Macroview Headline inflation in the euro area doubled in September as the impact of weaker energy prices declined, but core inflation was stable. As expected, euro area flash HICP inflation rose to 0.4% year on year (y-o-y) in September, from 0.2% in August as the impact of weak energy prices continued to fade. But measures of core inflation were slightly weaker than expected, remaining stable at 0.8% y-o-y against expectations of a small rise.Weaker industrial goods inflation in particular is to blame for the lack of momentum in the broader core index. Services prices are picking up at a slightly faster pace but, overall, we expect core inflation to rise only slowly in the quarters ahead, to around 1.25% by end-2017. This alone provides the European Central Bank (ECB) with a strong argument to maintain a very accommodative monetary stance. We still forecast headline HICP inflation in the euro area to average 0.2% in 2016 and 1.3% in 2017. Risks to the medium-term outlook for price stability remain to the downside, in our view, forcing the ECB to err on the dovish side for now.While we expect the ECB to act in December, extending its quantitative easing (QE) scheme by at least six months and announcing technical changes to address the scarcity of government bonds it can buy as part of QE, we suspect that pressure will remain on the Governing Council to do more.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: euro area core inflation, euro area headline inflation, Euro area inflation, HICP inflation, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Headline inflation in the euro area doubled in September as the impact of weaker energy prices declined, but core inflation was stable.

As expected, euro area flash HICP inflation rose to 0.4% year on year (y-o-y) in September, from 0.2% in August as the impact of weak energy prices continued to fade. But measures of core inflation were slightly weaker than expected, remaining stable at 0.8% y-o-y against expectations of a small rise.

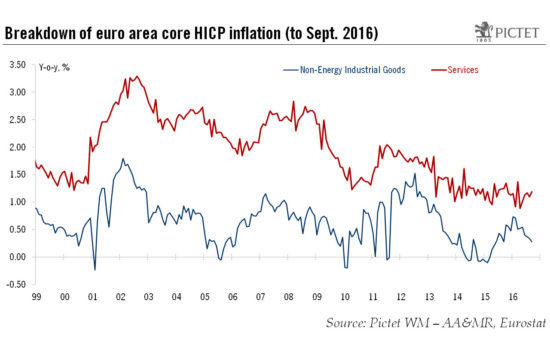

Weaker industrial goods inflation in particular is to blame for the lack of momentum in the broader core index. Services prices are picking up at a slightly faster pace but, overall, we expect core inflation to rise only slowly in the quarters ahead, to around 1.25% by end-2017. This alone provides the European Central Bank (ECB) with a strong argument to maintain a very accommodative monetary stance. We still forecast headline HICP inflation in the euro area to average 0.2% in 2016 and 1.3% in 2017. Risks to the medium-term outlook for price stability remain to the downside, in our view, forcing the ECB to err on the dovish side for now.

While we expect the ECB to act in December, extending its quantitative easing (QE) scheme by at least six months and announcing technical changes to address the scarcity of government bonds it can buy as part of QE, we suspect that pressure will remain on the Governing Council to do more. At the bank’s meeting next March, the ECB’s staff forecasts will be extended out to 2019, with the risk that these forecasts reveal the possibility that price stability is not met within a 2-3 year horizon.

All in all, a key concern for the ECB will be that underlying price pressures lack momentum, even though headline inflation still chimes with staff forecasts.