We continue to think that the US economy is in better shape than most appreciate, and that underpins our strong dollar call Tensions are likely to remain high after reports emerged last week that the US will look into limiting capital flows into China US September jobs data Friday will be the data highlight of the week; there is a heavy slate of Fed speakers this week UK, eurozone, and Japan are expected to report weak data this week RBA meets Tuesday and is expected...

Read More »EM Preview for the Week Ahead

We think the Fed has signaled that the bar to another cut is high. Unless the US data weakens considerably, we see rates on hold for now and this means the liquidity story for EM has worsened. Elsewhere, US-China trade talks appear to be going nowhere. With no end in sight to the trade war, we remain negative on EM. Korea reports trade data for the first 20 days of September Monday. Between the US-China trade war and Korea-Japan tensions over exports of strategic...

Read More »Some Thoughts on the Fed and Oil Shocks

Oil prices have spiked after the weekend attack on Saudi oil facilities. Will it impact the Fed tomorrow? No. We compare the current (but still unfolding) situation to past oil shocks from the 1970s and discuss the policy responses taken. RECENT DEVELOPMENTS The weekend bombing of Saudi oil facilities continues to reverberate. The drone strike removed about 5% of global supplies from the market, leading Brent oil to spike to $72 per barrel Monday before falling...

Read More »Turkey Monetary Policy Planting Seeds of Future Crisis

Turkey central bank meets September 12 and is expected to cut rates 275 bp. With Erdogan talking about single digit rates and inflation, it’s clear that rates are headed significantly lower. At some point soon, we think the risk/reward for investing in Turkey will send investors fleeing for the exits.POLITICAL OUTLOOK President Erdogan sacked central bank Governor Murat Cetinkaya on July 6, ostensibly for not cutting rates quickly enough. In early August, several...

Read More »EM Preview for the Week Ahead

Despite some positive developments last week, we think the three key issues for risk assets have not been resolved yet. Hong Kong protests continue, while reports suggest the US and China remain far apart. Even Brexit has likely been given only a three month reprieve. We remain negative on EM until these key issues have been ultimately resolved. China reports August money and loan data this week but no data has been set. With the recently announced cuts in...

Read More »Latest Thoughts on the US Economic Outlook

The US economy is starting to show cracks from the ongoing trade war. While we do not want to make too much from one data point, we acknowledge that headwinds are building whilst US recession risks are rising. RECENT DEVELOPMENTS US ISM manufacturing PMI fell to 49.1 vs. 51.3 expected. This is the first sub-50 reading since August 2016 and the lowest since January 2016. The employment component fell to 47.4 from 51.7 in July, while new orders fell to 47.2 from 50.8...

Read More »Drivers for the Week Ahead

We remain dollar bulls; this is an important data week for the US Final August eurozone manufacturing PMIs will be reported Monday; UK reports August PMIs this week RBA meets Tuesday and is expected to keep rates steady at 1.0%; BOC meets Wednesday and is expected to keep rates steady at 1.75% Swedish Riksbank meets Thursday and is expected to keep rates steady at -0.25%; in EM, the central banks of Chile and Russia meet Market sentiment rallied last week on a lot of...

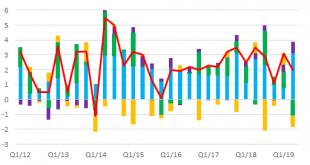

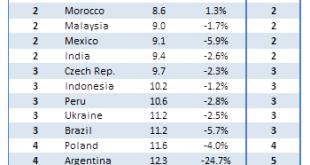

Read More »Emerging Markets: FX Model for Q3 2019

The broad-based dollar rally remains intact despite the market’s overly dovish take on the Fed We still believe markets are vastly overestimating the Fed’s capacity to ease in 2019 and 2020 What’s clear is that the liquidity story is not enough to sustain EM MSCI EM FX is on track to test the September 2018 low near 1575 and then the April 2017 low near 1568 Our 1-rated (strongest fundamentals) grouping for Q3 2019 consists of TWD, PHP, CNY, THB, and KRW Our...

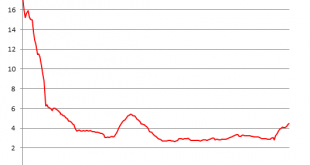

Read More »Why 2011

The eurodollar era saw not one but two credit bubbles. The first has been studied to death, though almost always getting it wrong. The Great Financial Crisis has been laid at the doorstep of subprime, a bunch of greedy Wall Street bankers insufficiently regulated to have not known any better. That was just a symptom of the first. The housing bubble itself was more than housing. What was going on in the shadows wasn’t...

Read More »Living In The Present

The secret of health for both mind and body is not to mourn for the past, nor to worry about the future, but to live in the present moment wisely and earnestly. Buddha Review It’s that time of year again, time to cast the runes, consult the iChing, shake the Magic Eight Ball and read the tea leaves. What will happen in 2019? Will it be as bad as 2018 when positive returns were hard to come by, as rare as affordable...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org