This isn’t going to be like the tale of Goldilocks, at least not how it’s usually told. There are three central banks, sure, call them bears if you wish, each pursuing a different set of fuzzy policies. One is clearly hot, the other quite cold, the final almost certainly won’t be “just right.” Rather, this one in the middle simply finds itself…in the middle of the other two. Running red-hot to the point of near-horror, that’s “our” Federal Reserve. The FOMC minutes from last month’s rate hike meeting were published today, not that anyone needed any addition to the ongoing jawboning. Speeches and appearances by any of the FOMC between then and now have clearly indicated just how uncomfortable policymakers have become about the CPI (or PCE Deflator, if you prefer,

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, China, Christine Lagarde, currencies, ECB, economy, Europe, Featured, Federal Reserve/Monetary Policy, FOMC, Markets, newsletter, PBOC, QE, rate cuts, rate hikes, tapering, yi gang

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| This isn’t going to be like the tale of Goldilocks, at least not how it’s usually told. There are three central banks, sure, call them bears if you wish, each pursuing a different set of fuzzy policies. One is clearly hot, the other quite cold, the final almost certainly won’t be “just right.” Rather, this one in the middle simply finds itself…in the middle of the other two.

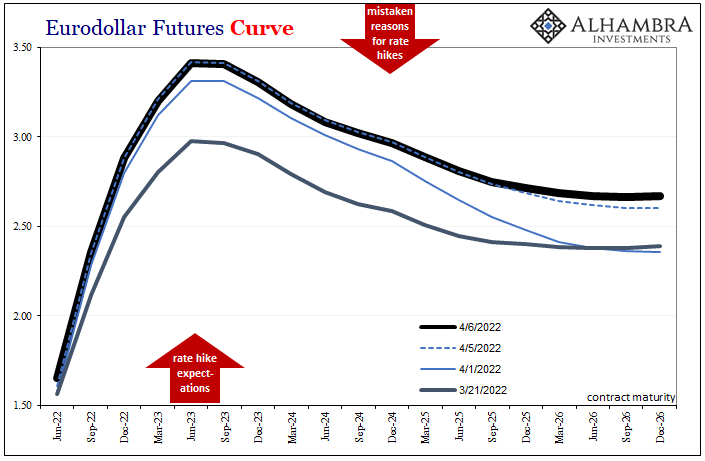

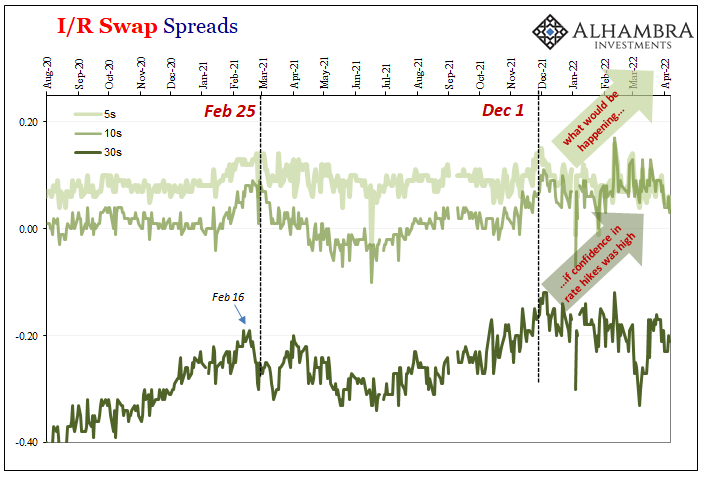

Running red-hot to the point of near-horror, that’s “our” Federal Reserve. The FOMC minutes from last month’s rate hike meeting were published today, not that anyone needed any addition to the ongoing jawboning. Speeches and appearances by any of the FOMC between then and now have clearly indicated just how uncomfortable policymakers have become about the CPI (or PCE Deflator, if you prefer, like they do). Pure political theater, the word used in the minutes was “expeditiously.” In other words, the committee members want to get the fed funds range up to what they consider “neutral” (whatever that might be; it is defined as a theoretical rate neither tight nor accommodative, so it won’t contribute more to “inflation” assuming rates actually matter in this way; they don’t) as fast as possible. |

|

| To that demand, the minutes also wrote how “many participants” would have preferred a double to kick things off last month, a fifty hike rather than the typical, stoic twenty-five, and that “many participants” clearly prefer a few fifties moving expeditiously forward.

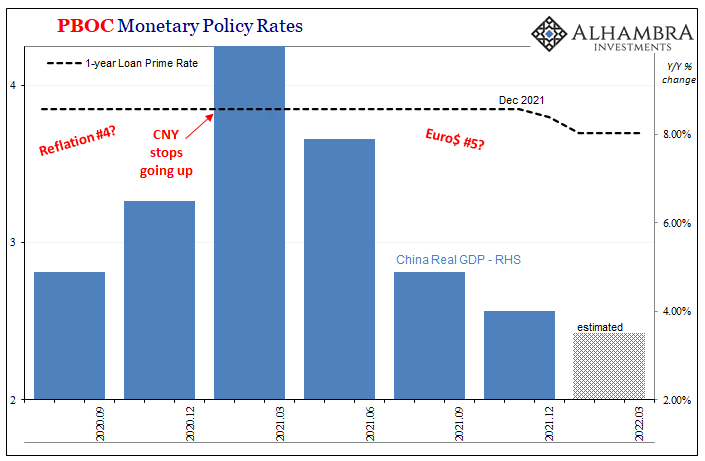

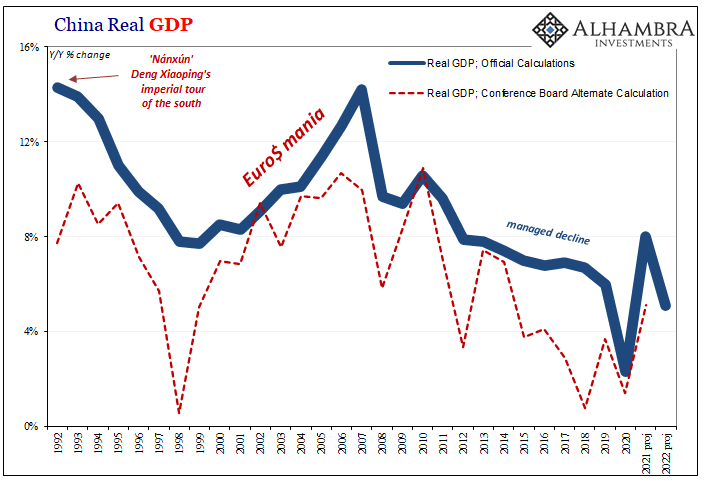

While the Federal Reserve is scorching with rate hiking, consumer price theater, their Chinese counterparts are chilling down freezing cold. The PBOC may have paused for both February and March, yet everyone (including those at the PBOC) expects already prior rate cuts (December and January) to resume later this month. |

|

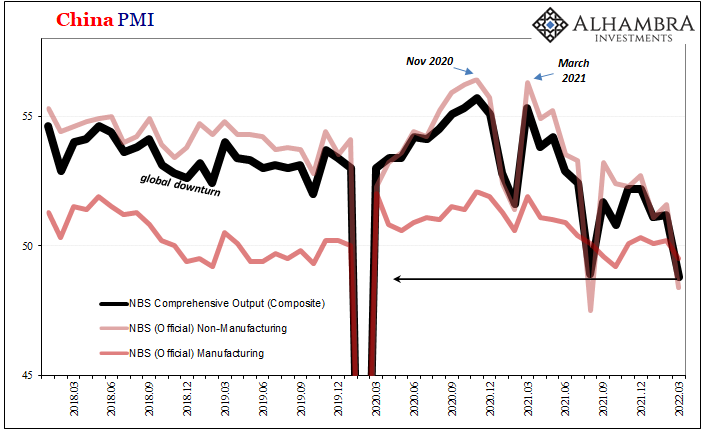

| China’s economy is wrestling with more than draconian, frankly dystopian zero-COVID insanity. While that isn’t helping, and might explain the depths of temporary downside monthly data, far more alarming is the trend which remains unbroken to the upside even after whichever latest variant (and lockdowns) passes meekly through history.

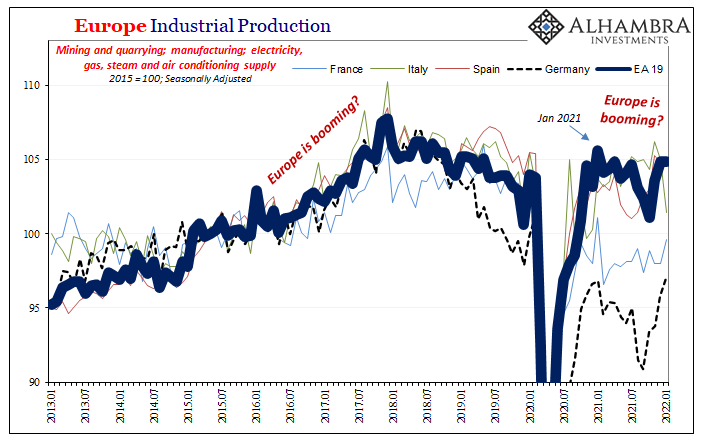

In between the PBOC and the Fed, our friends over in Europe. This one’s even more compelling if not weird because European consumer prices accelerated to 7.5% year-over-year (preliminary) for March 2022, which, you’ll note, is practically the same pace for US prices. However, unlike the Powell panic, Christine Lagarde’s ECB continues to play it rather cool. |

|

| Officials there have steadfastly claimed rate hikes will not begin until the QEs are wound completely down to nothing, which will take several months more.

And even when those done and gone, Lagarde also has repeatedly stated how her hikes may not start up immediately after the asset purchasing ends. On top of that, she also purposefully dropped the word “gradual” several more times, meaning that once European rate hikes do begin (if ever) they will not proceed expeditiously. Three central banks, each moving forward in separate ways. Only one global economy. |

|

| Meaning, that there aren’t separate scenarios (decoupling) where all three do the “right” thing, each one best responding to individual and isolated idiosyncratic circumstances, rather it is an either/or situation that, like 2018-19, is bound to get synchronized in one way or the other.

Will it be the way the Fed is leaning, rate hikes taming sustained red hot consumer prices leading to the, um, Goldilocks soft landing? Or the PBOC, where rate cuts are increasingly seen even by mainstream cheerleaders as truly warranted if only to keep that part of the global system from tanking any further than it already has (see: recent PMIs, including Caixin)? How about the ECB and Ms. |

|

| Lagarde’s more determined cautiousness which isn’t all Russian spillover?

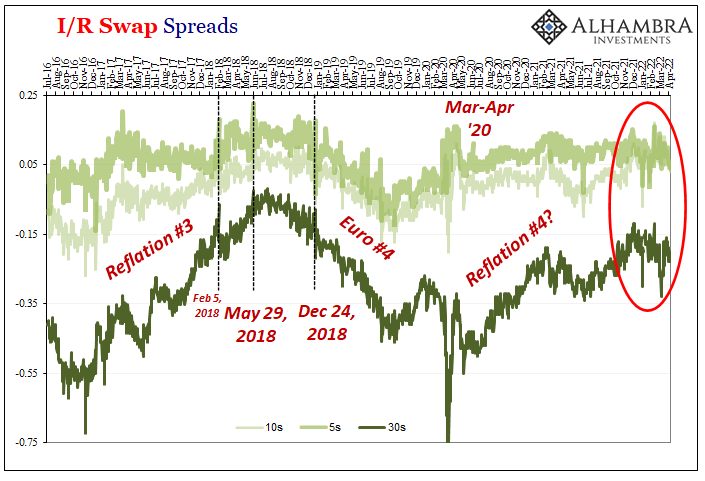

For the latter pair, there is the lesson of 2018 to begin with. Mario Draghi, Lagarde’s immediate predecessor, you might recall his huge error when from the start of that year he dismissed growing weakness (in Europe as well as China) as nothing more than an immaterial slowdown from a rapid high in 2017. It did not work out well for him, or, you know, Europe and the rest of the world. Rather importantly, it also didn’t go very well at all for one Jay Powell. It might be that Christine unlike Mario is more attuned to not just that mistake but also how it could’ve been avoided by paying much closer attention to what was going on in China and with the PBOC’s interpretation of risks and tendencies rather than sticking closely by the uncontroversial mainstream-ness of Powell and the Fed. Given how much China directly affects Europe, far more than Russia (in broad macro terms, outside of energy, yes), you have to wonder just how much of a wary eye the ECB is keeping on the Far East rather than the rest of the West’s inflation clutching. |

|

| Also, markets. A whole lot of markets.

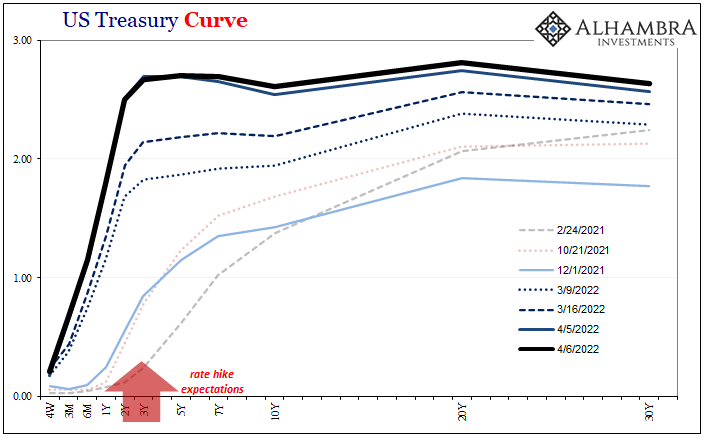

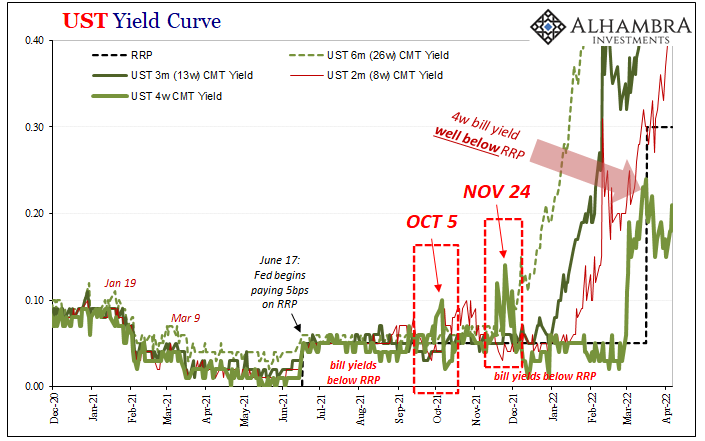

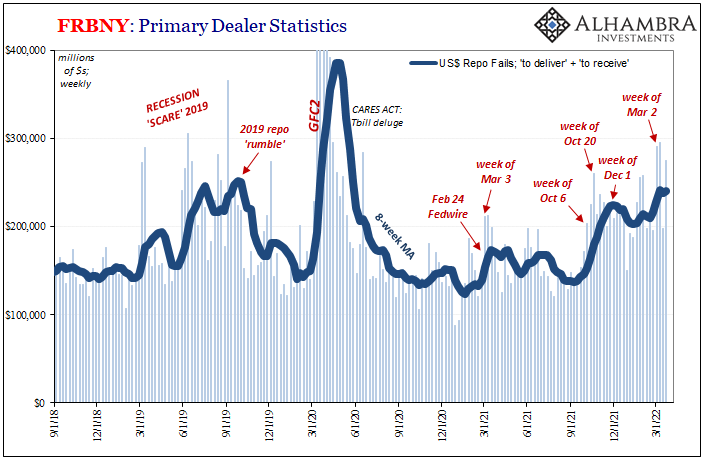

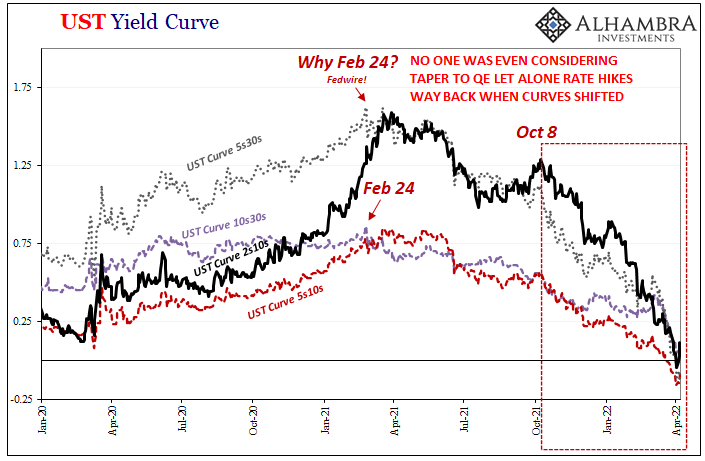

Despite rate hikes from the Fed and the confidence in the economy expressed by them, inversions all over. Deep, profound ugliness, the upside-down which, it should go without saying, isn’t anywhere close to the Goldilocks story (see: below; special attention to bills and fails which I’ll write more about tomorrow). Jay Powell’s doing his thing, Lagarde hers, and China’s Yi Gang totally opposite either. What a fascinating series of confused conundrums. Markets are far more with China, even the big one over in Europe. |

|

| Goldilocks this time, like last time and the prior times, might just find the “right” answer is, in fact, still too cold. | |

Tags: Bonds,China,Christine Lagarde,currencies,ECB,economy,Europe,Featured,Federal Reserve/Monetary Policy,FOMC,Markets,newsletter,PBOC,QE,rate cuts,rate hikes,tapering,yi gang