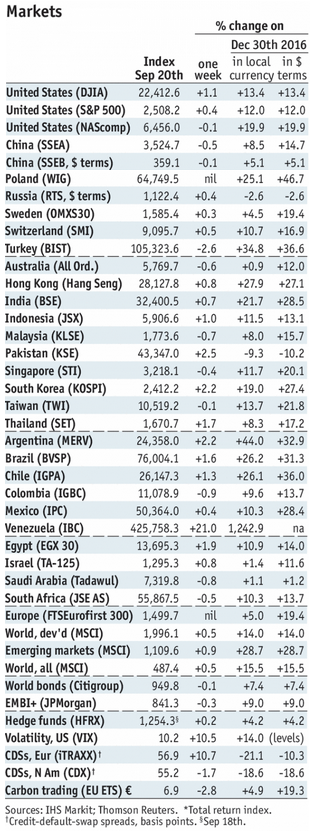

Stock Markets EM FX was mostly firmer on Friday, but capped off a week of broad-based losses. US rates gave back some of post-FOMC rise, and that weighed on the dollar. Not much in the way of US data until Friday’s core PCE reading and Chicago PMI. Stock Markets Emerging Markets, September 20 Source: economist.com - Click to enlarge Singapore Singapore reports August CPI Monday, which is expected to remain steady at 0.6% y/y. It then reports August IP Tuesday, which is expected to rise 14.3% y/y vs. 21% in July. MAS holds its semiannual policy meeting in October. No change in policy is seen. In addition, we think it’s unlikely that the statement language is adjusted to signal possible tightening at the April

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX was mostly firmer on Friday, but capped off a week of broad-based losses. US rates gave back some of post-FOMC rise, and that weighed on the dollar. Not much in the way of US data until Friday’s core PCE reading and Chicago PMI. |

Stock Markets Emerging Markets, September 20 Source: economist.com - Click to enlarge |

SingaporeSingapore reports August CPI Monday, which is expected to remain steady at 0.6% y/y. It then reports August IP Tuesday, which is expected to rise 14.3% y/y vs. 21% in July. MAS holds its semiannual policy meeting in October. No change in policy is seen. In addition, we think it’s unlikely that the statement language is adjusted to signal possible tightening at the April 2018 meeting. BrazilBrazil reports August current account and FDI data Tuesday. It reports central government budget data Thursday. This will be followed by consolidated budget data Friday. Brazil reported much stronger than expected tax revenues for August, up 13.5% y/y. This warns of positive surprises in the budget data. ThailandBank of Thailand meets Wednesday and is expected to keep rates steady at 1.5%. Inflation was 0.3% y/y in August, well below the 1-4% target range. Yet the economy remains robust and the government is likely to revise up its growth forecast for this year that’s currently 3.5-4.0%. Czech RepublicCzech National Bank meets Wednesday and is expected to keep rates steady at 0.25%. A very small minority of analysts looks for a 25 bp hike to 0.50%. CPI rose 2.5% y/y in August, above the 2% target. However, Governor has said that he would like to see updated staff forecasts at the November 2 meeting before deciding to hike again. MexicoMexico reports August trade Wednesday. Banco de Mexico then meets Thursday and is expected to keep rates steady at 7.0%. Inflation is showing signs of topping out, but rates are unlikely to be cut until next year. Bloomberg consensus sees the first rate cut in Q2 2018, and we concur. KoreaKorea reports September CPI Thursday, which is expected to rise 2.2% y/y vs. 2.6% in August. While this would still be above the 2% target, we think disinflation and downside risks to growth will keep the BOK on hold for now. Next policy meeting is October 19, no change expected then. Korea then reports August IP (0.9% y/y expected) and current account data Friday. September trade will be reported over the weekend. ChinaCaixin reports September China manufacturing PMI Friday, which is expected at 51.5 vs. 51.6 in August. Official manufacturing PMI will be reported Saturday local time, and is expected to remain steady at 51.7. This will be the first snapshot for September, and comes after generally disappointing data in July and August that suggests the economy is losing some momentum. South AfricaSouth Africa reports August money and private sector credit, trade, and budget data Friday. SARB surprised markets with steady rates last week, despite a dovish statement. Vote was split 3-3 and then the MPC ultimately decided to be cautious and did not hike. The next meeting November 23 could be problematic, as it comes a day before S&P and Moody’s are due to issue ratings decisions. TurkeyTurkey reports August trade Friday, which is expected at -$5.9 bln. If so, the 12-month total would rise to -$64 bln from -$62.9 bln in July, and would be the highest since November 2015. The external accounts have been worsening in recent months, due mostly to stronger imports. The 12-month current account deficit rose to -$37.1 bln in July, the highest since September 2015. PolandPoland reports September CPI Friday, which is expected to rise 2.0% y/y vs. 1.8% in August. If so, it would still be in the bottom half of the 1.5-3.5% target range. Central bank officials have downplayed the need for tightening next year. However, the economy remains robust and so this dovish forward guidance will likely be tested. Next policy meeting isOctober 4, no change is expected then. ChileChile reports August IP Friday. The economy is picking up, which supports the central bank’s view that the easing cycle is over. CPI rose 1.9% y/y, below the 2-4% target range, which gives the bank to leave rates steady for the time being. Next policy meeting is October 19, no change is expected then. ColombiaColombia central bank meets Friday and is expected to keep rates steady at 5.25%. Inflation was 3.9% y/y in August, still in the 2-4% target range but up from 3.4% in July. We’re not convinced the easing cycle is over, and warn that there are risks of a dovish surprise then. |

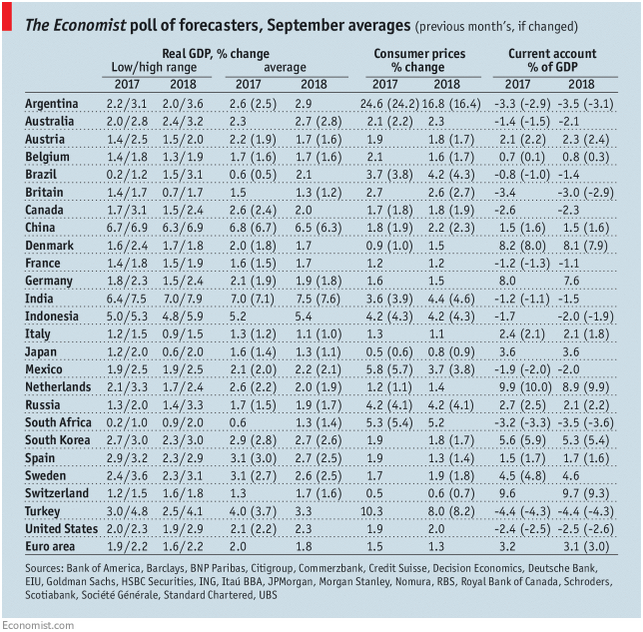

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, September 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin