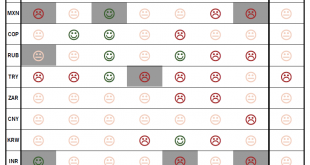

The environment will remain challenging for EM currencies next year. Despite a dovish shift by the Fed and the temporary truce in the US-Chinese trade dispute, the global environment remains challenging for emerging market (EM) currencies. In fact, our latest EM FX scorecard, which ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks, is still unable to identify a single...

Read More »Emerging market currencies: idiosyncratic risks strike back

The environment will remain challenging for EM currencies next year.Despite a dovish shift by the Fed and the temporary truce in the US-Chinese trade dispute, the global environment remains challenging for emerging market (EM) currencies. In fact, our latestEM FX scorecard, which ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks, is still unable to identify a single attractive EM currency among the 10 it monitors on a 12-month horizon.Being...

Read More »House View, December 2018

Pictet Wealth Management’s latest positioning across asset classes and investment themes. Asset Allocation We remain neutral on global equities overall, seeing relatively limited potential for developed market stocks in particular as earnings growth declines. We favour companies with pricing power as well as measurable growth drivers and low leverage. We have moved from underweight to neutral in US Treasuries, as the...

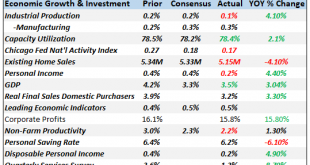

Read More »Monthly Macro Monitor – November 2018

Is the Fed’s monetary tightening about over? Maybe, maybe not but there does seem to be some disagreement between Jerome Powell and his Vice Chair, Richard Clarida. Powell said just a little over a month ago that the Fed Funds rate was still “a long way from neutral” and that the Fed may ultimately need to go past neutral. Clarida last week said the FF rate was close to neutral and that future hikes should be “data...

Read More »Cool Video: Bloomberg Clip from Discussion on Emerging Markets

Bloomberg Clip from Discussion on Emerging Markets In my first television appearance since joining Bannockburn Global Forex, I joined Tom Keene and Francine Lacqua on the Bloomberg set. In this nearly 2.5 min clip, we talk about the Indonesia rupiah and the dollar’s move above the IDR15000 level for the first time since the 1997-1998 Asian financial crisis. I suggest there are several factors weighing on many emerging...

Read More »Emerging Markets: Preview of the Week Ahead

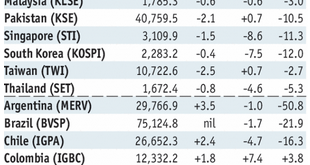

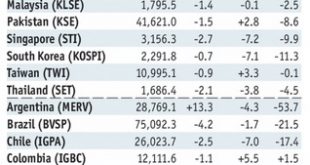

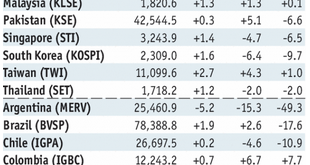

Stock Markets EM FX ended mixed in Friday, capping off an up and down week. RUB and TRY initially firmed on their respective rate hikes but gave back some of those gains heading into the weekend. Trade tensions are likely to remain high, as press reports suggest President Trump is pushing ahead with tariffs on $200 bln of Chinese imports even as high-level talks are planned. With US rates pushing higher, we think the...

Read More »Emerging Markets: What has Changed

Summary Philippine central bank signaled another big hike. Poland central bank appears to be moving its forward guidance out further. Russia officials are sending confusing signals regarding monetary policy. Russia officials stand ready to support the ruble debt market if new US sanctions negatively impact it. South Africa’s African National Congress pledged to undertake land reform responsibly. Moody’s cut its 2018...

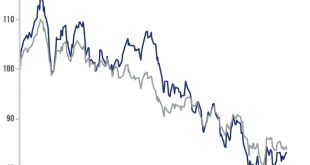

Read More »Cool Video: Emerging Markets Continue to Sell-Off

- Click to enlarge I had the privilege of being on the Bloomberg set with Tom Keene and Francine Lacqua earlier today. Lakshman Achuthan, co-founder of ECRI also joined us for the discussion. This 6.5 min video clip captures the essence of the discussion. The US dollar was rallying against all the major and most EM currencies. The second consecutive quarterly economic contraction in South Africa pushed the rand...

Read More »Emerging Market Week Ahead Preview

Stock Markets EM FX ended last week on a firm note, but weakness resumed Monday. Higher than expected Turkish inflation hurt the lira, which in turn dragged down BRL, ARS, ZAR, and RUB. We expect EM to remain under pressure this week when the US returns from holiday Tuesday. Stock Markets Emerging Markets, August 29 - Click to enlarge Korea Korea reports August CPI Tuesday, which is expected to rise 1.4% y/y...

Read More »Emerging Markets: What Changed

Summary China stepped up efforts to attract more foreign inflows to the onshore bond market. Russia has softened its unpopular pension reform proposal. The African National Congress withdrew an existing land expropriation bill. Moody’s downgraded twenty Turkish financial institutions. Turkey central bank Deputy Governor Erkan Kilimci has reportedly resigned. Moody’s moved the outlook on Egypt’s B3 rating from stable to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org