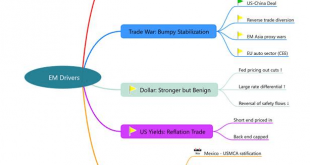

With year-end upon us, we review some of the key risks to EM assets and how we think they progress from here. In short, the two most significant downside risks would be a decisive improvement in Elizabeth Warren’s polling figures and an upset in the US-China trade negotiations. We expect a stronger dollar and higher yields in the near-term but with the upside for both capped, leaving us with a modestly favourable risk-taking environment. In terms of risk...

Read More »EM Preview for the Week Ahead

EM was mostly lower last week, as doubts crept in about the recent trade optimism. Some events also served as reminders of idiosyncratic EM risk that can’t be overlooked, such as downgrade risks (South Africa), failed oil auctions (Brazil), and violent protests (CLP). EM may remain on its back foot until we get further clarity on the US-China talks, but we remain confident in our call that a deal will be struck soon that lower existing tariffs. AMERICAS Mexico...

Read More »EM Preview for the Week Ahead

EM should continue to benefit from the generalized improvement in the global backdrop. Trade tensions have eased whilst the risks of a hard Brexit have fallen, at least for now. Yet recent developments in some major EM countries underscores how important it is for investors to differentiate between the strong credits and the weak ones. For instance, South Africa, Hong Kong, Argentina, and Chile all come with idiosyncratic risks. AMERICAS Chile reports September GDP...

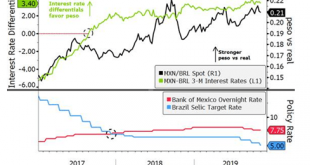

Read More »Mexico vs. Brazil Near-Term Outlook

Both Brazil and Mexico are in a good position to benefit from the current improvement in market sentiment. However, when comparing the factors driving the currencies of both countries, we think there are relatively more near-term positives for the Mexican peso than for the Brazilian real. These include: (1) the peso will maintain its carry advantage for some time; (2) hedging-related flows should be mixed for the real, but could net as a drag; (3) Mexico’s near-term...

Read More »EM Preview for the Week Ahead

EM has been on a good run but this week will be a big test. Brexit uncertainty may finally end. Or it may not. A delay would be positive for EM, whilst a potential hard Brexit would be negative. The Fed meets Wednesday and key US data will be reported during the week, culminating with the jobs report Friday. The dollar has been on its back foot as September data have come in weaker than expected, so any sort of positive data surprises this week could add to the...

Read More »A New Stage of the US-China Conflict

The US-China diplomatic relationship may be entering a new stage. The balance of power between the key players – Trump, China, the US Congress, and the Democrats – is changing and their roles are being reshuffled. This might be enough to break the endless cycle of agreements and re-escalations. In short, we think both Trump and Chinese officials have a greater incentive to reach a deal (or at least not to escalate) this time around. Meanwhile, the rising antagonist...

Read More »EM Preview for the Week Ahead

We are beginning to become more constructive on EM. The main trigger for some optimism is the shifting US-China dynamic. In our view, the partial trade deal reveals weakness on the part of the US. Reports suggest China will begin pushing for all existing tariffs to be dropped as part of Phase 2, which would be very positive for EM. That is still likely months away but this shifting dynamic bears watching. We will be putting out a longer MarketView piece on this topic...

Read More »EM Preview for the Week Ahead

EM benefited greatly from the improvement in US-China trade relations and quite possibly Brexit. The dollar is likely to remain under some pressure near-term as a result. Yet we must caution investors against getting too optimistic. The details of the partial trade deal still need to be worked out, while existing tariffs will still remain in place if the deal is signed next month as most expect. Brexit negotiations have accelerated but we note that any deal must...

Read More »Drivers for the Week Ahead

The dollar rally has been derailed by weak US data and rising recession fears The September jobs data was not a game-changer and so we are left waiting for more clues Believe it or not, the US economy remains solid; however, the US repo market has not fully normalized yet The Chinese trade delegation arrives in Washington Thursday for two days of trade talks Brexit optimism has worn off; there are several key EM events . The dollar rally has been derailed by weak US...

Read More »Musings on the Repo Market, Fed Policy, and the US Economy

The US repo market appears to finally be normalizing. The low pace of normalization is concerning and so a more permanent solution may be needed to head off similar problems at year-end. We do not think this issue has any implications for the economic outlook, which we continue to view as solid. RECENT DEVELOPMENTS The repo market provides an efficient, reliable, and predictable channel to raise short-term funding. It is but one part of a larger short-term funding...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org