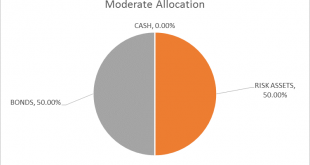

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolios this month. The post Fed meeting market reaction was a bit surprising in its intensity. The actions of the Fed were, to my mind anyway, pretty much as expected but apparently the algorithms that move markets today were singing from a...

Read More »Is The Swiss National Bank A Fraud?

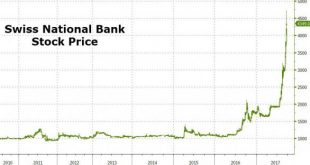

The price of shares in The Swiss National Bank is up 11 days in a row, soaring 150% in the last two months. SNB Stock Price, 2010 - 2017(see more posts on Swiss National Bank Stock, ) - Click to enlarge That sounds like a ‘tulip’ bubble-like ‘fraud’… Bitcoin and SNB, 2013 - 2017(see more posts on Bitcoin, Swiss National Bank Stock, ) - Click to enlarge The SNB is up over 120% in Q3 so far – more than double...

Read More »Gold Investment “Compelling” As Fed Likely To Create Next Recession

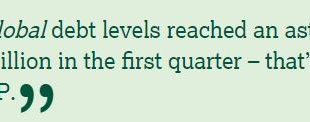

Gold Investment “Compelling” As Fed Likely To Create Next Recession – Is the Fed about to kill the business cycle? – 16 out of 19 rate-hike cycles in past 100 years ended in recession – Total global debt at all time high – see chart – Global debt is 327% of world GDP – ticking timebomb… – Gold has beaten the market (S&P 500) so far this century – Safe haven demand to increase on debt and equity risk – Gold looks...

Read More »Abe and BOJ

Summary: BOJ is unlikely to change policy. A snap election suggests continuity of policy. US 10-year yield remains one of most important drivers of the exchange rate. There is practically no chance that the BOJ changes policy. BOJ shares the common dilemma among major central banks. Growth is ok–above trend, which in Japan is seen as about 0.8%, but price pressures remain weak. The core rate in Japan, which...

Read More »India: The Genie of Lawlessness is out of the Bottle

Recapitulation (Part XVI, the Last) Since the announcement of demonetization of Indian currency on 8th November 2016, I have written a large number of articles. The issue is not so much that the Indian Prime Minister, Narendra Modi, is a tyrant and extremely simplistic in his thinking (which he is), or that demonetization and the new sales tax system were horribly ill-conceived (which they were). Time erases all...

Read More »Fed’s Asset Bubbles Now At The Mercy Of The Rest Of The World’s Central Bankers

“Like watching paint dry,” is how The Fed describes the beginning of the end of its experiment with massively inflating its balance sheet to save the world. As former fund manager Richard Breslow notes, however, Yellen’s decision today means the risk-suppression boot is on the other foot (or feet) of The SNB, The ECB, and The BoJ; as he writes, “have no fear, The SNB knows what it’s doing.” As we reported previously, In...

Read More »Swiss annual growth forecast takes a cut

Manufacturing has picked up, but not overall growth. (Keystone) Swiss economic growth estimates for the year have been revised down to under 1% by the State Secretariat for Economic Affairs (SECO). This would make it the slowest year since 2009. The stats released Thursday predict a growth rate of 0.9% for 2017. The figure has fallen from previous estimates of 1.4%, and would mark the worst-performing economic year...

Read More »Pensions and Debt Time Bomb In UK: £1 Trillion Crisis Looms

– £1 trillion crisis looms as pensions deficit and consumer loans snowball out of control– UK pensions deficit soared by £100B to £710B, last month– £200B unsecured consumer credit “time bomb” warn FCA– 8.3 million people in UK with debt problems– 2.2 million people in UK are in financial distress– ‘President Trump land’ there is a savings gap of $70 trillion– Global problem as pensions gap of developed countries...

Read More »Expectations and Acceptance of Potential

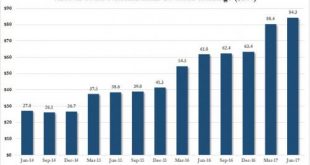

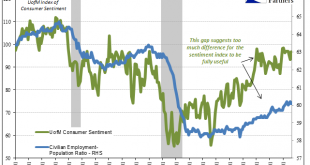

The University of Michigan reports that consumer confidence in September slipped a little from August. Their Index of Consumer Sentiment registered 95.3 in the latest month, down from 96.8 in the prior one. Both of those readings are in line with confidence estimates going back to early 2014 when consumer sentiment supposedly surged. University of Michigan Consumer Confidence, Jan 1997 - 2017(see more posts on...

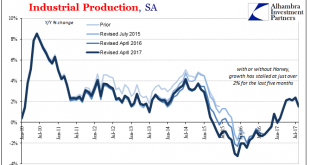

Read More »IP Weathers Storms But Not Cars

In late August 2006, ABC News asked more than a dozen prominent economists to evaluate the impacts of hurricane Katrina on the US economy. The cataclysmic storm made landfall on August 29, 2005, devastating the city of New Orleans and the surrounding Gulf coast. The cost in human terms was unthinkable, and many were concerned, as people always are, that in economic terms the country might end up in similar...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org