Macroview Euro area inflation remains sluggish, holding out the prospect of further intervention by the ECB before year’s end. Euro area headline inflation remained broadly stable in August, at an annual rate of 0.2%, according to a flash estimate from Eurostat on August 31, while core inflation unexpectedly declined. Excluding energy, food, alcohol and tobacco, prices rose at an annual rate of 0.8% in August, according to the flash estimate, compared with 0.9% in July. The broader picture remains one of relatively stable underlying inflation for the past 12 to 15 months at just below 1%.Today’s figures confirm the lack of upward momentum in underlying prices despite the European Central Bank’s (ECB) past efforts.Looking ahead, we forecast euro area inflation to rise at a frustratingly slow pace, averaging 0.2% in 2016 and 1.3% in 2017, in line with ECB June staff projections (which we expect to be left broadly unchanged at the central bank’s September policy meeting).The ECB will be concerned by the latest inflation figures, which remain a long way below its inflation target of below, but close to 2%. More monetary easing remains likely, but the timing of the next move(s) is debatable. On balance, we expect the ECB to extend asset purchases by six months at its 8 December meeting, when it may also signal changes in the parameters of its asset-purchase programme.

Topics:

Frederik Ducrozet considers the following as important: ECB monetary easing, Euro area inflation, Eurozone core inflation, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Euro area inflation remains sluggish, holding out the prospect of further intervention by the ECB before year’s end.

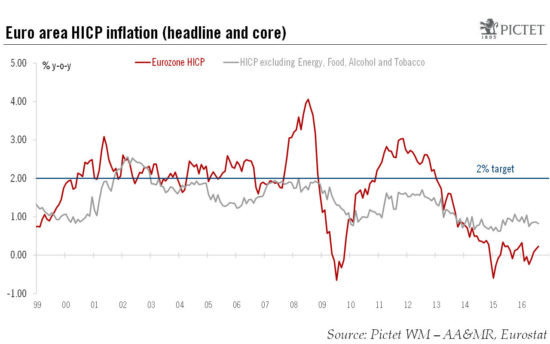

Euro area headline inflation remained broadly stable in August, at an annual rate of 0.2%, according to a flash estimate from Eurostat on August 31, while core inflation unexpectedly declined. Excluding energy, food, alcohol and tobacco, prices rose at an annual rate of 0.8% in August, according to the flash estimate, compared with 0.9% in July. The broader picture remains one of relatively stable underlying inflation for the past 12 to 15 months at just below 1%.Today’s figures confirm the lack of upward momentum in underlying prices despite the European Central Bank’s (ECB) past efforts.

Looking ahead, we forecast euro area inflation to rise at a frustratingly slow pace, averaging 0.2% in 2016 and 1.3% in 2017, in line with ECB June staff projections (which we expect to be left broadly unchanged at the central bank’s September policy meeting).

The ECB will be concerned by the latest inflation figures, which remain a long way below its inflation target of below, but close to 2%. More monetary easing remains likely, but the timing of the next move(s) is debatable. On balance, we expect the ECB to extend asset purchases by six months at its 8 December meeting, when it may also signal changes in the parameters of its asset-purchase programme.