A close look at recent data suggest that core inflation in the currency area is edging higher, supporting the ECB ‘s plans for policy normalisation.Euro area flash HICP inflation rose to 1.5% y-o-y in August from 1.3% in July, while core inflation remained stable at 1.2% year on year. In our opinion, modest upward price momentum has started to build over the past few months, with core inflation likely to edge slightly higher from here.Euro area core inflation has broken out of the tight range of close to but below 1% in which it has fluctuated for the past three years. We forecast euro area core HICP inflation (excluding energy, food, alcohol and tobacco) to slowly edge higher, to around 1.3% by the turn of the year, and closer to 1.5% in 2018. We expect the upward trend to become

Topics:

Frederik Ducrozet considers the following as important: ECB exit strategy, ECB policy normnalisation, Euro area inflation, Euro dtrength, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

A close look at recent data suggest that core inflation in the currency area is edging higher, supporting the ECB ‘s plans for policy normalisation.

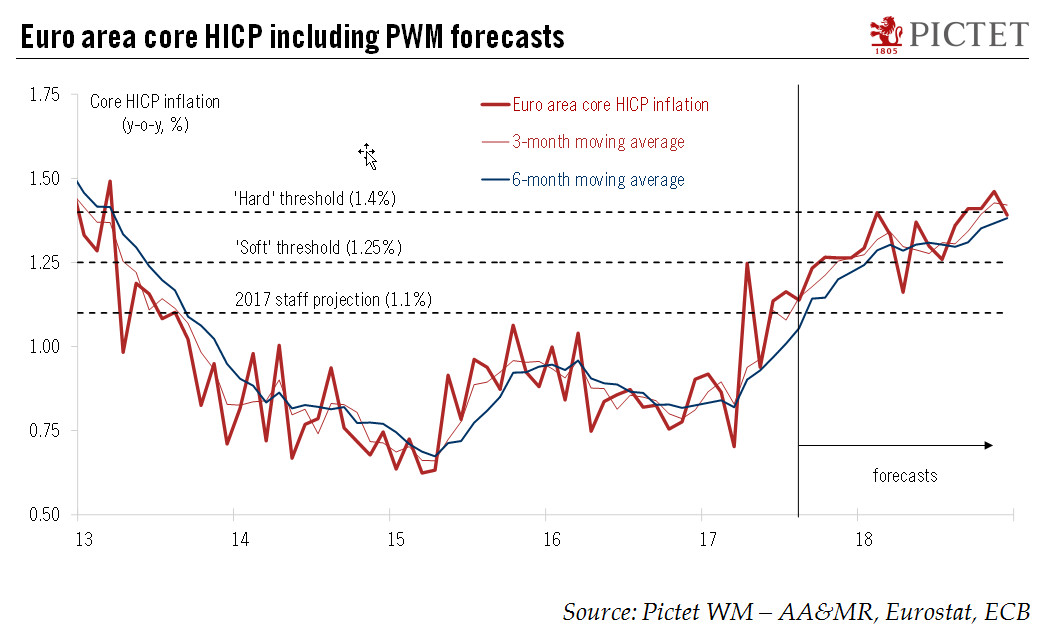

Euro area flash HICP inflation rose to 1.5% y-o-y in August from 1.3% in July, while core inflation remained stable at 1.2% year on year. In our opinion, modest upward price momentum has started to build over the past few months, with core inflation likely to edge slightly higher from here.

Euro area core inflation has broken out of the tight range of close to but below 1% in which it has fluctuated for the past three years. We forecast euro area core HICP inflation (excluding energy, food, alcohol and tobacco) to slowly edge higher, to around 1.3% by the turn of the year, and closer to 1.5% in 2018. We expect the upward trend to become increasingly visible after a period of volatile inflation figures that were due to a combination of one-off factors.

Although upside potential probably remains limited over the longer term, this mini regime shift to higher core inflation would likely be enough to broadly meet the European Central Bank’s (ECB) criteria for launching its strategy for policy normalisation.

Recent currency appreciation will weigh on core inflation dynamics, but currency pass-through is likely to be limited because of a number of offsetting factors. We expect the ECB to look through the macro effects of a stronger euro and prepare to exit from quantitative easing in 2018. A detailed announcement is likely to be made at the ECB’s 26 October policy meeting.