Summary PBOC fixed USD/CNY at the highest level since December 14. Bank Indonesia delivered a larger than expected 50 bp to 5.25%. Bulgarian Prime Minister Boyko Borissov survived a second no-confidence vote this year. Turkish President Recep Tayyip Erdogan was re-elected but with sweeping new powers. Saudi Arabia, Kuwait, and UAE are reportedly in talks to help stabilize Bahrain. The South African Reserve Bank...

Read More »Emerging Markets: Preview of the Week Ahead

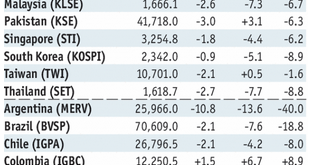

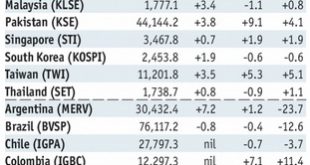

Stock Markets EM FX ended Friday mixed, and capped off a mixed week overall as the dollar’s broad-based rally was sidetracked. EM may start the week on an upbeat after PBOC cut reserve requirements over the weekend. Best EM performers last week were ARS, MXN, and TRY while the worst were THB, IDR, and BRL. Stock Markets Emerging Markets, June 20 - Click to enlarge Indonesia Indonesia reports May trade Monday....

Read More »Emerging Markets: What Changed

Summary Nor Shamsiah Mohd Yunus was named the new Governor of Malaysia’s central bank. Moody’s cut the outlook on Pakistan’s B3 rating to negative from stable. National Bank of Hungary tiled more hawkish. Israeli Prime Minister Benjamin Netanyahu’s wife was charged with misusing public funds. MSCI added Saudi Arabia and Argentina to its Emerging Markets index Brazil’s government its split on the inflation target for...

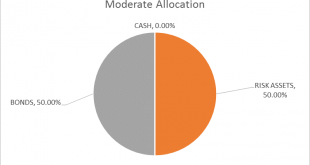

Read More »Global Asset Allocation Update

The risk budget is unchanged this month. For the moderate risk investor the allocation to bonds and risk assets is evenly split. There are changes this month within the asset classes. How far are we from the end of this cycle? When will the next recession arrive and more importantly when will stocks and other markets start to anticipate a slowdown? These are critical questions for investors and ones that can’t be...

Read More »Emerging Markets: Week Ahead Preview

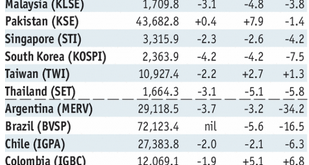

Stock Markets EM FX was mixed on Friday but capped off a largely losing week. MYR, CLP, and CNY were the best performers over the last week, while ARS, TRY, and ZAR were the worst. We expect EM FX to continue weakening, but note that with very few fundamental drivers this week, we may see some consolidation near-term. Stock Markets Emerging Markets, June 13 - Click to enlarge Singapore Singapore reports May...

Read More »Emerging Markets: What Changed

Summary US-China trade tensions are rising. Pakistan devalued the rupee for a third time since December. Bulgaria will seek to join the eurozone banking union and ERM-2 simultaneously. The National Bank of Hungary appears to have tilted more hawkish. Newly elected Egyptian President El-Sisi shuffled his cabinet. Argentina has a new central bank chief after Federico Sturzenegger resigned. Chile central bank signaled...

Read More »A Slight Hint Of A 2011 Feel

Whenever a big bank is rumored to be in unexpected merger talks, that’s always a good sign, right? The name Deutsche Bank keeps popping up as it has for several years now, this is merely representative of what’s wrong inside of a global system that can’t ever get fixed. In this one case, we have a couple of perpetuated conventional myths colliding into what is still potentially grave misfortune. As noted last time, I...

Read More »Emerging Markets: Preview of the Week Ahead

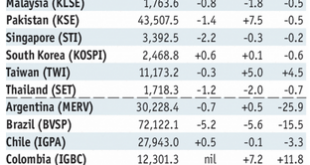

Stock Markets EM FX ended Friday on a mixed note, capping off a roller coaster week for some of the more vulnerable currencies. We expect continued efforts by EM policymakers to inject some stability into the markets. However, we believe the underlying dollar rally remains intact. Central bank meetings in the US, eurozone, and Japan this week are likely to drive home that point. Stock Markets Emerging Markets, June 6...

Read More »Emerging Markets: What Changed

Summary The Reserve Bank of India hiked rates for the first time since 2014. Malaysia’s central bank governor resigned. Czech central bank tilted more hawkish. Russia central bank tilted more dovish. Argentina got a $50 bln standby program from the IMF. Brazil central bank signaled more aggressive FX intervention ahead. Mexico trade tensions with US are rising. Peru has a new Finance Minister. Stock Markets In the EM...

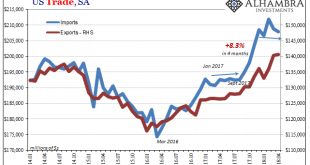

Read More »US Trade Settles Down Again

US trade is further leveling off after several months of artificial intrusions. On the import side, in particular, first was a very large and obvious boost following last year’s big hurricanes along the Gulf Coast. Starting in September 2017, for four months the value of imported goods jumped by an enormous 8.3% (revised, seasonally-adjusted). Most of the bump related to consumer and capital goods. Since December,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org