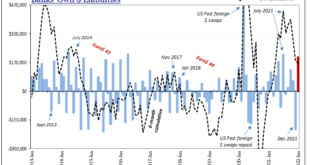

With the Fed (sadly) taking center stage last week, and market rejections of its rate hikes at the forefront, lost in the drama was January 2022 TIC. Understandable, given all its misunderstood numbers are two months behind at their release. There were some interesting developments regardless, and a couple of longer run parts that deserve some attention. Picking up where TIC left off from December, when more indicated bad (tight money) than good (not as tight),...

Read More »As The Fed Seeks To Justify Raising Rates, Global Growth Rates Have Been Falling Off Uniformly Around The World

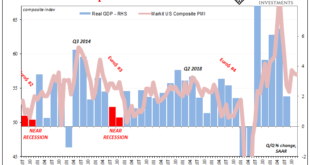

Sentiment indicators like PMI’s are nice and all, but they’re hardly top-tier data. It’s certainly not their fault, these things are made for very times than these (piggy-backing on the ISM Manufacturing’s long history without having the long history). Most of them have come out since 2008, if only because of the heightened professional interest in macroeconomics generated by a global macro economy that can never get itself going. What PMI’s do have going for them is...

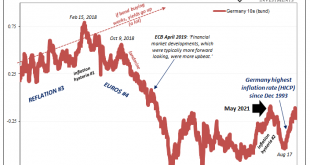

Read More »The Real Tantrum Should Be Over The Disturbing Lack of Celebration (higher yields)

Bring on the tantrum. Forget this prevaricating, we should want and expect interest rates to get on with normalizing. It’s been a long time, verging to the insanity of a decade and a half already that keeps trending more downward through time. What’s the holdup? You can’t blame COVID at the tail end for a woeful string which actually dates back farther than the last pandemic (H1N1). Emil Kalinowski has it absolutely right; what happened in 2013 in the Treasury...

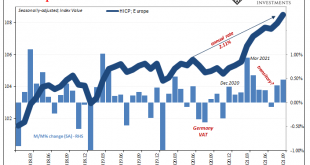

Read More »Tapering Or Calibrating, The Lady’s Not Inflating

We’ve got one central bank over here in America which appears as if its members can’t wait to “taper”, bringing up both the topic and using that particular word as much as possible. Jay Powell’s Federal Reserve obviously intends to buoy confidence by projecting as much when it does cut back on the pace of its (irrelevant) QE6. On the other side of the Atlantic, Europe’s central bank will be technically be doing the same thing likely at the same time. Except,...

Read More »Freedom Is Not Free You Have To Fight For It, The People Will Demand Decentralization

[unable to retrieve full-text content]Claudio begins his discussion with him taking a trip from Switzerland to Spain. On his travels he realized that the borders are open for cars and people were not asked for proof of vaccination. The people will begin to come together when they cannot function in everyday life because of inflation. People will look for decentralization because the globalist system does not work for the people. Freedom is not free you have to fight for it.

Read More »Freedom Is Not Free You Have To Fight For It, The People Will Demand Decentralization

Claudio begins his discussion with him taking a trip from Switzerland to Spain. On his travels he realized that the borders are open for cars and people were not asked for proof of vaccination. The people will begin to come together when they cannot function in everyday life because of inflation. People will look for decentralization because the globalist system does not work for the people. Freedom is not free you have to fight for it. All source links to the report can be found...

Read More »Pandemic diplomacy in the Western Balkans

by Blerim Reka The business of fighting Covid-19 is now estimated at around $150 billion. As of March 2021, 354 million vaccine doses have been delivered – 90 percent of them to countries that are home to only 10 percent of the world’s population. If 65 to 85 percent of people have to be vaccinated to reach global immunity, then it is unlikely to happen this year. By the end of February 2021, 140 states had yet to see their first shipment, Kosovo among them...

Read More »The end of central banking as we know it

The severest crisis the European Central Bank (ECB) ever faced coincided with the early days of a new Executive Board. Over the past year and a half, the board’s six members, including the ECB’s president and vice president, have all been replaced, either because they resigned, or because their eight-year mandate expired. New team By order of appointment, the new board consists of: Luis de Guindos, who replaced Vitor Constancio as vice president in June 2018...

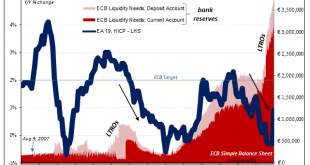

Read More »Even The People ‘Printing’ The ‘Money’ Aren’t Seeing It

Everyone in Europe has long forgotten about what was going on there before COVID. First, an economy that had been stuck two years within a deflationary downturn central bankers like Italy’s new recycled top guy Mario Draghi clumsily mistook for an inflationary takeoff. Both the inflation puzzle and ultimately a pre-pandemic recession have taken a back seat to everything corona. Whereas Draghi spent those years howling for inflationary conditions that were nowhere in...

Read More »FX Daily, January 29: Please Stay Seated, the Ride is not Over

Swiss Franc The Euro has risen by 0.16% to 1.0789 EUR/CHF and USD/CHF, January 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Powerful corrective forces continue to grip the market. After a large rally to start the New Year, the correction is punishing. Most Asia Pacific equities markets were off again today to bring the week’s loss to 2.5% to 5.5% throughout the region. Europe’s Dow Jones Stoxx 600 is a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org