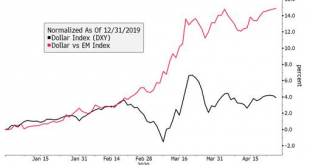

Dollar softness this week will take some pressure off of the foreign currencies but it’s too early to sound the all clear. This piece focuses on how central banks around the world may be intervening to influence their currencies. Most of the world, particularly EM, is grappling with supporting weak currencies but a select few are dealing with stronger currencies. This is a very opaque process and so we are simply making our best guesses. As April reserves data...

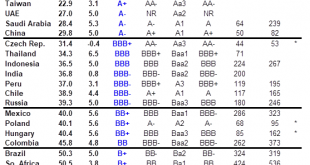

Read More »EM Sovereign Rating Model For Q2 2020

The major ratings agencies are punishing Emerging Markets (EM) credits much more than their DM counterparts. Our own sovereign ratings model suggests that there is still more pain to come. We have produced this interim ratings model to assist investors in assessing relative sovereign risk across the major EMs. While the situation is still fluid with regards to the ultimate coronavirus impact on the global economy as well as the policy responses, we thought it...

Read More »EM Preview for the Week Ahead

EM may get a little support from a potential OPEC+ deal to limit oil. Even if a deal is struck, the impact is likely to be fleeting as the global growth outlook remains terrible. We remain negative on EM for the time being. AMERICAS Mexico reports March CPI Tuesday, which is expected to rise 3.37% y/y vs. 3.70% in February. If so, inflation would move further towards the 3% target. February IP will be reported Wednesday, which is expected to contract -1.2% y/y...

Read More »EM Preview for the Week Ahead

Market sentiment is likely to open this week on an upswing after the Fed’s emergency rate cut and expanded QE were announced Sunday afternoon local time. Yet as we have seen time and again this past couple of weeks, added stimulus has had little lasting impact on markets as the virus numbers continue to worsen. Europe is now reporting more daily cases than China did at its peak. We remain negative on EM until the global growth outlook becomes clearer. AMERICAS...

Read More »Seven Big-Picture Considerations for Covid-19

Below is a non-exhaustive list of medium- and long-term implications from the Covid-19. We discuss the yuan, China’s competitiveness, its position in the global production chains, the impact on the Phase One trade deal, and rising financial stability risks. Globally, the virus will bring about a new wave of fiscal spending and revive the discussions about the limits of monetary policy. Lastly, we are concerned that the virus may provide further momentum for the...

Read More »EM Preview for the Week Ahead

The still-growing impact of the coronavirus should keep EM and risk sentiment under pressure this week. The weekend G20 meeting in Saudi Arabia acknowledged the risks to the global economy and said participants agreed on a “menu of policy options.” However, the G20 offered little specific in terms of a coordinated policy response. AMERICAS Mexico reports mid-February CPI Monday, which is expected to rise 3.56% y/y vs. 3.18% in mid-January. If so, inflation would...

Read More »EM Preview for the Week Ahead

EM remains vulnerable to deteriorating risk sentiment as the coronavirus spreads. China announced a series of measures over the weekend to help support its financial markets, but this may not be enough to turn sentiment around yet. China markets reopen Monday after the extended Lunar New Year holiday and it won’t be pretty. AMERICAS Brazil reports January trade Monday. December IP will be reported Tuesday, which is expected to fall -0.8% y/y vs. -1.7% in...

Read More »EM Preview for the Week Ahead

The spread of the coronavirus continues and is likely to weigh on risk assets and EM. Most markets in Emerging Asia are closed for all or part of this week due to the Lunar New Year holiday. China has extended the holiday until February 2 as it struggles to contain the virus. The Asian region is just starting to recover from the global trade tensions, and now it must cope with what is likely to be a sharp drop-off in tourism. Policymakers in the region may have...

Read More »EM Preview for the Week Ahead

Market sentiment on EM remains positive after the Phase One trade deal was signed. Data out of China is also supportive for EM. Key forward-looking data this week are Taiwan export orders and Korea trade data for the first 20 days of January. The global liquidity story also remains beneficial for risk, with the ECB, Norges Bank, BOC, and BOJ all set to maintain steady rates this week. AMERICAS Mexico reports mid-January CPI Thursday, which is expected to rise 3.16%...

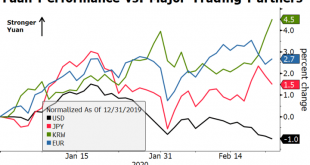

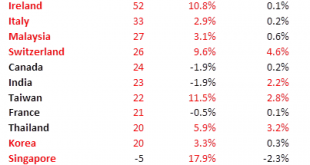

Read More »Some Thoughts on the Latest Treasury FX Report

The US Treasury’s latest “Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States” report no longer considers China a currency manipulator. The underlying message is that the Trump administration will continue to use an ad hoc “carrot and stick” approach to improve US access to the domestic markets of its major trading partners. This suggests there will still be many minor trade skirmishes this year. RECENT DEVELOPMENTS The latest...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org