The ECB made no change in its forward guidance at its July meeting. Our baseline scenario remains unchanged.At its July meeting, the ECB made no change in its monetary policy statement, as we expected. Importantly, the bias for QE extension “in terms of size and/or duration” was kept in the statement. ECB president Mario Draghi mentioned that the Governing Council (GC) was unanimous in communicating no change to forward guidance.Draghi reiterated that a very substantial degree of accommodation is still needed for underlying inflation pressures to build up. During the Q&A session, he mentioned that the GC had not discussed an exit strategy. He also tried to reassure financial markets after his Sintra speech in June.Following today’s press conference, our baseline scenario remains

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: ECB monetary policy, euro area, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The ECB made no change in its forward guidance at its July meeting. Our baseline scenario remains unchanged.

At its July meeting, the ECB made no change in its monetary policy statement, as we expected. Importantly, the bias for QE extension “in terms of size and/or duration” was kept in the statement. ECB president Mario Draghi mentioned that the Governing Council (GC) was unanimous in communicating no change to forward guidance.

Draghi reiterated that a very substantial degree of accommodation is still needed for underlying inflation pressures to build up. During the Q&A session, he mentioned that the GC had not discussed an exit strategy. He also tried to reassure financial markets after his Sintra speech in June.

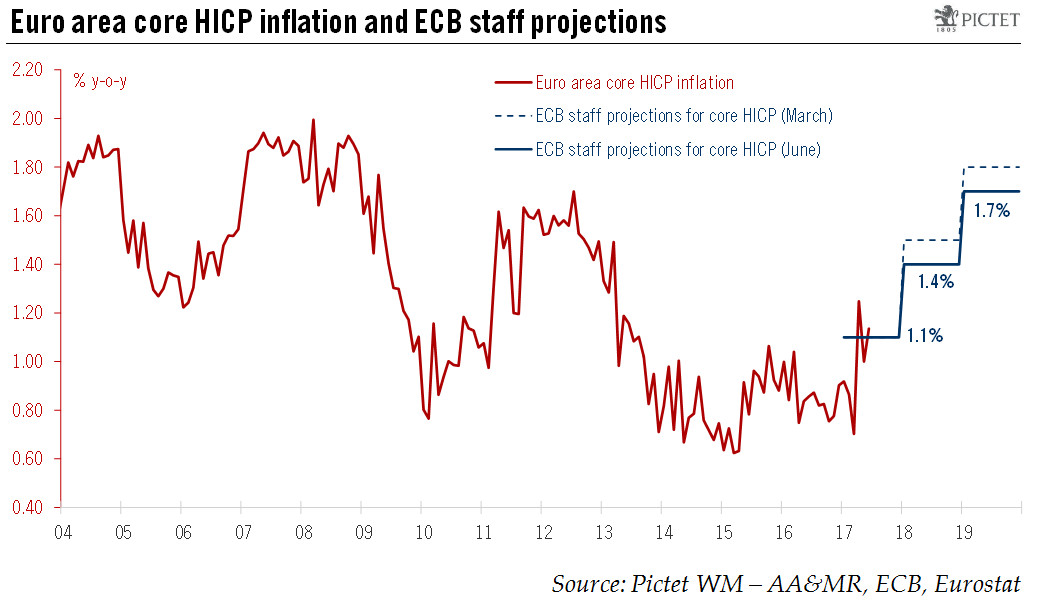

Following today’s press conference, our baseline scenario remains unchanged. We continue to expect a slow tapering of asset purchases starting in Q1 2018 and a one-off deposit rate hike in June 2018, but risks are tilted towards a delay. Specifically, we see a growing risk that a tapering announcement will be postponed to October, if not December, in order for the ECB to secure a more convincing rise in core inflation. In particular, our forecast suggest that euro area core harmonised index of consumer prices (HICP) inflation will start to rebound more significantly from September 2017, with the flash estimate published after the ECB’s 7 September meeting.