Rising core prices, along with wage growth, should help the ECB along the road to policy normalisation.Euro area cyclical inflation has been slowly rising over the past few months, from low levels. Several measures of underlying inflation have broken out of the tight range around which they have fluctuated for the past three years.The ECB’s ‘super core’ inflation rate rose to a three-year high of 1.04% in August, with other indicators showing a stronger upward momentum. Today’s...

Read More »Upward momentum in euro area inflation is building

A close look at recent data suggest that core inflation in the currency area is edging higher, supporting the ECB ‘s plans for policy normalisation.Euro area flash HICP inflation rose to 1.5% y-o-y in August from 1.3% in July, while core inflation remained stable at 1.2% year on year. In our opinion, modest upward price momentum has started to build over the past few months, with core inflation likely to edge slightly higher from here.Euro area core inflation has broken out of the tight...

Read More »Rebound in euro area core inflation

While core inflation was slightly stronger than expected in June, we believe it will rise only slowly for the rest of this year.Euro area ‘flash’ HICP inflation eased to 1.3% y-o-y in June (down from 1.4% in May) while core inflation increased to 1.1% (up from 0.9% in May). Both figures were slightly above consensus expectations, but our overall assessment is unchanged. The bottom line from the June inflation report is that the broad picture remains unchanged – we continue to expect euro...

Read More »Core inflation clouds ECB’s next move

Although flash inflation was down in May, we expect core prices to pick up gradually and the ECB to move very cautiously toward policy normalisation.Euro area ‘flash’ HICP inflation came in at 1.4% y-o-y in May (down from 1.9% in April) while core inflation eased to 0.94% (down from 1.2%), both slightly below consensus expectations, as energy-related base effects and Easter distortions faded. We forecast euro area inflation to remain relatively stable in the next few months before core...

Read More »PMI survey signals sustained euro area expansion in Q1

Although business surveys outpaced expectations and there are signs of rising price pressures, we continue to believe the ECB will not shift its monetary stance in the near term.The euro area composite flash PMI surged to 56.0 in February, the highest reading since April 2011. The main boost came from a surge in the services index due to strong data in Germany and France.The euro area average composite PMI is now consistent with a GDP growth rate of about 0.6% q-o-q in Q1, above our...

Read More »Inflation and the ECB (part 1): the four criteria

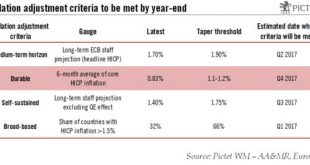

Euro area inflation was well above consensus in January. However, we believe that the ECB will look through this spike in (imported) inflation as underlying price pressures remain subdued.Although euro area headline inflation jumped to 1.8% in January, the closest it has been to ECB’s 2% target since Q1 2013, core inflation remained low at 0.9%. We continue to expect the ECB to wait until September before it announces a tapering of its asset purchases in 2018.A “sustained adjustment in...

Read More »Euro area core inflation lacks momentum

Macroview Headline inflation in the euro area doubled in September as the impact of weaker energy prices declined, but core inflation was stable. As expected, euro area flash HICP inflation rose to 0.4% year on year (y-o-y) in September, from 0.2% in August as the impact of weak energy prices continued to fade. But measures of core inflation were slightly weaker than expected, remaining stable at 0.8% y-o-y against expectations of a small rise.Weaker industrial goods inflation in particular...

Read More »Euro area inflation frustratingly slow to rise

Macroview Euro area inflation remains sluggish, holding out the prospect of further intervention by the ECB before year’s end. Euro area headline inflation remained broadly stable in August, at an annual rate of 0.2%, according to a flash estimate from Eurostat on August 31, while core inflation unexpectedly declined. Excluding energy, food, alcohol and tobacco, prices rose at an annual rate of 0.8% in August, according to the flash estimate, compared with 0.9% in July. The broader picture...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org