Given that today started with a review of the “dollar” globally as represented by TIC figures and how that is playing into China’s circumstances, it would only be fitting to end it with a more complete examination of those. We know that the eurodollar system is constraining Chinese monetary conditions, but all through this year the PBOC has approached that constraint very differently than last year.The updated balance sheet numbers through August show that unlike in the second half of 2016 China’s central bank in 2017 is very reluctant to increase the RMB portion of its balance sheet. The vast majority of its assets are forex, but those continue to fall (the subject of that earlier TIC investigation). In January

Topics:

Jeffrey P. Snider considers the following as important: $CNY, China, China Fixed Asset Investment, currencies, Dollar, economy, EuroDollar, eurodollar system, fai, Featured, Federal Reserve/Monetary Policy, fixed asset investment, Liquidity, Markets, newslettersent, PBOC, pboc balance sheet, RMB, shibor, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

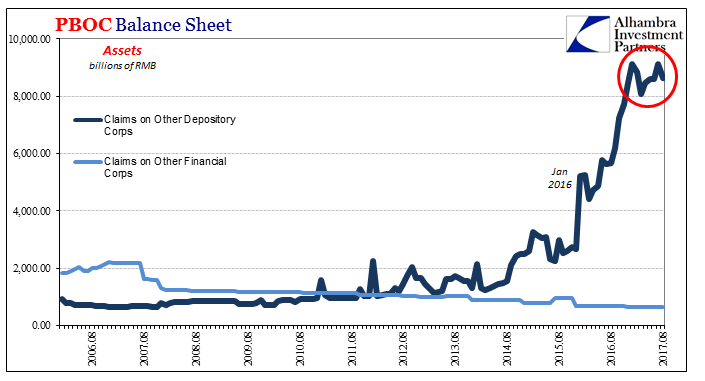

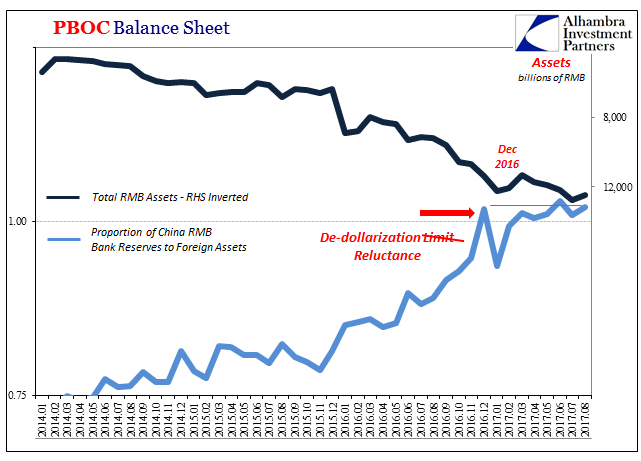

| Given that today started with a review of the “dollar” globally as represented by TIC figures and how that is playing into China’s circumstances, it would only be fitting to end it with a more complete examination of those. We know that the eurodollar system is constraining Chinese monetary conditions, but all through this year the PBOC has approached that constraint very differently than last year.The updated balance sheet numbers through August show that unlike in the second half of 2016 China’s central bank in 2017 is very reluctant to increase the RMB portion of its balance sheet. The vast majority of its assets are forex, but those continue to fall (the subject of that earlier TIC investigation).

In January 2017, the PBOC had allowed largely the biggest banks to borrow RMB 9.1 trillion through its various liquidity programs. Given that the central bank had ended 2015 with only RMB 2.7 trillion in balances, that was an enormous liquidity program (at least on its own terms) to be conducted condensed to just over one year’s time. |

PBOC Balance Sheet, Aug 2006 - 2017(see more posts on pboc balance sheet, ) |

| The question has been why monetary authorities stopped. The mainstream view is that policy has shifted to tightening. |

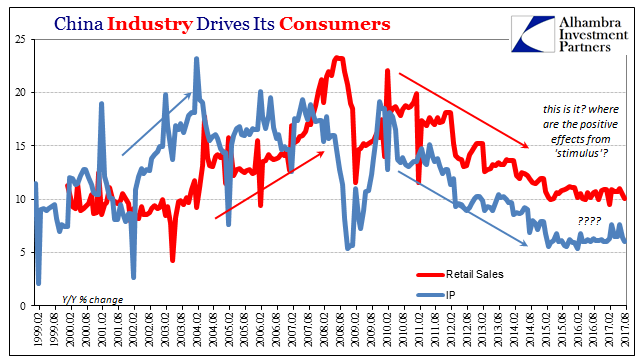

China Industry, Feb 1999 - Aug 2017 |

| That is the effect, not the reason. It is supposed to be restraint in the name of bubbles and getting control of them, but instead it works out in economic growth to the same problems as the past few years. |

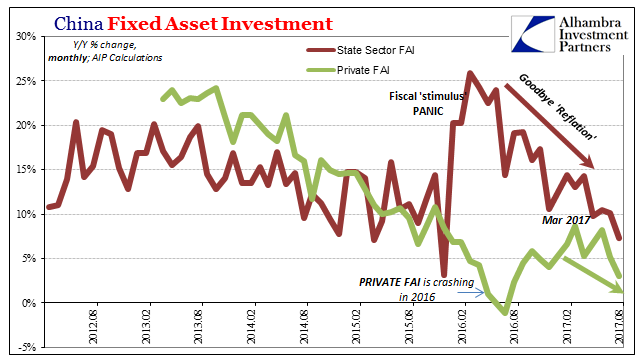

China Fixed Asset Investment, Aug 2012 - 2017(see more posts on China Fixed Asset Investment, ) |

| Bubbles aren’t the immediate issue, FAI is and always will be. The economy in China reflects monetary restraint which cannot be separated from that overriding “dollar” constraint. |

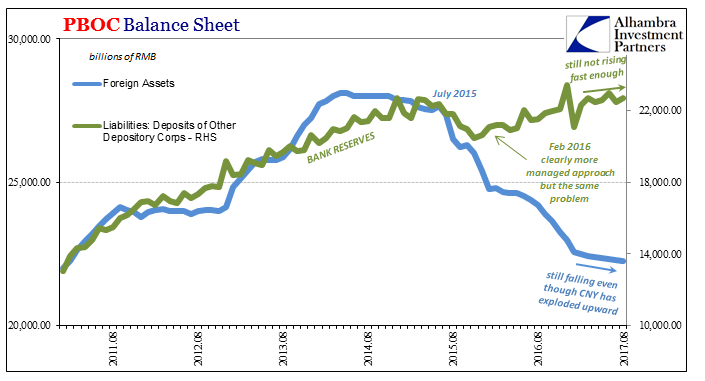

PBOC Balance Sheet, Aug 2011 - 2017(see more posts on pboc balance sheet, ) |

| The simple fact is that RMB bank reserves are not growing near fast enough to support economic momentum. |

Sources vs Uses |

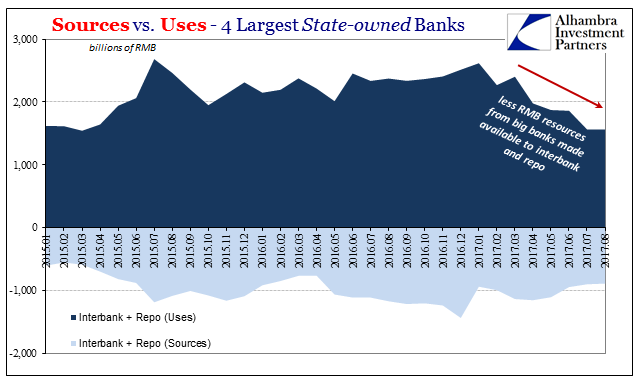

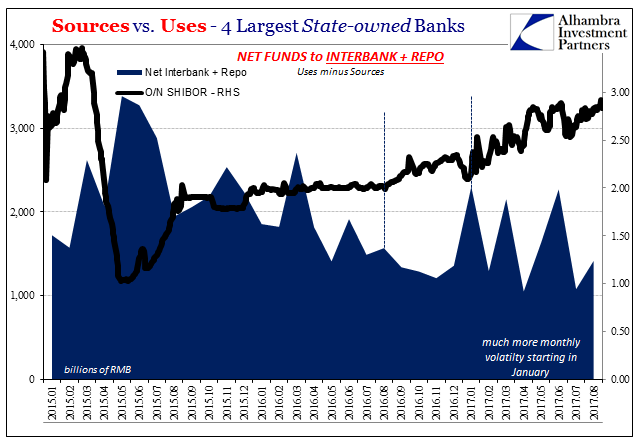

| Because the PBOC is restraining itself in RMB this year, it has left the big banks to depend more on deposit creation and less on interbank activities – including their forwarding of surplus liquidity into repo and unsecured interbank markets. |

Sources vs Uses, Jan 2015 - Aug 2017 |

| The result of all that is rising RMB money rates that aren’t just going up but going up in often very erratic fashion. It is that volatility more than rising rates that would hamper economic growth. Commercial exposure to unpredictable money conditions is quite predictable. |

PBOC Balance Sheet, Jan 2014 - Aug 2017(see more posts on pboc balance sheet, ) |

| I don’t believe that adds up to prioritizing bubbles over economic growth. The real policy variable is, in my view, CNY. I fully believe that the Chinese experience during the “rising dollar” has proved to the PBOC and the government that there can be no recovery or even the slightest sustainable economic momentum until that condition is finally dealt with.

They tried the RMB approach last year to no avail. The consequence of that priority was not bubbles but a clear lack of real economy response (as shown above). It has left them this year throwing a great deal (of unknown origin) at CNY to convince the world that it is stable, if not on its way back up like it used to trend in the good ol’ days. |

China's Dollars, Aug 2016 - 2017 |

With 2017 nearly three-quarters finished, and China stuck largely in the same trap, it is worth revisiting why we spend so much time on the topic and the idiosyncrasies of such a faraway place:

People often ask why I care so much about China. In some ways the answer is obvious, meaning that China is the world’s second largest economy (the largest under certain methods of measurement). Therefore, marginal changes in the Chinese economy are important to understanding our own global situation.

But it goes much deeper than that. I have described my own fixation with RMB money markets as weirdly obsessive. It is “weird” only in the sense that it isn’t immediately clear to someone on the outside why anyone who isn’t Chinese should care. After all, the 3-month interest rate swap on overnight SHIBOR is about as far away from a Federal Reserve blaming opioid use for the failure of QE’s to create a recovery as you might get. The second part we in the US have to deal with every day, so the first doesn’t seem to rate any notice.

In reality, however, those two are linked. There is everything in China that we might want to know about the failure of the US economy to recover – as well as a great deal about how it all came to be this way in the first place. China is in many ways a mirror onto the eurodollar, a window into its existence that remains far from our everyday view. It matters because it is what ails the world.

Tags: $CNY,China,China Fixed Asset Investment,currencies,dollar,economy,EuroDollar,eurodollar system,fai,Featured,Federal Reserve/Monetary Policy,fixed asset investment,Liquidity,Markets,newslettersent,PBOC,pboc balance sheet,RMB,shibor