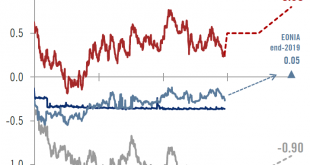

It’s all about the European Central Bank’s hiking cycle.In our central scenario, we expect the 10-year Bund yield to rise gradually to 0.8% by the end of next year from 0.26% on 17 December. Underpinning this upward movement is our expectation of a cumulative deposit rate hike of 40 basis points (bps) by the ECB, against current market expectations of only 10 bps.The euro area economic activity has been decelerating this year and the latest prints are not showing encouraging signs going into...

Read More »TIPS Goes Online

The ECB launches its Target Instant Payment Settlement (TIPS) system, which facilitates instant money transfers between banks and allows end users connected to those banks to make instant retail payments across the Euro zone. Report in the FAZ. Last year’s report by Mehreen Khan in the FT. From the ECB’s website: TIPS was developed as an extension of TARGET2 and settles payments in central bank money. TIPS currently only settles payment transfers in euro. However, in case of demand other...

Read More »TIPS Goes Online

The ECB launches its Target Instant Payment Settlement (TIPS) system, which facilitates instant money transfers between banks and allows end users connected to those banks to make instant retail payments across the Euro zone. Report in the FAZ. Last year’s report by Mehreen Khan in the FT. From the ECB’s website: TIPS was developed as an extension of TARGET2 and settles payments in central bank money. TIPS currently only settles payment transfers in euro. However, in case of demand other...

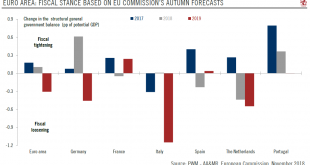

Read More »Euro area’s fiscal policy to turn supportive of growth next year

SUMMARY The Euro area’s fiscal stance will turn expansionary in 2019. Among the five biggest economies, this shift mainly reflects significant fiscal loosening in Germany, Italy and the Netherlands. France and Spain plan modest fiscal tightening, but less that what the European Commission (EC) demanded. In Italy, the government budget plan represents a significant deviation from the EU’s fiscal rules. The outcome of arm...

Read More »Euro area’s fiscal policy to turn supportive of growth next year

Modest fiscal easing could help counter mounting external risks and slowing growth indicators.Euro area member states have all submitted their 2019 Draft Budgetary Plans (DBP) to the European Commission (EC) by now. These show that, collectively and based on EU Commission’s autumn forecasts, the euro area’s fiscal stance1 will turn supportive in 2019, although it varies significantly from one country to the next.Germany, Italy and the Netherlands are planning fiscal expansions, but Spain,...

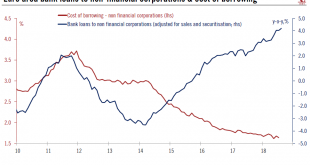

Read More »Credit Growth Remains Buoyant in the Euro Area

Financial conditions remain supportive and are not expected to tighten much in the coming months. Lending to non-financial corporations in the euro grew by an annual 4.2% in August, its fastest rate since April 2009. Forward-looking indicators suggest that euro area credit growth should remain strong over the coming months. Overall, domestic demand is likely to continue to be the main driver of growth in the euro area,...

Read More »Credit growth remains buoyant in the euro area

Financial conditions remain supportive and are not expected to tighten much in the coming months.Lending to non-financial corporations in the euro grew by an annual 4.2% in August, its fastest rate since April 2009. Forward-looking indicators suggest that euro area credit growth should remain strong over the coming months.Overall, domestic demand is likely to continue to be the main driver of growth in the euro area, helping to mitigate external weakness. Strong job growth combined with...

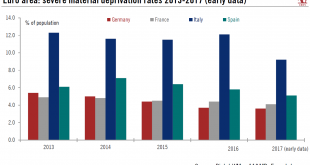

Read More »Italian material deprivation rates still the worst among large euro area economies

Latest poverty figures provide government with an argument for fiscal stumulus. Severe material deprivation rates gauge the proportion of people whose living conditions are severely affected by a lack of resources. According to Eurostat, “it represents the proportion of people living in households that cannot afford at least four of the following nine items: mortgage or rent payments, utility bills, hire purchase...

Read More »Italian material deprivation rates still the worst among large euro area economies

Latest poverty figures provide government with an argument for fiscal stumulus.Severe material deprivation rates gauge the proportion of people whose living conditions are severely affected by a lack of resources. According to Eurostat, “it represents the proportion of people living in households that cannot afford at least four of the following nine items: mortgage or rent payments, utility bills, hire purchase instalments or other loan payments; one week’s holiday away from home; a meal...

Read More »Revising our euro area 2018 GDP growth forecast down

The cut to our growth forecast reflects slippage in euro area data. According to Eurostat’s preliminary flash estimate, euro area real GDP expanded by 0.3% q-o-q in Q2 2018 (0.346% q-o-q unrounded, 1.4% q-o-q annualised, 2.1% y-o-y), below consensus expectations (0.4%). This was the weakest growth in two years and comes after a GDP growth of 0.4% q-o-q in Q1. The carryover effect for 2018 reached 1.7 %, meaning that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org