The US economy is starting to show cracks from the ongoing trade war. While we do not want to make too much from one data point, we acknowledge that headwinds are building whilst US recession risks are rising. RECENT DEVELOPMENTS US ISM manufacturing PMI fell to 49.1 vs. 51.3 expected. This is the first sub-50 reading since August 2016 and the lowest since January 2016. The employment component fell to 47.4 from 51.7 in July, while new orders fell to 47.2 from 50.8 in July. The only spin we can put on this PMI reading is that manufacturing makes up only 12% of the total US economy. But make no mistake, this is a bad sign. ISM non-manufacturing PMI will be reported Thursday and is expected at 54.0 vs. 53.7 in July. The next round of US tariffs on Chinese goods

Topics:

Win Thin considers the following as important: 5.) The United States, 5) Global Macro, Articles, developed markets, emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The US economy is starting to show cracks from the ongoing trade war. While we do not want to make too much from one data point, we acknowledge that headwinds are building whilst US recession risks are rising.

RECENT DEVELOPMENTSUS ISM manufacturing PMI fell to 49.1 vs. 51.3 expected. This is the first sub-50 reading since August 2016 and the lowest since January 2016. The employment component fell to 47.4 from 51.7 in July, while new orders fell to 47.2 from 50.8 in July. The only spin we can put on this PMI reading is that manufacturing makes up only 12% of the total US economy. But make no mistake, this is a bad sign. ISM non-manufacturing PMI will be reported Thursday and is expected at 54.0 vs. 53.7 in July. The next round of US tariffs on Chinese goods went into effect this past weekend. While markets are happy that things haven’t gotten worse, these and the already existing tariffs will be a headwind for the US economy. The next round goes into effect December 15, and both rounds focus more on consumer goods. As such, the average consumer will feel the pinch more than the previous tariff rounds. Despite claims from President Trump that talks with China are going well, we think they are anything but. President Xi reportedly urged his party to prepare for a long-term struggle. The more we see official China comments, the less confident we are of a trade deal anytime soon. We think Trump underscored his complete unreliability as a negotiating partner with his claims that China contacted him to restart talks. No China official would confirm the calls and we are left with no date set for September talks. The Fed releases its Beige Book report this Wednesday for the upcoming September 18 FOMC meeting. We suspect the report will highlight the softening manufacturing outlook in many parts of the country. On the bright side, manufacturing jobs have been rising this year and are up a total of 157k over the twelve months through July. After a quiet August, the Fed speaking schedule picks up again temporarily. Rosengren speaks today. Wednesday has Williams, Bowman, Bullard, Kashkari, and Evans all speaking. Powell wraps up the week by speaking in Zurich Friday. With the media blackout ahead of the FOMC meeting going into effect next week, these speaking engagements will be very important, particularly Powell on Friday. |

|

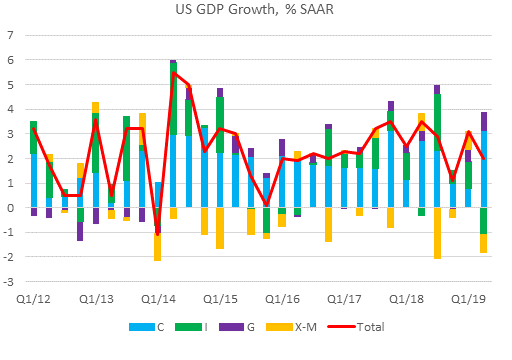

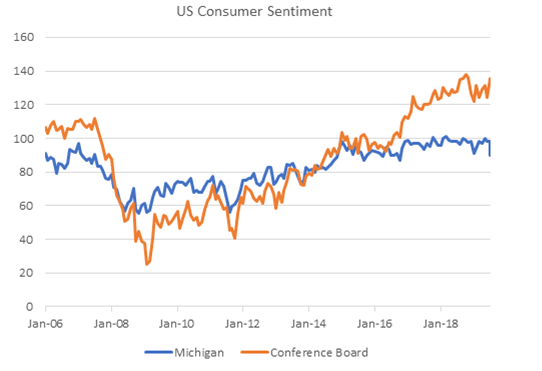

A BRIEF ECONOMICS LESSONEconomics 101 teaches us that there are four major components of GDP: consumption, investment, government spending, and net exports. Let’s look at each component and how it has been doing lately. Personal Consumption Expenditures (C): This makes up about 70% of total US GDP. In Q2, consumption grew 4.7% SAAR and was the strongest rate since Q4 2014. Consumption contributed 3.1 percentage points towards total GDP growth of 2.0%. The labor market remains robust and this is helping boost consumption. Ominously, consumer sentiment has worsened recently. The University of Michigan’s measure fell sharply to 89.8 in August from 98.4 in July, the lowest since October 2016. Both expectations and current situation deteriorated. The Conference Board’s measure has held up better, but it bears watching. Mortgage refinancing has jumped sharply, suggesting homeowners will have a little more money for discretionary spending. |

US GDP, Q1 2012 - 2019(see more posts on U.S. Gross Domestic Product, ) |

| Private Domestic Investment (I): This makes up about 18% of total US GDP. In Q2, investment contracted -6.1% SAAR and was the weakest rate since Q1 2011. Investment subtracted -1.1 percentage points from total GDP growth of 2.0%. This can be broken down further, with inventories subtracting -0.9 percentage points and both residential and non-residential investment subtracting -0.1 each.

We do not think it is the cost of capital that is holding back investment. Rather, we think it is the uncertainty emanating from the US-China trade war that is preventing firms from investing. Until the trade war with China ends, we believe investment will continue to be a drag on US growth regardless of what the Fed does. Government Consumption Expenditures (G): This makes up about 17% of total US GDP. In Q2, government consumption grew 4.5% SAAR and was the strongest rate since Q2 2009. Government consumption contributed 0.8 percentage points towards total GDP growth of 2.0%. |

US Consumer Sentiment, January 2006 - 2019(see more posts on U.S. Consumer Confidence, ) |

Given the huge budget deficits that are already baked in the cake, we think it will be nearly impossible for G to add more upside to growth going forward.

Net exports (X-M): This makes up about -5% of total US GDP, with gross exports accounting for 13% of GDP and gross imports for -18%. In Q2, net exports subtracted -0.7 percentage points from total GDP growth of 2.0.

Global trade volume has dropped significantly over the past year, and the US is clearly feeling the impact. Until the trade war with China ends, we believe net exports will continue to be a drag on US growth. We do not think the strong dollar is a major driver here. Rather, the trade war and slowing global growth are the likely bigger culprits.

Bottom line: C and G are strong, I and (X-M) are not. Consumption is most at risk given this latest round of tariffs and so the retail sales data going forward will be closely watched. Even if the Fed cuts rates another 25-50 bp this month, we do not think it would spur investment. Rather, most economic risks can be traced back to the US-China trade war and the bad news is that no end is in sight right now.

ECONOMIC OUTLOOK

Up until today, the US was one of the few countries anywhere to have a manufacturing PMI reading above 50. Eurozone rose half a point to 47.0 in August, while UK fell to 47.4 and Japan fell to 49.3. Official China PMI fell to 49.5 while Caixin reading rose to 50.4. Virtually all emerging Asia is sub-50, with India and Thailand the major exceptions. Clearly, the US-China trade war is having a negative impact on global manufacturing.

Our broad macro calls will be tested over the next two weeks with another big data dump for the US. Looking ahead, we get auto sales tomorrow (16.8 mln expected), jobs data this Friday (160k expected), PPI on September 11, CPI on September 12 (2.3% y/y core expected), and retail sales September 13 (0.3% m/m expected).

We don’t want to make too much of one data point or even one month of data, but it’s clear that the US is getting dragged down by the trade war. Of the upcoming data, we believe retail sales will be the most important. The firm labor market has helped sustain consumption this year. If US firms try to pass on the higher tariff costs on to consumers, then retail sales are likely to suffer, as will growth.

We believe the Chicago Fed National Activity Index remains the single best indicator to gauge US recession risks. The 3-month average was -0.14 in July, the best since January and still well above the recessionary threshold of -0.7. The August reading will be reported September 23. Note that a value of zero shows an economy growing at trend. Positive values represent above trend growth, while negative values represent below trend growth.

The US economy remains in solid shape, at least for now. The Atlanta Fed’s GDPNow model is tracking 1.7% SAAR growth in Q3, down from 2.0% previously. This is just below trend (~2%) as well as the revised 2.0% SAAR in Q2. Elsewhere, the NY Fed’s Nowcast model is tracking 1.8% SAAR growth in Q3, steady from the previous week.

The 3-month to 10-year curve has continued to invert and is at a cycle high -49 bp today, signaling even greater recession risk. Using the shape of the US yield curve, the New York Fed calculates the probability of a US recession 12 months ahead. This fell to 31.5% in July from the cycle high of 33% in June. We expect this to rise above 35% in August. If the current inversion remains intact, then we expect the odds to move near 40% in September.

INVESTMENT OUTLOOK

We remain dollar bulls but just like the Fed, we are struggling with the potential economic impact of the trade war. Powell admitted last week that the Fed is still trying to figure out how to react to global trade tensions. Markets clearly believe the Fed will bail Trump out again. We are not so sure, but we will know more September 18. WIRP suggests 100% odds of a cut then, with 24% odds of a 50 bp move.

Until we get confirmation that the US is facing imminent recession risk, we are sticking with our broad macro calls. These include a stronger dollar, higher equities, and a bearish steepening of bond yields. These calls were coming to fruition last month, but the renewed tariff threats led to a huge reset across all markets. Our calls hinge critically on our view that the trade war will not trigger a US recession this year. These calls will be tested time and again and we expect heightened volatility across all markets to continue in the coming months.

The dollar continues its climb, with DXY trading at a new high for this move near 99.37 before the ISM PMI data. Weak US data will make it a tougher slog for the dollar. However, we stress that as uncertain as the US outlook is, things elsewhere look even worse. Taking that into consideration, we believe DXY is still on track to test the May 2017 high near 99.888. Looking further out, the April 2017 high near 101.34 is the next major chart point.

The data remain key. If the outlook changes and the economy slows significantly or goes into recession, then the Fed will have no choice but to adjust its expected rate path significantly lower and we would have to revisit our bullish dollar call. For now, we think the rates markets are getting too negative once again.

EM will likely remain under severe pressure. The renewed trade tensions and broad-based risk off sentiment have conspired to crush EM FX and equities. These drivers are carrying over into this month and so we remain bearish on EM. MSCI EM recently made a new low for this move near 957 and is on track to test the January low near 945.50 and then the October low near 930. Likewise, MSCI EM FX just made a new low for this move today near 1587 and is on track to test the September low near 1575.

Tags: Articles,developed markets,Emerging Markets,Featured,newsletter