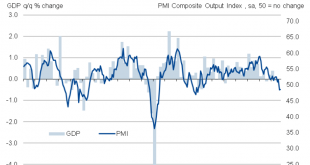

Eurostat confirmed earlier today that Europe has so far avoided recession. At least, it hasn’t experienced what Economists call a cyclical peak. During the third quarter of 2019, Real GDP expanded by a thoroughly unimpressive +0.235% (Q/Q). This was a slight acceleration from a revised +0.185% the quarter before. The real question, though, is whether the business cycle approach means anything in this day and age. I don’t think it does, and that’s a big part of why...

Read More »More Signals Of The Downturn, Globally Synchronized

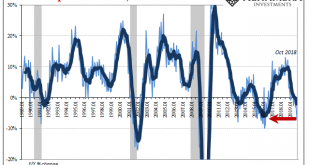

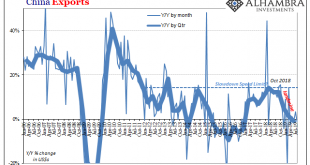

For US importers, October is their month. And it makes perfect sense how it would be. With the Christmas season about to kick into full swing each and every November, the time for retailers to stock up in hearty anticipation is in the weeks beforehand. The goods, a good many future Christmas presents, find themselves in transit from all over the world during the month of October. For the Census Bureau’s trade data, that means this is the month that shines above...

Read More »FX Daily, November 6: Markets Catch Collective Breath as Dollar Consolidates Yesterday’s Advance

Swiss Franc The Euro has risen by 0.14% to 1.1008 EUR/CHF and USD/CHF, November 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors seem to be catching their collective breath today, and the global capital markets are consolidating recent moves. A notable exception is the Chinese yuan, which has continued to strengthen, and the dollar has slipped back below CNY7.0. Asia Pacific equities were mixed, and...

Read More »Somehow Still Decent European Descent

How times have changed. In the middle of 2018, we were told the risks to the global economy were all tilted to the upside. If central bankers weren’t careful, they chanced an uncontrollable inflationary breakout, the kind that would make the last few years of the 2010’s look too much like the 1970’s. Always eager to bottle up the inflation genie, Germany out of everyone actually welcomed negative factors as they built up during the year. From last August: In spite of...

Read More »No Longer Hanging In, Europe May Have (Been) Broken Down

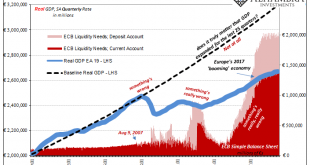

Mario Draghi can thank Jay Powell at his retirement party. The latter being so inept as to allow federal funds, of all things, to take hold of global financial attention, everyone quickly shifted and forgot what a mess the ECB’s QE restart had been. But it’s not really one or the other, is it? Once it actually finishes, the takeaway from all of September should be the world’s two most important central banks each botching their “accommodations.” It’s only a little...

Read More »A Bigger Boat

For every action there is a reaction. Not only is that Sir Isaac Newton’s third law, it’s also a statement about human nature. Unlike physics where causes and effects are near simultaneous, there is a time component to how we interact. In official capacities, even more so. Bureaucratic inertia means a lot more than just resistance to change, it also means, at times and in certain capacities, all sorts of biases. When the bureaucracy predicts one set of circumstance,...

Read More »Is The Negativity Overdone?

Give stimulus a chance, that’s the theme being set up for this week. After relentless buying across global bond markets distorting curves, upsetting politicians and the public alike, central bankers have responded en masse. There were more rate cuts around the world in August than there had been at any point since 2009. And there’s more to come. As Bloomberg reported late last week: Over the next 12 months, interest-rate swap markets have priced in around 58 more...

Read More »What if we have a ‘no deal’ Brexit ?

Although still not our central scenario, a no-deal Brexit is a distinct possibility on the 31 October, with distinct implications for the UK economy and financial assets.Prime Minister Boris Johnson has chosen a more aggressive negotiation technique than predecessor Theresa May, flagging the UK’s readiness to exit the European Union without a transition deal (current deadline is 31 October) if the withdrawal agreement that May reached with Brussels is not improved to match his demands....

Read More »Some Brief European Leftovers

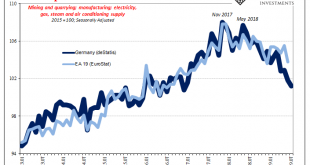

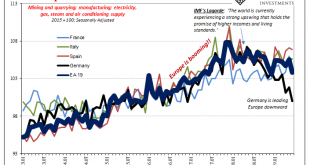

Some further odds and ends of European data. Beginning with Continent-wide Industrial Production. Germany is leading the system lower, but it’s not all just Germany. And though manufacturing and trade are thought of as secondary issues in today’s services economies, the GDP estimates appear to confirm trade in goods as still an important condition and setting for all the rest. The weakness is persisting and intensifying – particularly after May 2019. Europe...

Read More »Germany Struggles On

The popular image of the German industrial machine politics is one which has Germany’s massive factories efficiently churning out goods for trade with the South of Europe (Club Med). Because of the common currency, numerous disparities starting with productivity differences had left the South highly indebted to the North just as the Global Financial Crisis would strike. The aftermath of that crisis, particularly the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org