The cut to our growth forecast reflects slippage in euro area data.According to Eurostat’s preliminary flash estimate, euro area real GDP expanded by 0.3% q-o-q in Q2 2018, below consensus expectations. This was the weakest growth in two years and is down slightly from GDP growth of 0.4% q-o-q in Q1.Following today’s GDP growth data and recent economic indicators, we have revised down our GDP growth forecast for 2018. We now expect euro area real GDP to grow by 2.0% on average this year...

Read More »Euro area: a slight rebound

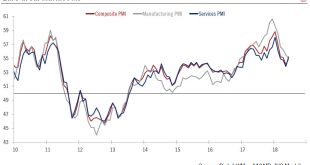

Overall, June saw a halt to recent declines in euro area business sentiment survey. The final reading for the euro area composite Purchasing Managers’ Index (PMI) rose from 54.1 in May to 54.9 in June, slightly higher than the initial estimate of 54.8. However, the manufacturing PMI fell further, to an 18-month low of 54.9, due to weakness in France and Germany. Growth remains decent in the sector but, as Markit...

Read More »Euro area: a slight rebound

Overall, June saw a halt to recent declines in euro area business sentiment survey.The final reading for the euro area composite Purchasing Managers’ Index (PMI) rose from 54.1 in May to 54.9 in June, slightly higher than the initial estimate of 54.8. However, the manufacturing PMI fell further, to an 18-month low of 54.9, due to weakness in France and Germany. Growth remains decent in the sector but, as Markit noted, the decline in business optimism “reflects rising trade worries, political...

Read More »Redenomination Risk in the Eurozone

In a CEPR discussion paper Christian Bayer, Chi Kim, Alexander Kriwoluzky analyze redenomination risk during the European debt crisis and how the European Central Bank’s interventions affected this risk. They conclude that the risk fell in the case of Italy but increased for France and Germany. From the abstract: … first estimate daily default-risk-free yield curves for French, German, and Italian bonds that can be redenominated and for bonds that cannot. Then, we extract the compensation...

Read More »Italy back in the spotlight

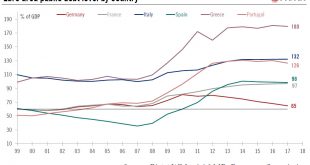

Italian elections are the next big political challenge facing the euro area. While near-term risks seem contained, medium-term ones remain.The Italian government confirmed 4 March as the date for the next parliamentary elections. The lower and upper houses will be elected under a new electoral law, but a hung parliament is the likely initial outcome of the elections given the fragmented political landscape in Italy.However, we do not think that, as things stand, political uncertainty will...

Read More »The IMF “In Principle” Approves Funding For Greece

In the FT, Mehreen Khan reports about the IMF’s conditional acceptance to lend to Greece. The IMF’s “agreement in principle” (AIP) tool draws on a practice where the fund is able to greenlight its involvement in a debtor country, conditional on the government and its creditors agreeing to future debt relief measures. Of course, the dispute about the merits of debt relief is unresolved. The IMF thinks Greek debt is ‘unsustainable’ and the European creditors should bear more losses, earlier...

Read More »ECB: see you in autumn

The ECB made no change in its forward guidance at its July meeting. Our baseline scenario remains unchanged.At its July meeting, the ECB made no change in its monetary policy statement, as we expected. Importantly, the bias for QE extension “in terms of size and/or duration” was kept in the statement. ECB president Mario Draghi mentioned that the Governing Council (GC) was unanimous in communicating no change to forward guidance.Draghi reiterated that a very substantial degree of...

Read More »Another spectacular rise in euro area PMIs

PMI surveys surprised to the upside in March. The euro area composite PMI surged to 56.7, its highest level since April 2011.The average composite PMI is now consistent with a GDP growth rate of about 0.6% q-o-q in Q1, above our forecast. At the same time, hard data came in slightly weaker than expected, suggesting that business surveys might be overstating the pace of growth to some extent. As a result, we are keeping our growth forecast unchanged at 1.5% for 2017Both the euro area...

Read More »Currency Denomination Risk in the Euro Area

In the FT (Alphaville), Marcello Minnena explains what type of currency denominations of Euro area sovereign debt constitute credit events; and how markets assess the risk of such denominations. After the Greek default in 2012 new ISDA standards entered into force: contracts made since 2014 protect against euro area countries redenominating their debt into new national currencies [unless the debt is redenominated] into a reserve currency: the US dollar, the Canadian dollar, the British...

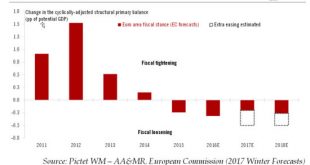

Read More »Euro area fiscal stimulus prospects

As the emphasis moves away from monetary initiatives, euro area GDP should benefit from a shift in fiscal policy going back to before the US elections.There has been growing evidence of a shift in the policy mix of various developed economies, from monetary to fiscal. In the euro area, we have likely entered a new cycle where the combination of austerity fatigue and greater flexibility on spending rules leads to more sustained fiscal support, however sub-optimal and uneven across countriesIn...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org