 bn. | +19.2 bn. | +2.0% |

| of which Services Trade net |

+4.1 bn.

|

+4.7 bn.

|

-14.6% |

| of which Investment Income net |

+7.4 bn.

|

+9.6 bn.

|

-29.7% |

| Financial Account | +12.5 bn. |

+6.0 bn.

|

+52% |

| of which Direct Investments net | -63.0 bn. | +6.4 bn. | -89.8% |

| of which Portfolio Investments net | +26.5 bn. | -0.5 bn. | +98.1% |

| of which Reserve Assets (SNB interventions) |

+19.0 bn. | +24.3 bn. | +27.9% |

Additional information from the press release

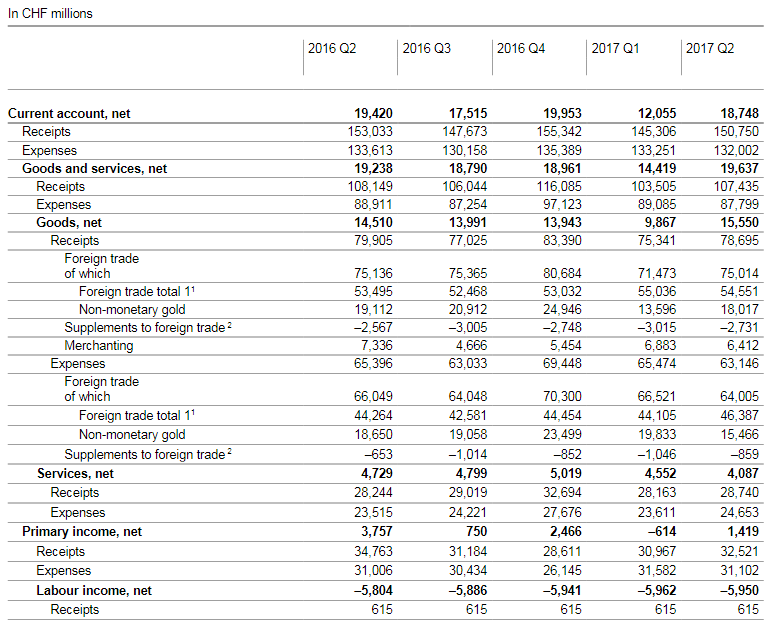

In the second quarter of 2017, the current account surplus amounted to CHF 19 billion, a reduction of CHF 1 billion on the year-back quarter. While the receipts surplus in goods trade increased, the surplus in primary income (labour and investment income) and in services declined. The expenses surplus in secondary income (current transfers) was also somewhat lower than in the same quarter in the previous year.

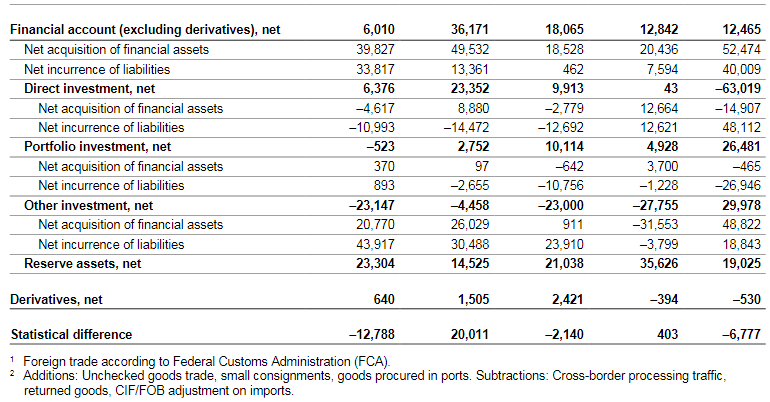

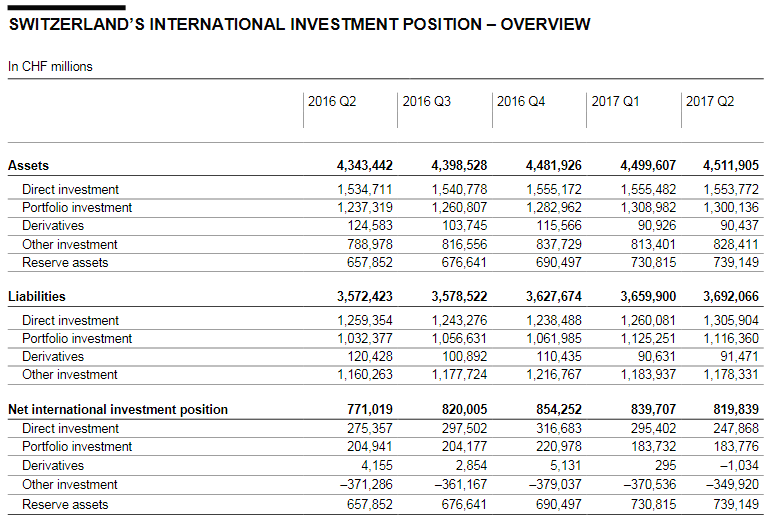

The transact ions recorded in the financial account resulted in both a high net acquisition of financial assets (CHF 52 billion) and a high net incurrence of liabilities (CHF 40 billion) in the second quarter of 2017. The net acquisition on the assets side was largely due to other investment and reserve assets. On the liabilities side, direct investment, in particular, registered a high net incurrence, as a result of acquisitions of resident companies by non-resident investors. Other investment also saw a net incurrence of liabilities, while portfolio investment experienced a net reduction. Overall, the financial account, including derivatives, reported a positive balance of CHF 12 billion.The net international investment position in the second quarter of 2017 fell by CHF 20 billion to CHF 820 billion. Stocks of assets were up by CHF 12 billion to CHF 4,512 billion, and stocks of liabilities by CHF 32 billion to CHF 3,692 billion. Despite a positive financial account balance, liabilities grew more than assets for two reasons. Firstly, assets recorded exchange rate losses as a result of the weaker US dollar. Assets are much more strongly affected by exchange rate fluctuations than liabilities since the majority of assets are held in foreign currencies. Secondly, capital gains were recorded on the liabilities side due to price rises on the stock market. Since the share of equity securities is higher in liabilities than in assets, movements in share prices have a stronger impact on liabilities than on assets.

Current AccountReceiptsAt CHF 79 billion, receipts from total goods trade were CHF 1 billion lower than in the year-back quarter. The decrease was attributable, first, to receipts from non-monetary gold trading, which fell by CHF 1 billion to CHF 18 billion, and, second, to net receipts from merchanting, which declined by CHF 1 billion to CHF 6 billion. By contrast, receipts from goods exports according to the foreign trade statistics (total 1) increased by CHF 1 billion to CHF 55 billion; while exports of jewellery and metals were up, exports of machinery and electronics receded.

At CHF 29 billion, receipts from foreign trade in services were equivalent to those of the year-back quarter. Tourism, financial services and licence fees registered an increase, while business services receipts declined.

As a result of lower receipts from investment abroad, particularly from direct investment, primary income (labour and investment income) decreased year-on-year by CHF 2 billion to CHF 33 billion. Secondary income (current transfers) advanced by CHF 1 billion to CHF 11 billion.

ExpensesExpenses for total goods trade amounted to CHF 63 billion, a CHF 2 billion reduction from the year-back quarter. In particular, expenses for non-monetary gold trading receded, by CHF 3 billion to CHF 15 billion. Expenses for goods imports according to the foreign trade statistics (total 1), by contrast, grew by CHF 2 billion to CHF 46 billion, with the largest rise recorded in chemical and pharmaceutical products as well as textiles, clothing and footwear.

At CHF 25 billion, expenses for services imports exceeded the figure for the year-back quarter by CHF 1 billion. This increase was chiefly driven by telecommunications, computer and information services, and busines s services.

Expenses for primary income (labour and investment income) came to CHF 31 billion, thus remaining at the same level as in the year-back quarter. Expenses for secondary income (current transfers) reduced by CHF 1 billion to CHF 13 billion.

NetThe current account surplus amounted to CHF 19 billion, a CHF 1 billion reduction from the year-back quarter. It was calculated as the sum of all receipts (CHF 151 billion) minus the sum of all expenses (CHF 132 billion).

|

Swiss Balance of Payments Q2 2017(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge |

Financial АccountNet Аcquisition of Financial AssetsThe net acquisition of financial assets totalled CHF 52 billion (Q2 2016: net acquisition of CHF 40 billion). Other investment saw a net acquisition of CHF 49 billion (Q2 2016: net acquisition of CHF 21 billion), with commercial banks in Switzerland increasing their claims against both non-resident banks and customers. As a result of the SNB’s foreign currency purchases, reserve assets recorded a net acquisition of CHF 19 billion (Q2 2016: net acquisition of CHF 23 billion). By contrast, direct investment recorded a net reduction of CHF 15 billion (Q2 2016: net reduction of CHF 5 billion). This was attributable to the fact that companies in Switzerland reduced their loans to affiliates abroad. In portfolio investment, resident investors’ purchases and sales of securities issued by non-residents were on a par, as in the year-back quarter.

Net Incurrence of LiabilitiesOverall, the liabilities side of the financial account registered a net incurrence of CHF 40 billion (Q2 2016: net incurrence of CHF 34 billion). This net incurrence was mainly attributable to corporate acquisitions: non-resident investors purchased majority interests in companies resident in Switzerland that had been previously held in free float by resident and non-resident investors. These transactions dominated both direct investment and portfolio investment. Direct investment posted a net incurrence of CHF 48 billion (Q2 2016: net reduction of CHF 11 billion). The corporate acquisitions were particularly evident in equity capital. The net reduction of liabilities in portfolio investment of CHF 27 billion (Q2 2016: net acquisition of CHF 1 billion) reflected the sale of free-float shares by former non-resident investors. Other investment posted net incurrence totalling CHF 19 billion (Q2 2016: net incurrence of CHF 44 billion). This was largely caused by an increase in the liabilities of commercial banks in Switzerland towards non-resident banks.

NetThe financial account balance came to CHF 12 billion (Q2 2016: CHF 7 billion). This is calculated as the sum of all net acquisitions of assets minus the sum of all net incurrence of liabilities plus the balance from derivatives transactions. This positive financial account balance corresponds to the increase in the net international investment position resulting from cross-border investment.

|

Switzerland Financial Account(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Extract from the Balance of Payments Q2 2017 Source: snb.ch - Click to enlarge |

Switzerland’s International Investment PositionForeign AssetsStocks of foreign assets were up CHF 12 billion on the previous quarter to CHF 4,512 billion. Whereas the transactions reported in the financial account (net acquisition of financial assets: CHF 52 billion) contributed to the increase in foreign assets, exchange rate losses on assets denominated in US dollars led to a decline. A reclassification was a significant factor in the main items on the assets side: As part of a group restructuring, loans which were previously reported under other investment were now reported under direct investment. This notwithstanding, stocks of direct investment fell by CHF 2 billion to CHF 1,554 billion due both to high exchange rate losses and to disinvestment. Despite the reclassification, stocks of other investment increased by CHF 15 billion to CHF 828 billion, in particular as a result of the high levels of transactions (net acquisition of financial assets: CHF 49 billion). Reserve assets grew by CHF 8 billion to CHF 739 billion. The assets under portfolio investment fell by CHF 9 billion to CHF 1,300 billion, largely due to exchange rate losses. Derivatives remained virtually unchanged at CHF 90 billion.

Foreign LiabilitiesStocks of foreign liabilities rose by CHF 32 billion to CHF 3,692 billion compared to the previous quarter. This was mainly attributable to the increase in direct investment stocks, which rose by CHF 46 billion to CHF 1,306 billion as a result of the large volumes of transactions reported in the financial account. Despite the high net reduction in liabilities, portfolio investment stocks declined by just CHF 9 billion to CHF 1,116 billion, due to price gains on the Swiss stock exchange of shares held by non-resident investors. Other investment decreased by CHF 6 billion to CHF 1,178 billion. Derivatives remained virtually unchanged, as on the assets side, at CHF 91 billion.

Net International Investment PositionThe net international investment position declined by CHF 20 billion to CHF 820 billion compared with the previous quarter, since foreign liabilities (up CHF 32 billion) advanced more strongly than foreign assets (up CHF 12 billion).

Backcasting of Current Account Time Series to 1983Current account data has now been backward calculated to 1983 (previously 2000). Time series for the financial account and the international investment position continue to start at 2000.

|

Switzerland International Investment Position(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Switzerland International Investment Position - Q2 2017 Source: snb.ch - Click to enlarge |

Remarks

Tags: Featured,newsletter,Switzerland Balance of Payments,Switzerland Capital Account,Switzerland Current Account,Switzerland Financial Account