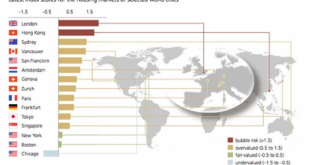

Two years ago, when UBS looked at the world’s most expensive housing markets, it found that London and Hong Kong were the only two areas exposed to bubble risk. UBS Global Real Estate Bubble Index - Click to enlarge What a difference just a couple of years makes, because in the latest report by UBS wealth Management, which compiles the bank’s Global Real Estate Bubble Index, it found that eight of the world’s...

Read More »It Was Collateral, Not That We Needed Any More Proof

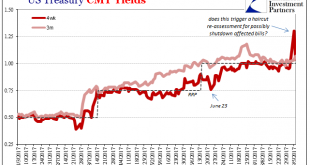

Eleven days ago, we asked a question about Treasury bills and haircuts. Specifically, we wanted to know if the spike in the 4-week bill’s equivalent yield was enough to trigger haircut adjustments, and therefore disrupt the collateral chain downstream. US Treasury, Jan - Sep 2017(see more posts on U.S. Treasuries, ) - Click to enlarge Within two days of that move in bills, the GC market for UST 10s had gone...

Read More »The Real Estate View For A Second Lost Decade

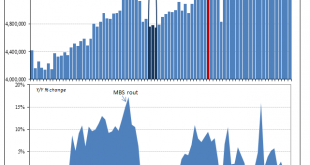

The National Association of Realtor (NAR) reports today that sales of existing homes in the US were down 1.7% in August 2017 from July. At a seasonally-adjusted annual rate of 5.35 million, that’s the lowest pace for resales since July 2016. It is yet another data point reflecting the almost certain end of “reflation” in the economic sense. US Existing Home Sales, Jan 2011 - Jul 2017(see more posts on U.S. Existing...

Read More »Here Are The Cities Of The World Where “The Rent Is Too Damn High”

In ancient times, like as far back as the 1990s, housing prices grew roughly inline with inflation rates because they were generally set by supply and demand forces determined by a market where buyers mostly just bought houses so they could live in them. Back in those ancient days, a more practical group of world citizens saw their homes as a place to raise a family rather that just another asset class that should be day traded to satisfy their gambling habits. But, thanks to the...

Read More »The Global Housing Bubble Is Biggest In These Cities

Two years ago, when UBS looked at the world's most expensive housing markets, it found that London and Hong Kong were the only two areas exposed to bubble risk. What a difference just a couple of years makes, because in the latest report by UBS wealth Management, which compiles the bank's Global Real Estate Bubble Index, it found that eight of the world's largest cities are now subject to a massive speculative housing bubble. And while perpetually low mortgage rates are clearly to...

Read More »Little Behind CNY

The framing is a bit clumsy, but the latest data in favor of the artificial CNY surge comes to us from Bloomberg. The mainstream views currency flows as, well, flows of currency. That’s what makes their description so maladroit, and it can often lead to serious confusion. A little translation into the wholesale eurodollar reality, however, clears it up nicely. Demand for foreign exchange outstripped that for yuan for...

Read More »Why The Fed’s Balance Sheet Reduction Is As Irrelevant As Its Expansion

The FOMC is widely expected to vote in favor of reducing the system’s balance sheet this week. The possibility has been called historic and momentous, though it may be for reasons that aren’t very kind to these central bankers. Having started to swell almost ten years ago, it’s a big deal only in that after so much time here they still are having these kinds of discussions. My own view on the topic is the same as...

Read More »PBOC RMB Restraint Derives From Experience Plus ‘Dollar’ Constraint

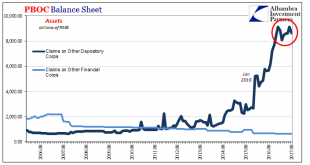

Given that today started with a review of the “dollar” globally as represented by TIC figures and how that is playing into China’s circumstances, it would only be fitting to end it with a more complete examination of those. We know that the eurodollar system is constraining Chinese monetary conditions, but all through this year the PBOC has approached that constraint very differently than last year.The updated balance...

Read More »Swimming The ‘Dollar’ Current (And Getting Nowhere)

The People’s Bank of China reported this week that its holdings of foreign assets fell slightly again in August 2017. Down about RMB 21 billion, almost identical to the RMB 22 billion decline in July, the pace of forex withdrawals is clearly much preferable to what China’s central bank experienced (intentionally or not) late last year at ten and even twenty times the rate of July and August. The US Treasury Department...

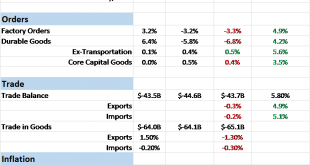

Read More »Bi-Weekly Economic Review: As Good As It Gets

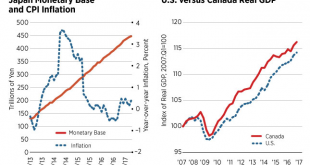

The incoming economic data hasn’t changed its tone all that much in the last several years. The US economy is growing but more slowly than it once did and we hope it does again. It is frustrating for economic bulls and bears, never fully satisfying either. Probably more important is the frustration of the average American, a dissatisfaction with the status quo that permeates the national debate. The housing bubble...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org